Facebook has filled the lead independent board director role with former Deputy Secretary of the Treasury and U.S. Ambassador to Germany Robert M. Kimmitt. We’ll have more details shortly

<p clas

s=”sh-color-black sh-color”>

Source: Tech Crunch

Chubb, a major cybersecurity insurance provider for businesses hit by data breaches, has itself become a target of a data breach.

The insurance giant told TechCrunch it was investigating a “security incident” involving the unauthorized access to data belonging to an unnamed third-party. Chubb spokesperson Jeffrey Zack said the company had “no evidence” the incident affected Chubb’s own network and that its network “remains fully operational.”

But the spokesperson declined to comment further or answer any of our questions, including if its customers were affected.

Brett Callow, a threat analyst at security firm Emsisoft, first alerted TechCrunch to the breach on Thursday. According to Callow, the security incident was a data-stealing ransomware attack launched by the Maze ransomware group. Maze not only spreads across a network, infecting and encrypting every computer in its path, it also exfiltrates the data to the attackers’ servers where it is held for ransom. If a ransom isn’t paid, the attackers publish the files online.

In December, the FBI privately warned businesses of an increase in Maze-related ransomware incidents.

Callow said the attackers behind the incident posted a listing of data, allegedly stolen from Chubb, and included the names and email addresses of three senior executives, including CEO Evan Greenberg.

The listing said the breach occurred in March. But the attackers have not yet published any of the stolen files.

Chubb is one of the largest cybersecurity providers in the United States, offering incident response services and covering companies from losses caused by data breaches. Target last year filed a $74 million lawsuit against Chubb after the retailer claimed the insurance carrier failed to properly compensate it for the costs incurred from its 2013 data breach involving the theft of 110 million customers’ data.

Got a tip? You can send tips securely over Signal and WhatsApp to +1 646-755–8849.

Source: Tech Crunch

Toyota, Honda and Fiat Chrysler Automobiles will not reopen North American factories at the end of the month as planned, as the COVID-19 disease spreads and dampens demand for new cars, trucks and SUVs.

FCA said Thursday that plants across the U.S. and Canada, as well as headquarters operations and construction projects, are intended to remain closed until April 14, dependent upon the various states’ stay-in-place orders and the readiness of each facility to return to production.

FCA’s Mopar Parts Distribution centers, which have been deemed essential to keeping first responders and commercial vehicles on the road, will continue to operate with paid volunteers. The status of production for FCA’s Mexico operations will be subject to a separate announcement, the company said in a statement emailed Thursday.

Meanwhile, Ford, Toyota and Honda also announced plans to extend closures. Ford also said it will extend its closure until April 7.

Honda also said it will keep all of its automobile, engine and transmission plants in the U.S. and Canada closed into the first week of April. Operations will resume on April 7, Honda said.

“This extension is in response to the continued steep decline in market demand across the automotive industry due to the impact of the COVID-19 pandemic on the economy, resulting in the inability of consumers in many markets to purchase new vehicles,” Honda said in an emailed statement. “As the market impact of the fast-changing COVID-19 situation continues to evolve, Honda will evaluate conditions and make additional adjustments as necessary. In undertaking this production adjustment, Honda is continuing to manage its business carefully through a measured approach to sales that aligns production with market demand.”

Toyota said its manufacturing facilities will remain closed through April 17 and will resume production on April 20. Toyota has numerous factories in North America, including Alabama, Indiana, Kentucky, Missouri, Tennessee and Texas, as well as Baja California, Mexico and Guanajuato, Mexico.

Toyota said its service parts depots and vehicle logistics centers will continue to operate.

Earlier this month, major automakers suspended productions at factories across the U.S., Mexico and Canada. Most had planned to restart March 31. Now as that date gets closer, a number of automakers are pushing back plans to restart production.

COVID-19, the disease caused by the coronavirus, has caused upheaval across every major industry as governments issue stay-at-home orders or directives for nonessential businesses to close in an effort to slow the spread of the pandemic. Closures first hit China, where the first cases of COVID-19 popped up three months ago. Those factories are now coming back online as plants in Europe and North America shut down temporarily.

Source: Tech Crunch

Startups across the nation and around the world are looking for ways to relieve shortages of much-needed personal protective equipment and sanitizers used to halt the spread of COVID-19.

While some of the largest privately held technology companies, like SpaceX and Tesla, have shifted to manufacturing ventilators, smaller companies are also trying to pitch in and relieve scarcity locally.

Supplies have been difficult to come by in some of the areas hardest hit by the outbreak of the novel coronavirus, and the shortfalls have been made worse by a lack of coordination from the federal government. In some instances local governments have been bidding for supplies against each other and the federal government to acquire needed personal protective equipment.

On Sunday, New York’s governor Mario Cuomo pleaded with local governments to not engage in a bidding war. In fact, Kentucky was outbid by the Federal government for personal protective equipment.

“FEMA came out and bought it all out from under us,” Kentucky governor Andy Beshear told a local newspaper. “It is a challenge that the federal government says, ‘States, you need to go and find your supply chain,’ and then the federal government ends up buying from that supply chain.”

Against this backdrop local startups and maker spaces are stepping up to do what they can to fill the gap.

Alcohol brands are turning their attention to making hand sanitizer to distribute in communities experiencing shortages. 3D printing companies are working on new ways to manufacture personal protective equipment and swabs for COVID-19 testing. And one fast fashion retail startup is teaching its tailors and seamstresses how to make cloth masks for consumer protection.

AirCo, a New York-based startup that developed a process to use captured carbon dioxide to make liquor, shifted its efforts to making hand sanitizer for donations in communities in New York City.

Now, new alcohol brands Bev and Endless West are joining the manufacturing push.

Endless West announced this morning that it would shift production away from its distillery to begin making hand sanitizers. The World Health Organization approved their sanitizers, which the company will produce in its warehouse in San Francisco.

The 2-ounce bottles will be donated to local restaurants and bars that remain open for delivery, so that employees can use them and distribute them to customers. Bulk quantities will be distributed to healthcare organizations and facilities that need them.

Endless West also put out a call for other companies to provide supplies to hospitals and health organizations in the San Francisco Bay Area.

“We felt it was imperative to do our part and dedicate what resources we have to assist with shortages in the healthcare and food & beverage industries who keep the engine running and provide such important functions in this time of immense need throughout the community.” said Alec Lee, CEO of Endless West, in a statement.

Los Angeles-based Bev is no different.

“As an alcoholic beverage company, Bev is very lucky in that we are licensed to purchase ethanol directly from our suppliers, who are doing their part by discounting the product to anyone licensed to purchase it,” said Bev chief executive, Alix Peabody. “Community underscores everything we do here at Bev, and as such, we will be producing hand sanitizer and distributing it free of charge to the homeless and elderly communities here in Venice, populations who largely have insufficient access to healthcare and essential goods like sanitizer.”

Hand sanitizer is one sorely needed item in short supply, but there are others — including face masks, surgical masks, face shields, swabs and ventilator equipment that other startups are now switching gears to produce.

(Photo by PAU BARRENA/AFP via Getty Images)

In Canada, INKSmith, a startup that was making design and tech tools accessible for kids, has now moved to making face shields and is hiring up to 100 new employees to meet demand.

“I think in the short term, we’re going to scale up to meet the needs of the province soon. After that, we’re going to meet the demands of Canada,” INKSmith CEO Jeremy Hedges told the Canadian news outlet Global News.

3D printing companies like Massachusetts-based Markforged and Formlabs are both making personal protective equipment like face shields, as well as nasal swabs to use for COVID-19 testing.

Markforged is pushing ahead with a number of efforts to focus some of the benefits of 3D printing on the immediate problem of personal protective equipment for healthcare workers most exposed to COVID-19.

“We have about 20 people working on this pretty much as much as they can,” said Markforged chief executive, Gregory Mark. “We break it up into three different programs. The first stage is prototyping validation and getting first pass to doctors. The second is clinical trials and the third is production. We are in clinical trials with two. One is the nasal swab and two is the face shield.”

The ability to spin up manufacturing more quickly than traditional production lines using 3D printing means that both companies are in some ways better positioned to address a thousandfold increase in demand for supplies that no one anticipated.

“3D printing is the fastest way to make anything in the world up to a certain number of days, weeks, months or years,” says Mark. “As soon as we get the green light from hospitals, 10,000 printers around the world can be printing face shields and nose swabs.”

FormLabs, which already has a robust business supplying custom-printed surgical-grade healthcare products, is pushing to bring its swabs to market quickly.

“Not only can we help in the development of the swabs, but we can manufacture them ourselves,” says FormLabs chief product officer, David Lakatos.

Swabs for testing are in short supply in part because there are only a few manufacturers in the world who made them — and one of those primary manufacturers is in Italy, which means supplies and staff are in short supply. “There’s a shortage of them and nobody was expecting that we would need to test millions of people in short order,” says Lakatos.

FormLabs is also working on another piece of personal protective equipment — looking at converting snorkeling masks into respirators and face masks. “Our goal is to make one that is reusable,” says Lakatos. “A patient can use it as a respirator and you can put it in an autoclave and reuse it.”

In Brooklyn, Voodoo Manufacturing has repurposed its 5,000 square foot facility to mass-produce personal protective equipment. The company has set up a website, CombatingCovid.com, where organizations in need of supplies can place orders. Voodoo aims to print at least 2,500 protective face shields weekly and can scale to larger production volumes based on demand, the company said.

STAMFORD, CT – MARCH 23: Nurse Hannah Sutherland, dressed in personal protective equipment (PPE) awaits new patients at a drive-thru coronavirus testing station at Cummings Park on March 23, 2020 in Stamford, Connecticut. Availability of protective clothing for medical workers has become a major issue as COVID-19 cases surge throughout the United States. The Stamford site is run by Murphy Medical Associates. (Photo by John Moore/Getty Images)

Finally, Resonance, the fast fashion startup launched by the founder of FirstMark Capital, Lawrence Lenihan, is using its factory in the Dominican Republic to make face masks for consumers on the island and beyond.

“To contribute to the Dominican health efforts, Resonance is acting to utilize their resources to manufacture safety masks for distribution to local hospitals, nursing homes, and other high-risk facilities as quickly as possible. They have provided user-friendly instructions and material and will pay their sewers who can to make these masks from the security of their homes,” a spokesperson for the company wrote in an email. “Resonance is currently working to share this downloadable platform and simple instructions to their website, so anyone in the world can contribute to their own local communities.”

All of these efforts — and countless others too numerous to mention — point to the ways small companies are hoping to do something to help their communities stay safe and healthy in the midst of this global outbreak.

But many of these extreme measures may not have been necessary had governments around the world actively coordinated their response and engaged in better preparation before the situation became so dire.

There are a litany of errors that governments made — and are still making — in their efforts to respond to the pandemic, even as the private sector steps in and steps up to address them.

Source: Tech Crunch

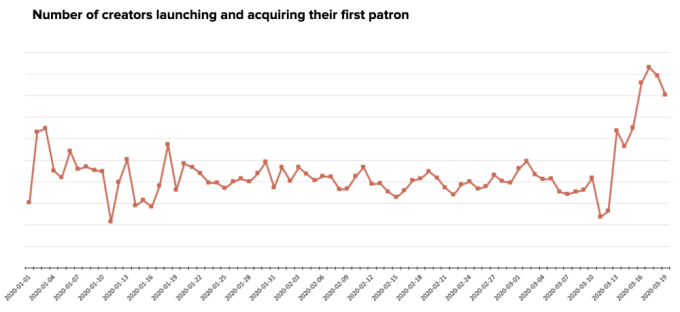

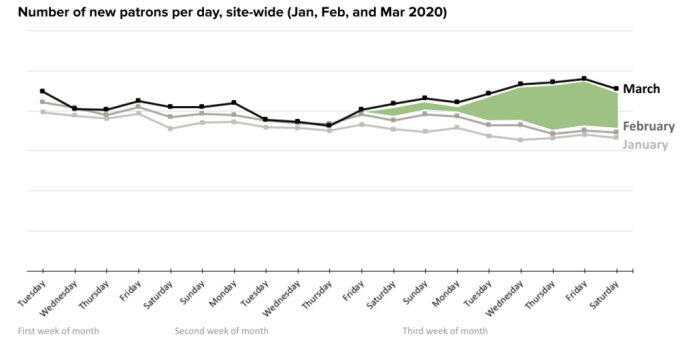

Creative professionals whose livelihoods have been impacted by the COVID-19 outbreak are flocking to membership platform Patreon in record numbers, the company claims. During the first three weeks of March, more than 30,000 new creators launched on the site — a much larger number than usual. These creators are also acquiring patrons faster than ever and they’re expanding their earnings at a quicker pace, as a result.

Creators around the world are being affected by the COVID-19 outbreak, often indirectly. To cut down on the spread of the novel coronavirus, live shows are being canceled and conferences and other events are being postponed. Other revenue streams creators may have previously relied on may be drying up, as well.

Many of these impacted creators have joined the Patreon platform in recent days to help with lost revenue, and their fans have quickly followed.

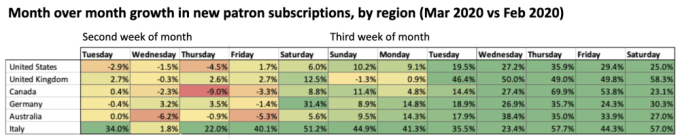

According to Patreon’s internal metrics, average new patron growth across the U.S., U.K., Canada, Germany, Australia and Italy is up 36.2% in March compared to February.

In particular, Patreon saw a shift in patron behavior and creator additions starting on Friday, March 13th.

Since then, creators have been joining the platform at a faster rate than at any other point in the company’s history.

In addition, the proportion of creators who acquire their first patron within 10 days of launching has also increased. This is one of the strongest influxes of memberships Patreon has seen, the company said.

Today, Patreon’s platform serves more than 150,000 total artists worldwide who generate income by offering exclusive content and communities to a network of over 4 million patrons across 180 countries. To date, creators have earned more than $1 billion through the Patreon platform.

However, it’s not all good news. Patreon also notes it’s seeing slightly higher patron deletions as some members are choosing to exit the site due to financial hardships related to the COVID-19 crisis. But overall, churn rates are stable for now, Patreon says, and the deletions are not at a rate other businesses are seeing.

Patreon isn’t the only platform seeing significant growth due to the societal impacts of COVID-19.

Fundraising sites like GoFundMe have also seen increases in recent weeks as people ask for assistance with living expenses, food and other basics, small business support, healthcare expenses and more.

GoFundMe recently said that more than 22,000 coronavirus-related fundraisers were created on its platform over the past few weeks, collectively raising over $40 million to support hospitals, businesses and other organizations. The company said it would commit $1.5 million to support communities impacted by the pandemic, as well.

Source: Tech Crunch

With limited prospects for growth, one of the iron laws of economic downturns is that advertising is among the first budgets to be cut.

Advertising revenues have already cratered at many alt-weekly newspapers, which heavily rely on local events and restaurants that have been shuttered in the wake of the COVID-19 outbreak. BuzzFeed even went so far (as they do) to label it a “media extinction event.”

Clearly it’s bad times, but I wanted to get a lot more granular around the data for ad rates, particularly around top startups. So I compiled a list of a little more than 100 unicorns across a variety of sectors and explored how the prices of their search engine keywords have changed with the global pandemic that is sparking a global recession.

The results aren’t surprising — there has been a collapse in prices for almost all ads (with some very interesting exceptions we will get to in a bit). But the variations across startups in their online ad performance says a lot about industries like food delivery and enterprise software, and also the long-term revenue performance of Google, Facebook and other digital advertising networks.

It’s common for startups to buy their own keywords on search engines like Google and the App Store. Owning that top rank guarantees that their own company’s page is the first result a user sees and prevents competitors from buying their name, potentially intercepting customers.

Source: Tech Crunch

The world is changing fast. With the spread of coronavirus keeping folks in their homes, there’s no time like the present to connect with people online.

Tomorrow at 3pm EDT, betaworks’ John Borthwick and Matt Hartman will be joining us for a live conference call via Zoom (here’s the dial-in link) for everyone on TechCrunch. Folks will be able to join and get characteristically insightful answers from these two tech scene veterans.

John Borthwick is cofounder and CEO of betaworks, the startup studio that has fostered companies like Digg, Dots, Giphy, Chartbeat, TweetDeck, Gimlet Media, Bitly, and Quibb. Borthwick is one of New York’s most prestigious investors and, on a personal note, a delightful conversationalist.

Matt Hartman is betaworks’ first partner, leading the company’s external investment arm. He’s invested in companies like Giphy, Anchor, Gimlet Media, Twitter, Venmo, Kickstarter, and Tumblr.

Both Borthwick and Hartman are experts in the field of new media, among other things, and will have some interesting insights into the changing landscape of media, both broadly and within the scope of coronavirus.

We’ll be talking to them about how they’re advising their portfolio companies during this tumultuous time, which of the coronavirus-caused evolutions are here to stay and which are temporary, and what tech they’re most interested in right now.

Folks who have questions should come prepared. I’m going to try to prioritize audience questions over my own, so jot ’em down now!

Join us tomorrow (Thursday, March 26) at 3pm EDT/noon PDT using this Zoom link. If you can’t make it to the call, we’ll publish the transcript on Extra Crunch shortly after the call. See you there!

Source: Tech Crunch

Victoria Stafford, a third-year student at UC Berkeley, was set to begin working at Yelp in June as a sales intern — the only internship she applied to. And then it was canceled because of the COVID-19 pandemic.

“When I first read the cancellation email, I didn’t believe it. I refreshed my inbox; I rubbed my eyes as if I were waking up from a dream. It was clear that COVID-19 was becoming a mounting concern, but it never occurred to me that my internship was in jeopardy,” Stafford said.

Internship cancellations hurt more than just summer plans. The programs are often pipelines into future jobs and access to valuable work experience.

For Stafford, a business and domestic environmental major from a small town in rural Utah, there are very few business and policy-related opportunities.

“I ask that employers do everything they can to make their internship opportunities more accessible in these upcoming months, and come next year and the year after, show understanding and compassion for employment gaps,” she said.

Dozens of other students from across the country flooded my inbox, sharing stories about the impact on internship cancellations on their paths toward employment.

One student turned down offers and interviews from Google, JP Morgan and Goldman Sachs to pursue a software engineering position. The offer they accepted was yanked weeks later. Another student lost their chance at a post-graduate job at their dream company because their offer was revoked. One only had an offer in their hands for three weeks before it was rescinded.

A number of companies across the country, including Google, Glassdoor, StubHub, Funding Circle, Yelp, Checkr and even the National Institutes of Health, have canceled their internship programs due to COVID-19, TechCrunch has learned. The cancellations, which will likely increase in the days and weeks to come, are unsurprising, due to the uncertainty the pandemic has caused. Still, fewer internships jeopardize the postgraduate job prospects for thousands of college students, and, beyond that, limit the talent pipeline on which tech companies so often are dependent.

There’s even a Twitter account that tracks the status of 2020 internships.

Like the concerts, conferences, universities and schools, these cancellations are because of the COVID-19 pandemic ravaging the world right now. While some companies cited health concerns, others pointed to the uncertain economic landscape.

In a statement, job search and review platform Glassdoor said the rapid spread of COVID-19 has grown “beyond a health concern into an economic one.” As a result, it has “decided to pause hiring and reprioritize some initiatives internally to ensure we are well positioned for both the downturn and recovery.”

A Funding Circle spokesperson confirmed that the company halted its internship program, “given the travel and relocation” for the upcoming intern cohort to San Francisco. In an email obtained by TechCrunch, the National Institute of Health canceled its prestigious internship — which has a 20% acceptance rate — to “stop community spread of Sars-Cov-2 through social distancing.”

“Therefore, hosting 1000+ early career scientists who deserve close supervision and intense mentoring is not appropriate at this time,” the email reads. “The cancellation of the NIH SIP applies to all students, whether you were planning to volunteer or were offered a fellowship position. It also applies, even if you were planning to do computational work that could be done remotely.”

In a statement to TechCrunch, NIH said its program has been reduced to “maintenance-only and mission critical (including research on COVID-19) operation due to spread of the novel coronavirus.”

“Regrettably, as part of this effort to keep people safe and limit the spread through social/physical distancing, it has been necessary to cancel the Summer Internship Program for young trainees at NIH for 2020, but those students already selected for the program will be given priority for summer internship positions in 2021.”

Checkr, based in Denver and San Francisco, put its summer internship program on hold due to “the challenges of onboarding interns while everyone is remote.”

Google has rescinded some internship offers for its UX design internship, per a LinkedIn post. Google denied this.

While a number of tech companies have put their internship programs on hold, others are piecing together experimental remote internship programs for their students.

Quizlet is preparing for its annual internship program and is preparing a “contingency plan for an internship that will be virtual if necessary.” Uber has formed a dedicated team to start working on an online internship program “should the situation remain unchanged.” Lyft and Twitter, depending on the state of the pandemic, plan to onboard San Francisco interns virtually.

The pandemic has certainly put remote internship management services in high demand. That said, a handful of startups have been working on the sector for years.

San Francisco-based Symba, which helps companies offer virtual internship programs, was founded in 2017. Co-founder Ahva Sadeghi said that last week more than 100 companies and 1,000 students reached out to Symba in regards to internship cancellations because of COVID-19.

“The companies we reached out to in the beginning who said, ‘This is great but not top of mind for us,’ are now calling us back asking us to jump on the phone today or tomorrow to get something implemented,” Sadeghi said in a phone call. “We thought we didn’t have product-market fit and now the conversation has completely changed.”

Sadeghi noted how internships assume a certain level of privilege in applicants, prioritizing those who can afford to move to a highly populated city with little to no pay. A remote internship, even in a time of health and prosperity, is important, she said.

“If you can log on to a laptop, you can access an opportunity,” she said. Another program, Chicago-based Sage Corps, founded in 2013, is pushing companies to sponsor the students impacted by internship cancellations. If sponsored, students can still participate in career growth development workshops virtually from Sage Corps, at $1,250 per student.

Thomas Brunskill, the founder of InsideSherpa, which helps companies host virtual internships, said he’s seen nearly 1,000 students a day sign up for the platform, from Northern Italy, to South-East Asia, to the United States. He started the company, which went through Y Combinator last year, to give students courses and online simulations of jobs through the comfort of their own homes.

He said his customers are mainly larger companies that employ upwards of 1,000 students, like JPMorgan Chase, Deloitte, Citi, BCG and GE.

On one end, Brunskill said the interest makes sense, as larger companies have to meet significant hiring demands. Per the National Association of Colleges and Employers, 70.4% of interns get return offers from the company where they intern.

On the other end, this concentration further showcases how smaller businesses will be impacted disproportionately from this pandemic. Many will freeze hiring altogether.

“Obviously [this] matters for students, but it also matters for companies who are now going to have this blackhole of talent,” Brunskill said. “Nobody wins in that situation — companies end up with less work-ready students who don’t really know what they’re getting into and students end up in full-time jobs that might not be aligned to their interest or skills because they never had an opportunity to test it out first.”

While layoffs are devastating, and obviously well upon us in the tech world, internship cancellations offer a harsh window into how COVID-19 doesn’t just impact our current workforce, but our future one as well.

Source: Tech Crunch

Seasoned secondary players were expecting it. As the markets began to plummet in recent weeks, shareholders who’d turned down earlier offers to buy this or that holding were suddenly curious to see if those interested parties might still be interested. Alas, it was too late. The market was moving too fast. It still is.

“Up until last week, everyone was calling to get old pricing,” says Hans Swildens, the founder of 20-year-old Industry Ventures in San Francisco, an investment firm that invests in hundreds of venture funds and is also among the industry’s biggest buyers of secondary shares. “It was, ‘Hey, we reconsidered this offer. Could you pay me what the market was paying last month?’”

Swildens says that everybody in the secondaries market said no. They had no choice. “It’s almost impossible to buy when you don’t know what numbers you’re buying against. Buyers don’t know how far the [net asset value] of funds will go down. No one wants to buy something for $10 million that might be worth $5 million [in the not-too-distant future].”

Such is the state of affairs in the venture-backed world of startups right now. Though 2020 once promised to be a year of splashy IPOs and long-awaited liquidity for players across the ecosystem — from employees to founders to venture firms to the limited partners that invest in venture firms — it may well be remembered instead as the year that time stood still.

Certainly, everyone seems stuck in place right now.

While limited partners are largely avoiding their phones, and hoping the venture managers in their portfolio will stop asking for capital, venture firms that didn’t push their portfolio companies to go public are now feeling pressured to produce liquidity somewhere in their holdings, and that’s tougher than ever right now. With some exceptions, cash-rich companies are in no hurry to go shopping (they also have to worry about looking monopolistic). With some exceptions, companies aren’t merging just yet (though expect a lot of this soon).

Yet secondary shops have hit the pause button, too, as the everyone on the ground tries to get a better sense of where the bottom might be.

It could take one to three quarters to assess, say those in the know. For one thing, a lot of nontraditional players have propped up the venture market over the last decade, and some, including hard-hit corporations and family offices, might not have the wherewithal to support their venture managers, even if that’s not obvious today.

On the company level, there are also plenty of questions that are unanswerable at the moment. “Right now, everything is on pause in terms of activity,” says Swildens, adding that “in a month, we’ll know more. Are people going back to work or not? What were Q1 numbers like? How does April look? Did this company miss revenue by 10% or 80%? Did it beat revenue in March or April? For the buy side, in a month, we’ll have data from the companies and the funds while right now, no one knows how bad it is.”

In the meantime, secondary players are in the catbird’s seat, seemingly, even while they have to sit tight for what insider say could be one to three quarters.

Chris Douvos, a longtime investor in venture funds observes that there’s an “immense amount of capital looking for fund stakes,” meaning from outfits like Industry Ventures and roughly 75 other players in the market. “If I’m a VC right now, I’m wondering when [these] investors — folks who have billions of dollars in committed capital and love to buy fund stakes at 65 cents on the dollar — start capitulating, but that’s like six to nine months out when you really see [these transactions] happen.”

Swildens suggests that’s about right. “Sellers have to reset pricing expectations, then buyers have to come up with a price they are willing to pay, and those things have to meet. And that takes one to two quarters.”

What’s happening between now and then are calls, more calls, and endless number-crunching. Some of it is proving dismal, with a lot of those numbers shrinking as revenue slows and sales cycles grow harder. Some of it, around pre-IPO companies, is likely particularly agonizing. “All the boards and CEOs are trying to work out pro forma plans now,” says Swildens. “If they cut spending too much, growth slows too much and they can’t take the company public next year. They can’t cut to the bone, or they can’t list it.”

There are bright spots, however. As Swildens observes, “Everybody is being negatively impacted right now, with the exception of some bandwidth, infrastructure, fintech and edtech investments. For some of these, [this shutdown] has been kind of a good thing. Edtech companies’ prices are probably going to go up with tens of millions of people suddenly signing up for their services.”

Now to hurry up and wait.

Source: Tech Crunch

By way of a working from home Twitter message, Apple CEO Tim Cook announced that the company has sourced and will be donating 10 million face masks. The number is sizable increase over the two million reported last week and a hefty bump over the nine million figure Vice President Mike Pence announced during last night’s White House Press Conference.

“Apple has sourced, procured and is donating 10 million masks to the medical community in the United States,” Cook says in the video. “These people deserve our debt of gratitude for all of the work they’re doing on the front lines.”

Apple is joining fellow tech companies in donating masks amid a national shortage as COVID-19 takes an increasing toll on the U.S. population. Many of the donated masks have been stockpiled, in order to adhere to California Occupational Safety and Health Standards put into action following last year’s devastating wildfires.

Other companies, like Ford, have transformed production facilities to create additional masks.

Source: Tech Crunch