The Station is a weekly newsletter dedicated to all things transportation. Sign up here — just click The Station — to receive it every Saturday in your inbox.

Hello and welcome back to The Station, a newsletter dedicated to all the present and future ways people and packages move from Point A to Point B.

I’ll skip the typical wind up and get right to things this week. We’ve got SPACs, venture deals and micromobility news along with a peek at one AV company’s newest vehicle.

I wanted to mention one item before we launch because it speaks to a larger issue of safety and how some shared mobility startups are turning to tech in an attempt to improve it.

Shared electric moped startup Revel resumed operations in New York City a month after shutting down its service following several deaths. The startup’s blue mopeds (3,000 of them) that had become a familiar sight in New York City are back, but with a number of new protocols and features aimed at boosting safety and assuaging city officials. Revel is leaning heavily on tech, and specifically its app, to improve safety, including training videos and tests, a helmet selfie feature that requires photographic evidence the user is wearing a helmet and a community reporting tool. The question is, will this effort be sufficient?

Image credits: Getty

Alright, let’s go!

Email me anytime at kirsten.korosec@techcrunch.com to share thoughts, criticisms, offer up opinions or tips. You can also send a direct message to me at Twitter — @kirstenkorosec.

Micromobbin’

Remember last week when I told y’all about California Assembly Bill 1286? Here’s a quick refresher: the bill passed the Assembly in 2019 and moved over to committee within the Senate. It sat untouched until this month, when it popped up and passed a committee vote, an action that sent it to the full Senate.

To say the micromobility industry was caught off guard, might be an understatement. The action set off alarm bells and a coalition of micromobility companies, advocacy groups and bike share operators sent a letter to Senate leadership arguing that the bill was an existential threat to shared micromobility in the state. The group was specifically concerned with a line in the bill that would prohibit companies from putting a liability waiver in the user agreement.

That language was removed this week, prompting at least a few emails with comments like “micromobility in California has been saved.”

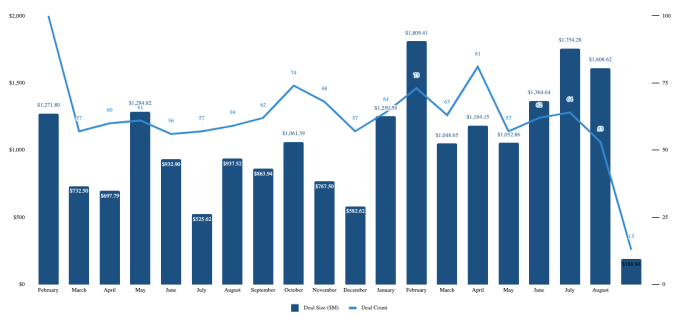

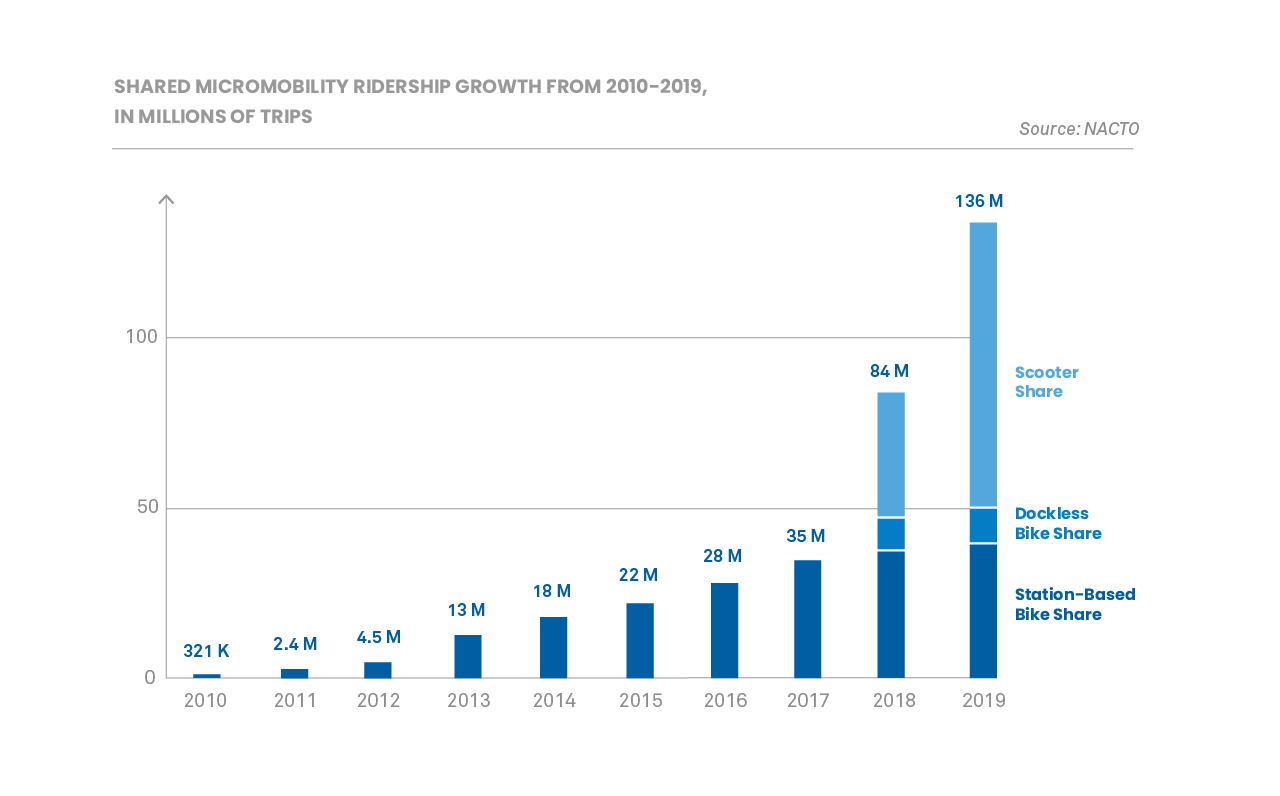

The National Association of Transportation Officials released its annual report on the growth and use of shared micromobility such as bike share, e-bike share and scooter share in the United States. This report focuses on 2019 ridership data, however, NACTO also weighs in a bit on the first half of 2020.

The study found that people in the U.S. took 136 million trips on bikes and scooters in 2019 — a 60% increase from the previous year. Of those trips, 40 million were on station-based bike share systems. The remaining 96 million trips were on dockless systems with 10 million on ebikes and 86 million on scooters.

That doesn’t mean it was a balanced picture. NACTO reported that scooter expansion was in some cases unstable as companies exited markets at the end of the year (prior to the pandemic), possibly due to over-competition and other market pressures.

Image Credits: NACTO

Shared micromobility trips were on average 11 to 12 minutes long and for a distance of 1 to 1.5 miles. Short trips are important, NACTO said in its report, noting that 35% of all U.S. car trips are under 2 miles.

Adam Kovacevich, Lime’s head of North America and APAC Government Affairs, called the numbers “eye popping” in an emailed statement, adding that “People are voting with their feet, and they clearly want more scooters and dockless bikes in their cities.”

We’re not finished yet; one more item of note. Jump returned to the Sacramento region on Saturday. Through an agreement with SACOG, Lime said it is now the “exclusive” regional bikeshare operator for the region.

Deal of the week

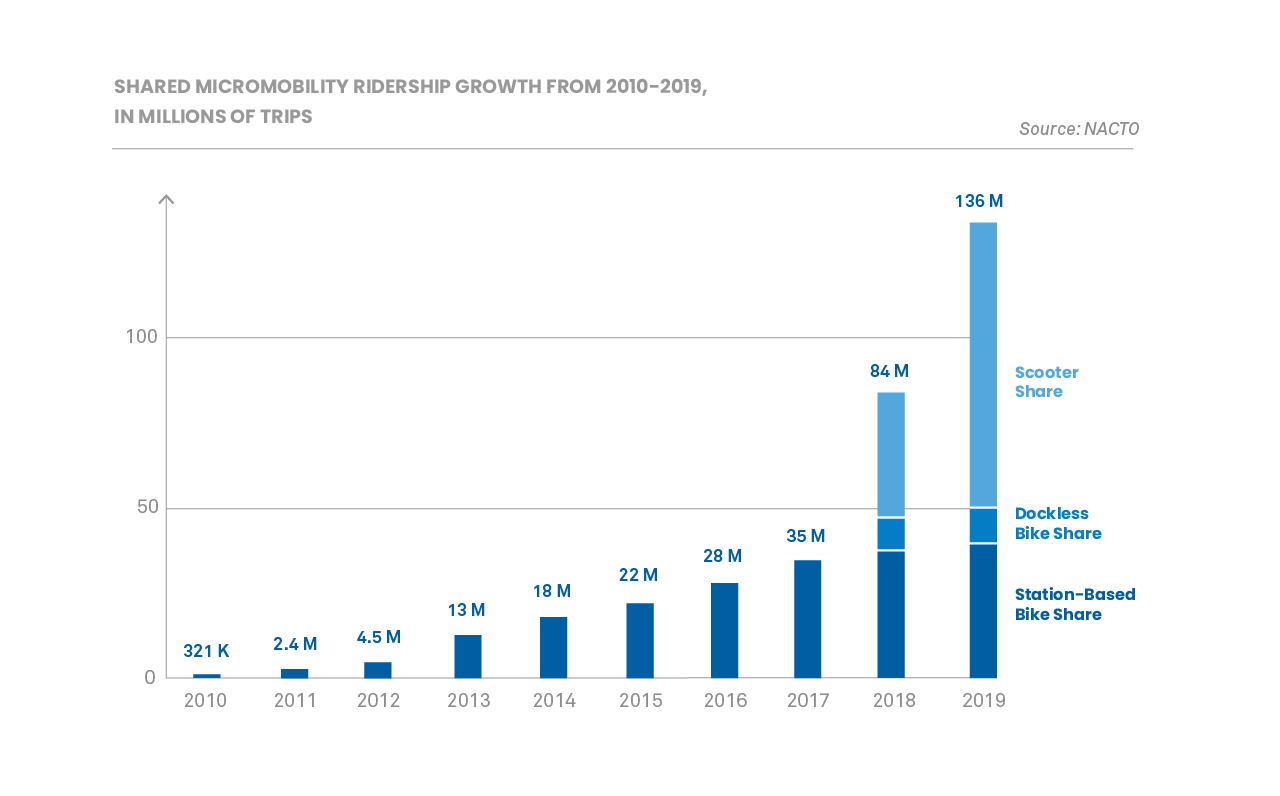

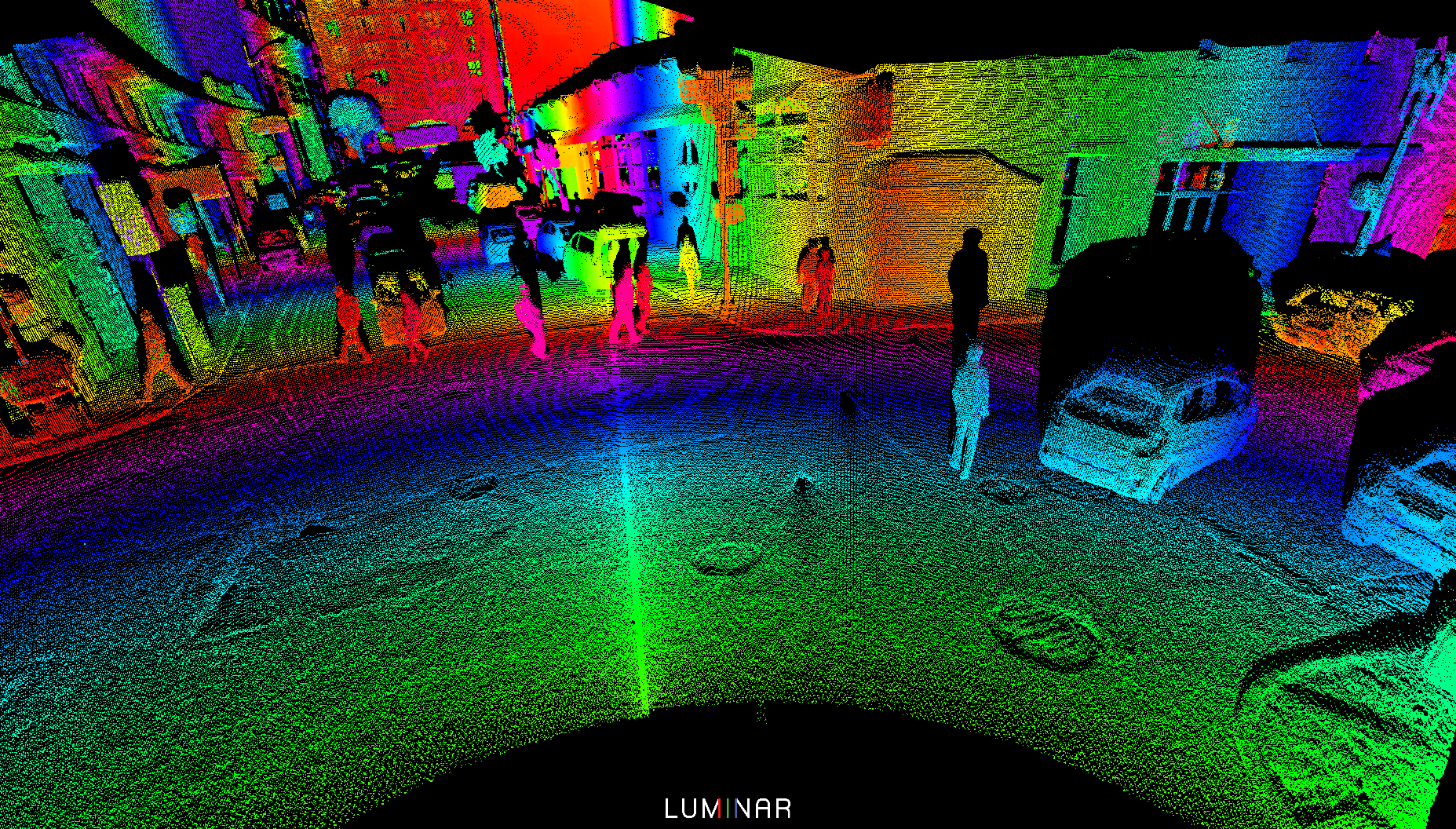

Luminar, the lidar startup founded in 2012 by whiz kid and Thiel fellow Austin Russell, has taken the SPAC path to the public markets. SUMMER OF THE SPAC CONTINUES!

The lidar startup announced it was merging with special purpose acquisition company Gores Metropoulos Inc., with a post-deal market valuation of $3.4 billion. The SPAC merger comes just three months after Luminar hit a critical milestone and announced that Volvo would start producing vehicles in 2022 equipped with its lidar and a perception stack. Volvo plans to use the Luminar technology to deploy an automated driving system for highways in its production vehicles.

Image Credits: Luminar

Russell told me in a recent interview that they wanted to go public at some point, but the momentum from the Volvo deal along with interest within public markets led the company to take the SPAC route.

Luminar is the latest startup — and second lidar company — to turn to SPACs this summer in lieu of a traditional IPO process. In June, Velodyne Lidar struck a deal to merge with special purpose acquisition company Graf Industrial Corp., with a market value of $1.8 billion. Four electric vehicle startups have also skipped the traditional IPO path in recent months, opting instead to go public through a merger agreement with a SPAC, which are also known as blank check companies. Canoo, Fisker Inc., Lordstown Motors and Nikola Corp. have gone public via a SPAC merger this spring and summer. Shift Technologies, an online used car marketplace, also used a SPAC to go public.

Image Credits: Xpeng via Weibo

Meanwhile, Chinese electric automaker Xpeng Inc. made its public market debut the old-fashioned way. Although this traditional IPO path still packed in some unexpected financial thrills. Despite escalating tensions between the U.S. and China, the company raised more than it expected in its initial public offering.

Xpeng, which began trading Thursday on the New York Stock Exchange under the ticker symbol XPEV, said in a filing that it sold 99.7 million shares for $15 each, raising about $1.5 billion through its initial public offering. The automaker had originally planned to sell 85 million shares with a price guidance of between $11 and $13.

Xpeng will need the capital. The company faces an increasingly crowded pool of electric automakers in China, including Tesla, Li Auto and Nio. Shares of Xpeng closed up at $22.79 on Friday.

Other deals that got my attention …

CoPilot, a mobile app for buying and owning vehicles, raised $10 million in a new Series A funding round led by Next Coast Ventures, with participation from Max Levchin’s SciFi Ventures and Arthur Patterson, co-founder of Accel Partners, along with existing investors Chicago Ventures. The investment brings the company’s total outside funding to $17 million.

curbFlow, a curb management startup that uses a network of computer vision devices to detect available parking spots, raised $8 million in seed stage funding led by General Catalyst and Initialized Capital. Doordash is its first paying customer. Keep an eye out for a longer piece on curbFlow; I interviewed the founder Ali Vahabzadeh about the startup and where he sees it evolving. If the name Ali Vahabzadeh sounds familiar, it should. He is the co-founder and former CEO of Chariot, the on-demand shuttle service that Ford acquired and then killed off.

Delivery Hero, the Berlin-based restaurant delivery company that operates mainly in emerging markets, acquired Dubai-based grocery delivery platform InstaShop. The acquisition values the company at $360 million, $270 million upfront plus an additional $90 million based on InstaShop meeting certain growth targets, according to the company. Investors in InstaShop are surely celebrating right now. The five year-old startup had raised just $7 million before being acquired.

Firefly, which offers Uber and Lyft drivers a digital display to make extra money by running ads, acquired Strong Outdoor. The company said it has also become the advertising partner for fleet operator Sally.

Fox Robotics, the Austin-based startup that builds automated forklifts, raised $9 million in a Series A round led by Menlo Ventures. The latest round brings its total funding to date up to $13 million, with support from previous investors Eniac, Famiglia, SignalFire, Congruent, AME and Joe.

Motiv Power Systems, a company that builds all-electric chassis and software systems for the electrification of medium-duty trucks and buses, said it has secured $15 million in additional funding from GMAG Holdings Corp. The company that the funding will be made by means of convertible notes that are expected to be converted into a Series C funding round, which Motiv is in the process of raising.

Shopmonkey, a San Jose, Calif.-based SaaS startup that serves auto repair shops, raised $25 million in a Series B funding round led by Bessemer Venture Partners with participation from Index Ventures, e.ventures and I2BF.

Zoomo, a three-year-old electric bike platform marketed to gig economy delivery workers, raised $11 million from a Series A funding round led by Australian Clean Energy Finance Corporation. Zoomo was actually Bolt Bikes until this past week. The company announced its new name along with its funding round. The round also included equity from Hana Ventures and existing investors Maniv Mobility and Contrarian Ventures, together with venture debt from OneVentures and Viola Credit.

People: layoffs, hiring and moves

It’s been a minute since I wrote about hirings and firings and such. Two bits of hiring news got my attention this week.

Image credit: Rivian

First up, Bloomberg reported that Rivian hired former Tesla executive Nick Kalayjian to lead its engineering. Kalayjian is replacing Mark Vinnels, a former executive a McLaren Automotive.

You might recall that relations between Rivian and Tesla are a bit prickly at the moment. Tesla filed a lawsuit in July against Rivian and four former employers on claims of poaching talent and stealing trade secrets. Specifically, Tesla claimed that Rivian instructed a recently departed Tesla employee about the types of confidential information it needed.

Rivian recently fired back. Rivian filed motion to dismiss the lawsuit, arguing that two of the three claims in the case fail to state sufficient allegations of trade-secret theft and poaching talent and instead was an attempt to malign its reputation and hurt its own recruiting efforts.

It should be noted that Kalayjian didn’t come directly from Tesla; he had a brief stint at San Francisco-based Plenty Inc., according to his Linkedin profile. Still, Kalayjian spent a decade at Tesla, and his move to Rivian likely got the attention of his former employer.

Convoy, the digital freight network that connects truckers with shippers, has hired former Expedia CEO Mark Okerstrom as the company’s president and Chief Operating Officer, effective August 31, 2020. Okerstrom will be responsible for Convoy’s finance, operations, sales, marketing, supply, and marketplace growth teams. Okerstrom wrote a blog about what prompted to leave Expedia after a decade.

Convoy is only five years old, but it’s become a giant in the nascent digital freight business. The company has managed to attract a slew of high-profile investors such as Jeff Bezos, Salesforce CEO Marc Benioff, Greylock Partners, Y Combinator, Cascade Investment (the private investment vehicle of Bill Gates) and Code.org founders Hadi and Ali Partovi. Even U2’s Bono and the Edge have invested in Convoy.

Last November, Convoy announced it had raised $400 million in a Series D funding round, funding that would be used to scale its business amid an increasingly competitive market. Convoy said at the time that its post-money valuation to $2.75 billion.

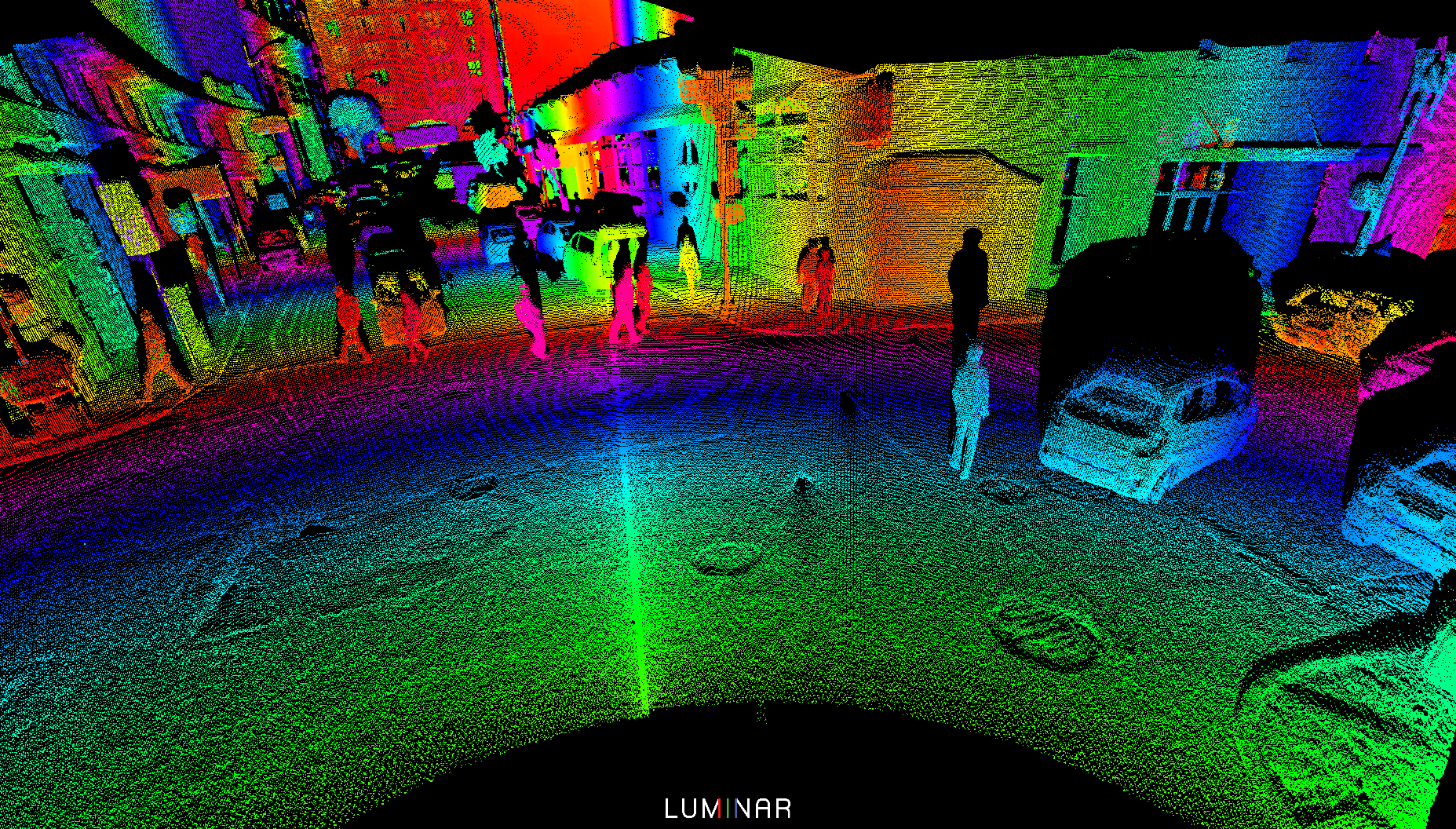

AV Spotlight: Voyage

Autonomous vehicle startup Voyage is a smaller enterprise than its industry peers, in terms of capital raised and number of employees. But that doesn’t mean Voyage isn’t making moves — and progress.

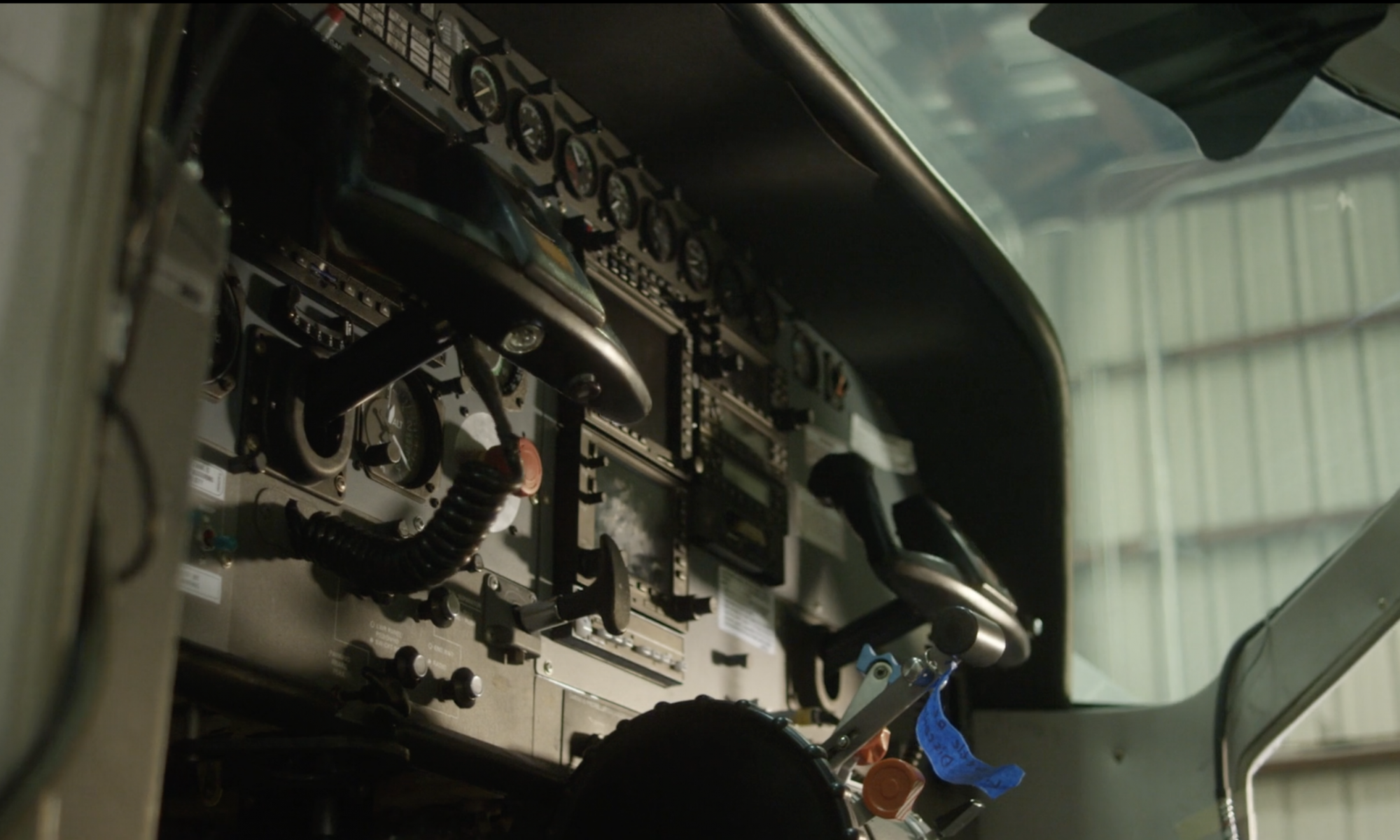

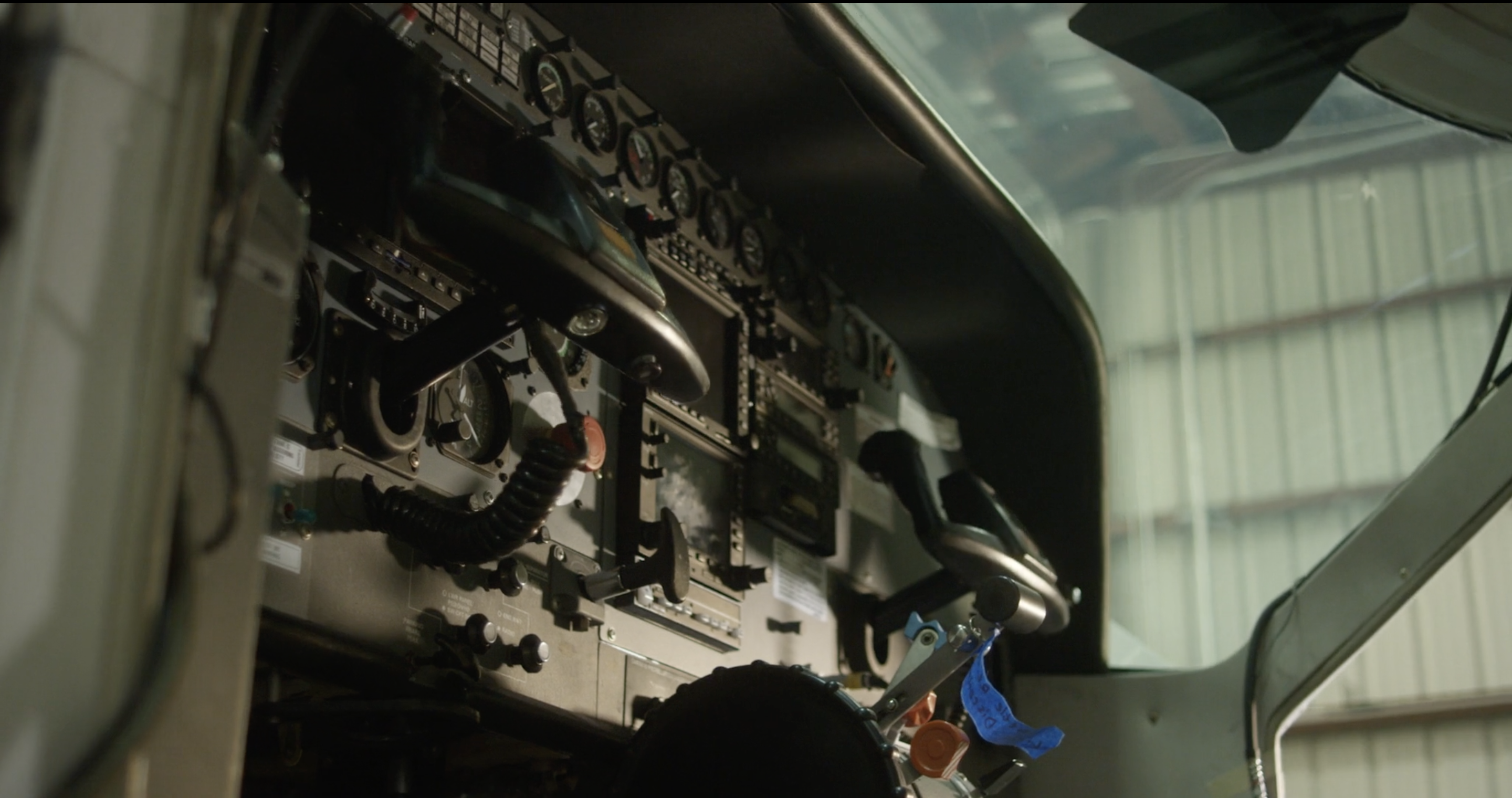

The three-year-old startup tests and operates a self-driving vehicle service (with human safety operators) in retirement communities in California and Florida. They started by modifying Ford Fusion vehicles and later retrofitted FCA’s Chrysler Pacifica Hybrid minivans with its autonomous vehicle technology. Last year, Voyage partnered with FCA to provide next-generation purpose-built Pacifica Hybrid vehicles that have been developed for integration of automated technology. These vehicles come with customizations such as redundant braking and steering that are necessary to safely deploy driverless vehicles. (The partnership wasn’t announced until this spring).

Now, Voyage is lifting the veil on its third-generation robotaxi, called G3. CEO Oliver Cameron tells me G3 is designed to drive without the need of a human safety operator, equipped with COVID killing U-VC hardware and half the cost of its previous second-generation (G2) vehicle.

It might seem odd for the CEO of an AV company to exclaim that its vehicle is designed to be driverless. What Cameron means is that the vehicle generation has progressed to a point where it has all of the necessary redundancies and automotive grade hardware to move beyond testing and into commercial driverless operations. Voyage points to three technologies that get it there.

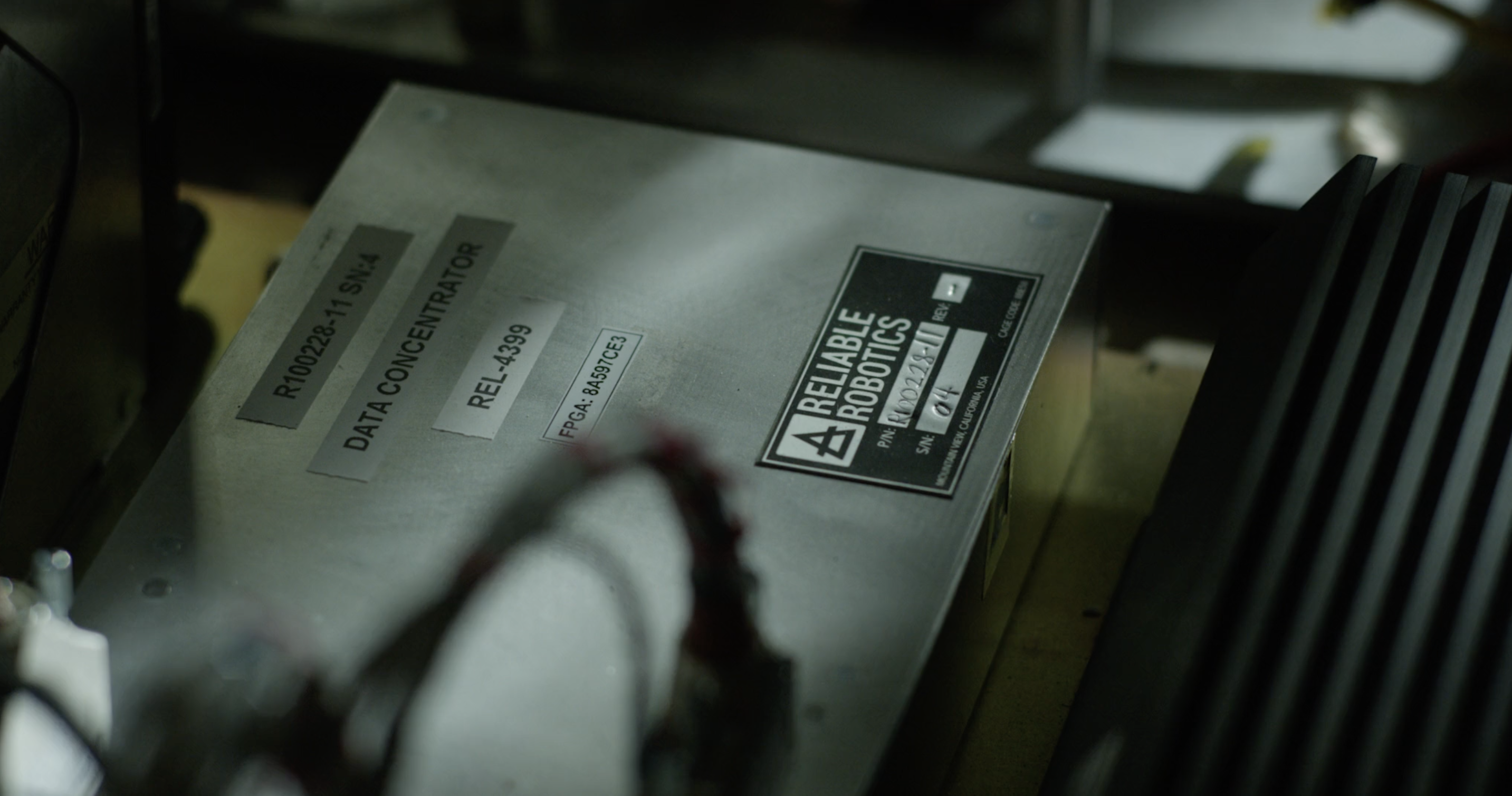

First, there’s the brain of the G3 — internally called Commander — that is powered by its perception, prediction and behavioral modules. Commander runs atop a safety-certified middleware and monitored by self-diagnostic systems. Then there’s the collision mitigation system called Shield that acts as a backup system to bring the vehicle to a safe stop if necessary. And then finally, a remote operations feature called Telessist. When the brain, or Commander, faces a novel or chaotic traffic situation it has the capability to ask for assistance.

Voyage has talked about these elements before, but it has never really dug into the compute side of things. As Cameron noted to me, “it used to be you had to choose between automotive grade and performance. Now, we have both.”

Voyage worked with Nvidia on the compute. It also involved another company, which took the Nvidia boards and made them automotive grade. “So think ruggedized aluminum, think safety certified, think liquid cooling — all the things you need to do this safely and in a vehicle,” Cameron said.

Also of note, Voyage is using Blackberry’s QNX operating system in the G3. This generation also has a number of features aimed at its senior citizen customers, including two-way voice, extra steps to help mobility-challenged riders get in and out of the vehicle, extra lighting, and an in-cabin user interface that caters to vision-impaired riders.

Image Credits: Voyage

Inside the vehicle, Voyage has added U-VC hardware to kill COVID and other airborne diseases. Cameron said they knew it would be critical to find some cost-effective way of cleaning the vehicles. A friend suggested that he look into ambulances.

“Ambulances have really figured out how to prevent contamination from one person to another after each trip,” Cameron said. “It turns out they primarily use UV-C and it turns out in multiple studies and publications that UV-C at a certain intensity, kills COVID.”

The UV-C lights, provided by a company called GHSP, are placed in each row of the vehicle.

Despite the extra cost of the UV-C lighting and other features, Cameron said the G3 is still 50% cheaper than its previous generation.

“In the past 12 months, we’ve seen our sensor costs decrease by 65% and our compute costs decrease by 25%, resulting in a vehicle that is about 50% cheaper than the prior generation. And that’s puts us on a viable path to make money.”

The G3 isn’t quite ready for prime time. Beta versions of the G3 are being tested on the road in San Jose. Production vehicles and commercial driverless are expected to follow next year.

Notable reads and other tidbits

Loads of other mobility news went down this week. Let’s check it out.

Bentley’s Bentayga packed in a series of surprises for TechCrunch’s Matt Burns. Here’s what he discovered over 24 hours with the $177,000 sport utility vehicle.

Blackberry is pushing into China. The company announced it will be powering the Level 3 driving domain controller of Xpeng, one of the most-funded electric vehicle startups in China, and Tesla’s local challenger.

Bollinger Motors, the Michigan-based startup known for its rugged electric SUV and pickup truck, unveiled a delivery van concept called the DELIVER-E that it plans to start producing in 2022. This shouldn’t be confused with the E-Chassis, now called Chass-E, that the company designed for Class 3 commercial vehicles.

Elon Musk called an attempted cyberattack against Tesla “serious,” a comment that confirmed the company was the target of a foiled ransomware attempt at its massive factory near Reno, Nevada. The Justice Department released a complaint that described a thwarted malware attack against an unnamed company in Sparks, Nevada. It wasn’t clear if the company was Tesla until Musk publicly commented on it. Russian national Egor Igorevich Kriuchkov, 27, allegedly attempted to recruit and bribe a Tesla employee to introduce malware in the company’s network, according to the complaint.

Ford, Bosch and Bedrock are demonstrating automated valet parking in downtown Detroit. This system is designed to allow drivers to exit a vehicle and the vehicle would park itself in the parking structure. You might recall that Bedrock also has a pilot with automated shuttle startup May Mobility.

Image Credits: Ford

GM is moving the engineering team responsible for the mid-engine Chevrolet Corvette to the company’s electric and autonomous vehicle programs to “push the boundaries” on what its future EV battery systems and components can deliver, according to an internal memo from Doug Parks.

Monet, a joint venture between SoftBank Corp. and Toyota Motor Corp. unveiled two adapted vans. One of the vans pumps fresh air through the vehicle to reduce the risk of COVID-19 exposure, Reuters reported.

Pony.ai, the self-driving startup Pony.ai, and Bosch reached an agreement to explore the future of automotive maintenance and repair for autonomous fleets. The companies started in July a pilot of the robotaxi fleet maintenance at an undisclosed Bosch Car Service location in the San Francisco Bay area.

Scout Campers unveiled its new Kenai unit, a camper that packs a massive amount of equipment into its small footprint, including a 160-watt solar panel, CNET’s Roadshow reports.

Xwing, the autonomous aviation startup, revealed its go-to-market strategy, a plan that includes focusing on regional 500-mile distance cargo flights.

Source: Tech Crunch