“The book itself is a curious artefact, not showy in its technology but complex and extremely efficient: a really neat little device, compact, often very pleasant to look at and handle, that can last decades, even centuries. It doesn’t have to be plugged in, activated, or performed by a machine; all it needs is light, a human eye, and a human mind. It is not one of a kind, and it is not ephemeral. It lasts. It is reliable. If a book told you something when you were 15, it will tell it to you again when you’re 50, though you may understand it so differently that it seems you’re reading a whole new book.”—Ursula K. Le Guin

Every year, Bill Gates goes off-grid, leaves friends and family behind, and spends two weeks holed up in a cabin reading books. His annual reading list rivals Oprah’s Book Club as a publishing kingmaker. Not to be outdone, Mark Zuckerberg shared a reading recommendation every two weeks for a year, dubbing 2015 his “Year of Books.” Susan Wojcicki, CEO of YouTube, joined the board of Room to Read when she realized how books like The Evolution of Calpurnia Tate were inspiring girls to pursue careers in science and technology. Many a biotech entrepreneur treasures a dog-eared copy of Daniel Suarez’s Change Agent, which extrapolates the future of CRISPR. Noah Yuval Harari’s sweeping account of world history, Sapiens, is de rigueur for Silicon Valley nightstands.

This obsession with literature isn’t limited to founders. Investors are just as avid bookworms. “Reading was my first love,” says AngelList’s Naval Ravikant. “There is always a book to capture the imagination.” Ravikant reads dozens of books at a time, dipping in and out of each one nonlinearly. When asked about his preternatural instincts, Lux Capital’s Josh Wolfe advised investors to “read voraciously and connect dots.” Foundry Group’s Brad Feld has reviewed 1,197 books on Goodreads and especially loves science fiction novels that “make the step function leaps in imagination that represent the coming dislocation from our current reality.”

This begs a fascinating question: Why do the people building the future spend so much of their scarcest resource — time — reading books?

Image by NiseriN via Getty Images. Reading time approximately 14 minutes.

Don’t Predict, Reframe

Do innovators read in order to mine literature for ideas? The Kindle was built to the specs of a science fictional children’s storybook featured in Neal Stephenson’s novel The Diamond Age, in fact, the Kindle project team was originally codenamed “Fiona” after the novel’s protagonist. Jeff Bezos later hired Stephenson as the first employee at his space startup Blue Origin. But this literary prototyping is the exception that proves the rule. To understand the extent of the feedback loop between books and technology, it’s necessary to attack the subject from a less direct angle.

David Mitchell’s Cloud Atlas is full of indirect angles that all manage to reveal deeper truths. It’s a mind-bending novel that follows six different characters through an intricate web of interconnected stories spanning three centuries. The book is a feat of pure M.C. Escher-esque imagination, featuring a structure as creative and compelling as its content. Mitchell takes the reader on a journey ranging from the 19th century South Pacific to a far-future Korean corpocracy and challenges the reader to rethink the very idea of civilization along the way. “Power, time, gravity, love,” writes Mitchell. “The forces that really kick ass are all invisible.”

The technological incarnations of these invisible forces are precisely what Kevin Kelly seeks to catalog in The Inevitable. Kelly is an enthusiastic observer of the impact of technology on the human condition. He was a co-founder of Wired, and the insights explored in his book are deep, provocative, and wide-ranging. In his own words, “When answers become cheap, good questions become more difficult and therefore more valuable.” The Inevitable raises many important questions that will shape the next few decades, not least of which concern the impacts of AI:

“Over the past 60 years, as mechanical processes have replicated behaviors and talents we thought were unique to humans, we’ve had to change our minds about what sets us apart. As we invent more species of AI, we will be forced to surrender more of what is supposedly unique about humans. Each step of surrender—we are not the only mind that can play chess, fly a plane, make music, or invent a mathematical law—will be painful and sad. We’ll spend the next three decades—indeed, perhaps the next century—in a permanent identity crisis, continually asking ourselves what humans are good for. If we aren’t unique toolmakers, or artists, or moral ethicists, then what, if anything, makes us special? In the grandest irony of all, the greatest benefit of an everyday, utilitarian AI will not be increased productivity or an economics of abundance or a new way of doing science—although all those will happen. The greatest benefit of the arrival of artificial intelligence is that AIs will help define humanity. We need AIs to tell us who we are.”

It is precisely this kind of an AI-influenced world that Richard Powers describes so powerfully in his extraordinary novel The Overstory:

“Signals swarm through Mimi’s phone. Suppressed updates and smart alerts chime at her. Notifications to flick away. Viral memes and clickable comment wars, millions of unread posts demanding to be ranked. Everyone around her in the park is likewise busy, tapping and swiping, each with a universe in his palm. A massive, crowd-sourced urgency unfolds in Like-Land, and the learners, watching over these humans’ shoulders, noting each time a person clicks, begin to see what it might be: people, vanishing en masse into a replicated paradise.”

Taking this a step further, Virginia Heffernan points out in Magic and Loss that living in a digitally mediated reality impacts our inner lives at least as much as the world we inhabit:

“The Internet suggests immortality—comes just shy of promising it—with its magic. With its readability and persistence of data. With its suggestion of universal connectedness. With its disembodied imagines and sounds. And then, just as suddenly, it stirs grief: the deep feeling that digitization has cost us something very profound. That connectedness is illusory; that we’re all more alone than ever.”

And it is the questionable assumptions underlying such a future that Nick Harkaway enumerates in his existential speculative thriller Gnomon:

“Imagine how safe it would feel to know that no one could ever commit a crime of violence and go unnoticed, ever again. Imagine what it would mean to us to know—know for certain—that the plane or the bus we’re travelling on is properly maintained, that the teacher who looks after our children doesn’t have ugly secrets. All it would cost is our privacy, and to be honest who really cares about that? What secrets would you need to keep from a mathematical construct without a heart? From a card index? Why would it matter? And there couldn’t be any abuse of the system, because the system would be built not to allow it. It’s the pathway we’re taking now, that we’ve been on for a while.”

Machine learning pioneer, former President of Google China, and leading Chinese venture capitalist Kai-Fu Lee loves reading science fiction in this vein — books that extrapolate AI futures — like Hao Jingfang’s Hugo Award-winning Folding Beijing. Lee’s own book, AI Superpowers, provides a thought-provoking overview of the burgeoning feedback loop between machine learning and geopolitics. As AI becomes more and more powerful, it becomes an instrument of power, and this book outlines what that means for the 21st century world stage:

“Many techno-optimists and historians would argue that productivity gains from new technology almost always produce benefits throughout the economy, creating more jobs and prosperity than before. But not all inventions are created equal. Some changes replace one kind of labor (the calculator), and some disrupt a whole industry (the cotton gin). Then there are technological changes on a grander scale. These don’t merely affect one task or one industry but drive changes across hundreds of them. In the past three centuries, we’ve only really seen three such inventions: the steam engine, electrification, and information technology.”

So what’s different this time? Lee points out that “AI is inherently monopolistic: A company with more data and better algorithms will gain ever more users and data. This self-reinforcing cycle will lead to winner-take-all markets, with one company making massive profits while its rivals languish.” This tendency toward centralization has profound implications for the restructuring of world order:

“The AI revolution will be of the magnitude of the Industrial Revolution—but probably larger and definitely faster. Where the steam engine only took over physical labor, AI can perform both intellectual and physical labor. And where the Industrial Revolution took centuries to spread beyond Europe and the U.S., AI applications are already being adopted simultaneously all across the world.”

Cloud Atlas, The Inevitable, The Overstory, Gnomon, Folding Beijing, and AI Superpowers might appear to predict the future, but in fact they do something far more interesting and useful: reframe the present. They invite us to look at the world from new angles and through fresh eyes. And cultivating “beginner’s mind” is the problem for anyone hoping to build or bet on the future.

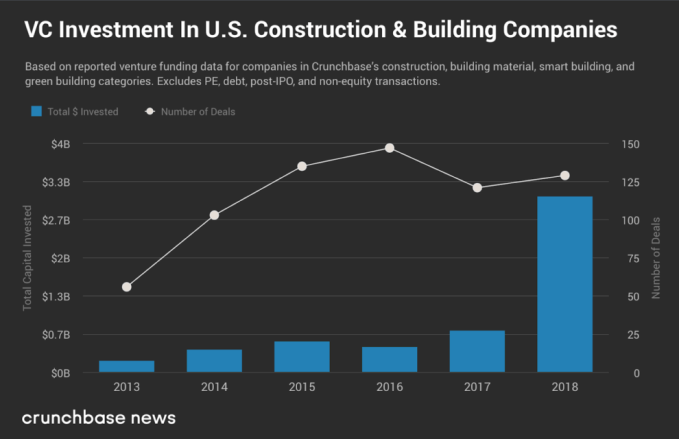

Source: Tech Crunch

(@dweekly)

(@dweekly)