After taking five consecutive business days off from my work laptop — and to shout at my personal laptop while losing games on Dominion online — I am back. I missed you. And while The Exchange’s regular columns were off this week (Friday aside, which you can read here), there’s still a hell of a lot to talk about.

First, a new website. If you click here, you’ll be taken to a sortable list (spreadsheet? database?) of startups with Black founders. Dubbed The Black Founder List, it’s a great asset and tool.

For folks like myself with a research and reporting focus, the list’s sortability of companies founded by Black entrepreneurs by gender, stage and market focus is amazing. And, for investors, it should provide potential dealflow. Do you write lots of Series C checks? The Black Founder List has 23 Series B startups with Black founders. Or if you prefer Series D checks, there are 11 Series C startups with Black founders to check out.

Who is writing the most checks to Black founders? Among the top names are M25, a midwest VC group, Techstars Boston and a number of angels.

The website was compiled by much the same team that TechCrunch highlighted earlier this year, when their data collection work concerning Black founders was more spreadsheet than app. So, please point your thanks for the new resource to Yonas Beshawred, Sefanit Tades, James Norman and Hans Yadav.

The Black Founder List also has a data submission button, so if you notice a missing name, add it. I want the data set to be as robust as possible, as, I reckon, it will prove a great reporting resource. And public data like this obviates certain excuses from the investing class.

Market Notes

- I missed a lot this week that I was looking forward to, including the Asana and Palantir IPOs. For fuller thoughts, head here. Summaries follow:

- Asana’s direct listing and resulting valuation and implied revenue multiples make its direct listing a win for the company, and the model. If other SaaS companies have the ability to raise ample pre-debut cash, perhaps the direct listing is not as dead as it seemed a few months ago when SPACs stole its spotlight, and most companies were pursuing traditional IPOs regardless.

- Palantir’s direct listing did not feel hot until it dropped some strong revenue guidance. With that, its direct listing went fine despite its cosmically comedic voting structure. Watching Palantir’s higher-ups try to snuff public input while still providing a thin patina of democracy made me think more about Russia or Texas than a functioning democratic system.

- Looking ahead, Airbnb is said to be hunting up $3 billion for its own IPO. Airbnb had to take on a lot of expensive cash when its business collapsed in the early COVID days. It wanted to direct list. Now it’s going to cash in a huge pile during its debut.

- Good. More capital > less capital.

- Sticking to our late-stage theme, when I left, Root was said to be pursuing an IPO, and when I came back, Roblox is now also tipped to be plotting with the public markets. (Root’s IPO in the wake of the successful Lemonade debut made sense. Insurtech is hot.)

- The news should not be a surprise; Roblox’s model has found cachet with young gamers and has found a great way to make money at the same time. With a mix of Legos and video game design and Minecraft, perhaps it’s not a surprise that the company is doing well.

- Reuters reports that Roblox could be worth $4 billion when it goes public. I believe it.

- Datto is going public. Ron and Danny have the details here.

- And I chatted with a few Accel investors, the juicy bits from which you can find here.

Various and Sundry

- Draper Esprit, a Europe-focused venture capital fund that trades on the London Stock Exchange, raised £110 million this week. Esprit is a fun shop to track (I’ve known its denizen James since his LSE days), because it’s more transparent than most VC firms than you’re familiar with thanks to its structure.

- According to the firm’s release, its share sale was “oversubscribed.” Tech.eu has more.

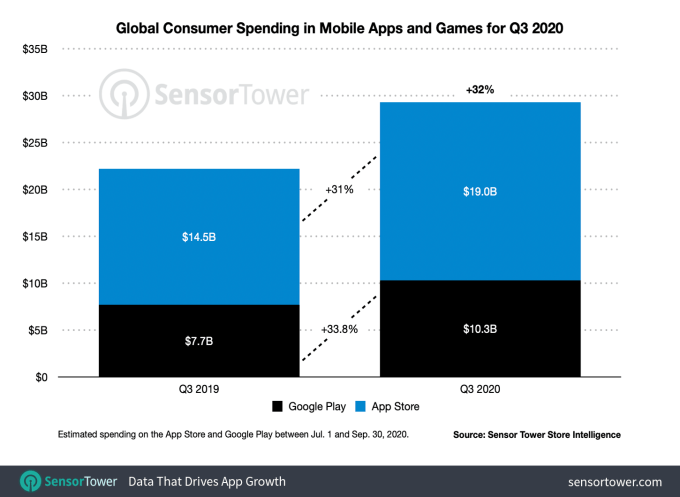

- Mobile app spend grew to $29.3 billion in Q3, driven by 36.5 billion installs, per SensorTower. Revenue was up 32% year-over-year.

- Uber sold $500 million worth of Uber Freight to a PE firm.

- As noted, tech stocks had a bad September, but just how bad might surprise you.

- And I covered Noyo’s Series A before I left, with the post going up on Monday.

- In short, Noyo is doing the hard work to build APIs to connect the world of health insurance. It’s a huge, hard task.

- The $12.5 million was “led by Costanoa Ventures and Spark Capital. Prior investors Core Innovation Capital, Garuda Ventures, the Webb Investment Network, Precursor Ventures and Homebrew upped their investment in the new round.”

- (I can’t shake the thought that there’s something in the middle of the no-code/low-code boom, and startups delivering more of their products via APIs instead of as managed services. And please don’t say mashups, we left that phrase behind ages ago.)

- I missed the window for officially commenting on the Coinbase culture dustup — the Equity crew did talk about it while I was AFK — so I will merely share this thread as my $0.02.

- Also, read this from Eileen Burbidge on TechCrunch concerning the same matter. It’s good.

Regular morning Exchange columns return Monday morning. It’s good to be back.

By the way, TechCrunch Sessions: Mobility is coming up next week. I am going! To help you get there, here’s a 50% off code for you to get full access to the event. Or if it’s your jam, this code will get you into the expo and breakout sessions for free.

Chat soon,

Source: Tech Crunch