The Station is a weekly newsletter dedicated to all things transportation. Sign up here — just click The Station — to receive it every Saturday in your inbox.

Hello and welcome back to The Station, a newsletter dedicated to all the present and future ways people and packages move from Point A to Point B.

Before we get into all the mobility news and analysis of the week I wanted to flag an upcoming event that might be of interest to the budding entrepreneurs out there. TC Disrupt, that BIG annual event we hold each fall, is virtual this year. I can’t tell you everything yet, except we put a lot of effort and tech into making this interactive and exciting. This is not going to some boring webinar.

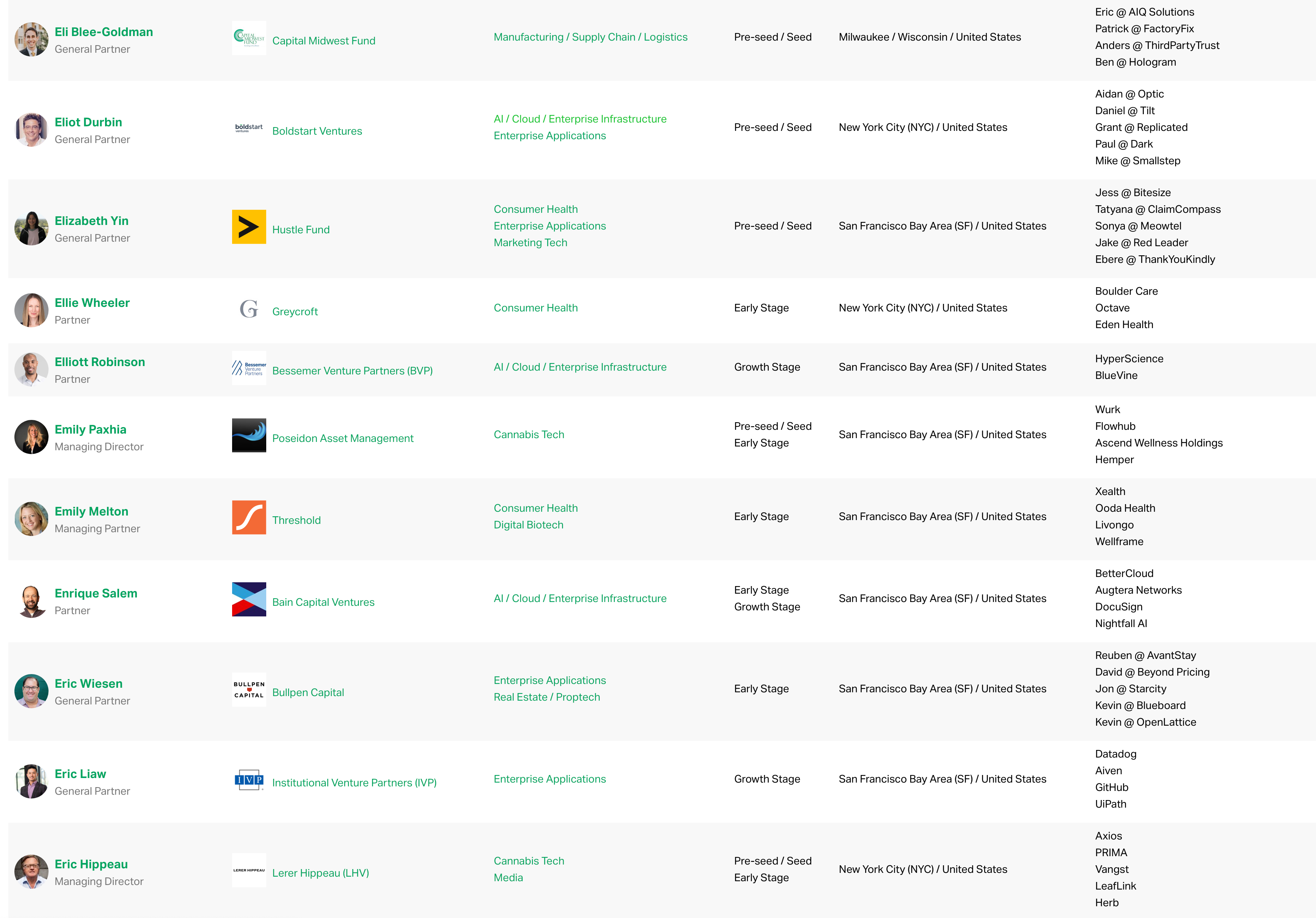

We’re adding a bunch of new events to Disrupt this year, including something we’re calling Pitch Deck Teardown. Top venture capitalists and entrepreneurs will evaluate and suggest fixes for Disrupt 2020 attendees’ pitch decks. Investors who signed up for the Pitch Deck Teardown, include Aileen Lee of Cowboy Ventures, Charles Hudson with Venture Forward, Niko Bonatsos of General Catalyst, Megan Quinn with Spark Capital, Cyan Banister of Long Journey Ventures, Roelof Botha from Sequoia and Susan Lyne with BBG.

Only pitch decks of registered Disrupt attendees will be selected. Here’s a complete breakdown of the event and how to register.

The Pitch Deck Teardown couldn’t come at a better time either. During our Early Stage event last month, Jake Saper with Emergence Capital talked about how to time your Series A fundraise. September just so happens to be a big month for investors to review pitch decks.

Alrighty then. Vamos.

Friendly reminder that you can reach out and email me anytime at kirsten.korosec@techcrunch.com to share thoughts, criticisms, offer up opinions or tips. You can also send a direct message to me at Twitter — @kirstenkorosec.

Micromobbin’

This summer is turning out to be a crucial period for scooter companies vying for permits in a handful of markets. Cities learned a thing or two during that first wave of electric scooters that hit the streets a couple of years ago. This time around, city leaders are placing more restrictions on e-scooters and limiting the number of companies allowed to operate in an urban area. That’s an important change, and one that raises the stakes for scooter companies.

First there was Paris, which awarded Dott, Lime and Tier permits to operate in the city. Now, Chicago has issued permits to Bird, Lime and Spin for its second pilot program. Chicago is limiting scooter use to 15 mph between 5 a.m. and 10 p.m. And there are few areas, like the Lakefront Trail, where scooters are prohibited.

Each scooter company is limited to no more than 3,333 devices, 50% of which must be deployed with an equity priority area. New to the second pilot is a requirement that all e-scooters must have locks that require riders to secure the scooter to a fixed object to end their trip.

On a side note, Lyft did not apply for the scooter permit. I asked Lyft, ‘why not?’ The company said it’s focusing on its expansion of Divvy, Chicago’s bike-sharing system. The city made Lyft the exclusive operator of Divvy last year and now starting to expand. The Divvy system will eventually include 16,500 bikes and 800 stations. Here’s what Lyft had to say:

“We have spent the better part of the last year working with communities in Chicago’s South and West Sides to prepare for new stations and ebikes. In order to prioritize our work with CDOT to expand Divvy and provide the highest possible experience for Divvy members, Lyft opted out of submitting an application that mirrored requests of this year’s scooter pilot. We are dedicated to the long-term success of micromobility in Chicago, and we look forward to future opportunities to work with the City to combine the benefits of bikes and scooters into one Divvy membership.”

In other micromobbin’ news …

Bird said Friday it is launching its shared e-scooters in Yonkers, New York as an “exclusive” operator. The word “exclusive” is one of those buzzwords that is tossed around a lot so I asked what this actually means. And Bird says it is the only company that will be issued a permit to operate in Yonkers. So there you have it. The company’s fleet of next-generation Bird Two scooters will be available to rent starting August 10.

Image Credits: Bird

Revel, the shared moped startup, has shut down operations in New York City following two deaths within days of each other. The startup’ blue mopeds had become a common sight in New York City. Revel, founded in March 2018 by Frank Reig and Paul Suhey, started with a pilot program in Brooklyn and later expanded to Queens. Revel has been on a fast-paced growth track, expanding to Austin, Miami and Washington, D.C in its first 18 months of operation. In January, the company launched in Oakland and recently announced plans to expand to San Francisco this August.

The company said in a statement that is reviewing its safety measures and does plan to return to New York.

Deal of the week

Prickly relations between China and the United States, particularly around trade, has not slowed the march of Chinese companies hoping to list on American stock exchanges. Li Auto is just the latest example, Rita Liao reported this week.

Li Auto is aiming for a growing Chinese middle class that aspires to drive cleaner, smarter and larger vehicles. Its first model, sold at a subsidized price of 328,000 yuan, or $46,800, is a six-seat electric SUV that began shipping at the end of last year.

The five-year-old Chinese electric vehicle startup raised $1.1 billion through its debut on Nasdaq. Li Auto priced its IPO north of its targeted range at $11.5 per share, giving it a fully diluted market value of $10 billion. It also raised an additional $380 million in a concurrent private placement of shares to existing investors.

Image credit: Li Auto

Other deals that got my attention this week …

Argo AI is now valued at $7.5 billion, a figure that was confirmed Thursday, nearly two months after VW Group finalized its $2.6 billion investment in the autonomous vehicle technology startup. You might recall that Argo came out of nowhere in 2017 with $1 billion (to be spread over several years) in back from Ford. Last year, VW announced it was going to invest in Argo as well.

Under the deal that was finalized last month, Ford and VW have equal ownership stakes, which will be roughly 40% each over time. The remaining equity sits with Argo’s co-founders as well as employees. Argo’s board is comprised of two VW seats, two Ford seats and three Argo seats. Ford said Thursday it netted $3.5 billion in the second quarter from selling some of its Argo equity to Volkswagen.

AUTO1 Group, the European digital used-car trading platform, raised 255 million euros ($300 million) in the form of convertible notes. The round was led by Farallon Capital Management and the Baupost Group as well as existing investor Softbank Group, the NYT reported.

Cargo.one, a Berlin-based startup that runs a marketplace for booking air freight, closed an $18.6 million Series A round of funding led by Index Ventures. Other participants in the round include Next47 as well as prior backers Creandum, Lufthansa Cargo and Point Nine Capital. A number of angel investors also joined in, including Tom Stafford of DST Global and Carlos Gonzalez-Cadenas, the COO of GoCardless and former chief product officer of Skyscanner.

LINE MAN, the Thai food delivery platform that is a unit of Japanese chat app LINE Corp, raised $110 million from BRV Capital Management and merged with a local restaurant aggregator. LINE MAN is loading up on capital as it aims to compete with Singapore-based Grab, Indonesia’s Go-Jek and Foodpanda of Germany’s Delivery Hero SE, Reuters reported.

FreightWaves, the freight data and analytics company, raised $37 million in a round led by Kayne Partners Fund. Other investors include 8VC, Fontinalis Partners, Revolution Ventures, Hearst Ventures, Prologis Ventures, Story Ventures and Engage Ventures.

Theeb Rent-a-Car is looking into a potential initial public offering. The Saudi Arabian rental company hired Saudi Fransi Capital to advise on the IPO, Bloomberg reported.

Toyota is taking a 10% stake in BluE Nexus, a company that makes electric drive modules. The investment is part of a deepening collaboration between the two companies.

Xpeng, the Chinese electric vehicle startup and Tesla rival that just announced a $500 million Series C+ round, is reportedly in talks to raise around $300 million ahead of an initial public offering (IPO) in the United States. (back to my earlier point about interest among Chinese companies to list on U.S. stock exchanges)

Delivery and data (breaches)

Image credit: Getty

If you hadn’t noticed, delivery has been cast as one of the big success stories to emerge during the COVID-19 pandemic. I use the term “cast” because it’s not all sunshine, roses and rainbows for the delivery industry or its users.

The COVID-19 pandemic has led to a spike in demand for delivery services. It has also helped propel unprecedented consolidation as companies like Uber seek profitability.

There are challenges though, including an area that perhaps deserves A LOT MORE ATTENTION. I’m talking about data and privacy. Delivery companies, which includes a growing number of autonomous and teleoperated services, collect a ton of personal data from its customers. The kind of valuable data, like home addresses and credit card numbers, that are sold on the dark web.

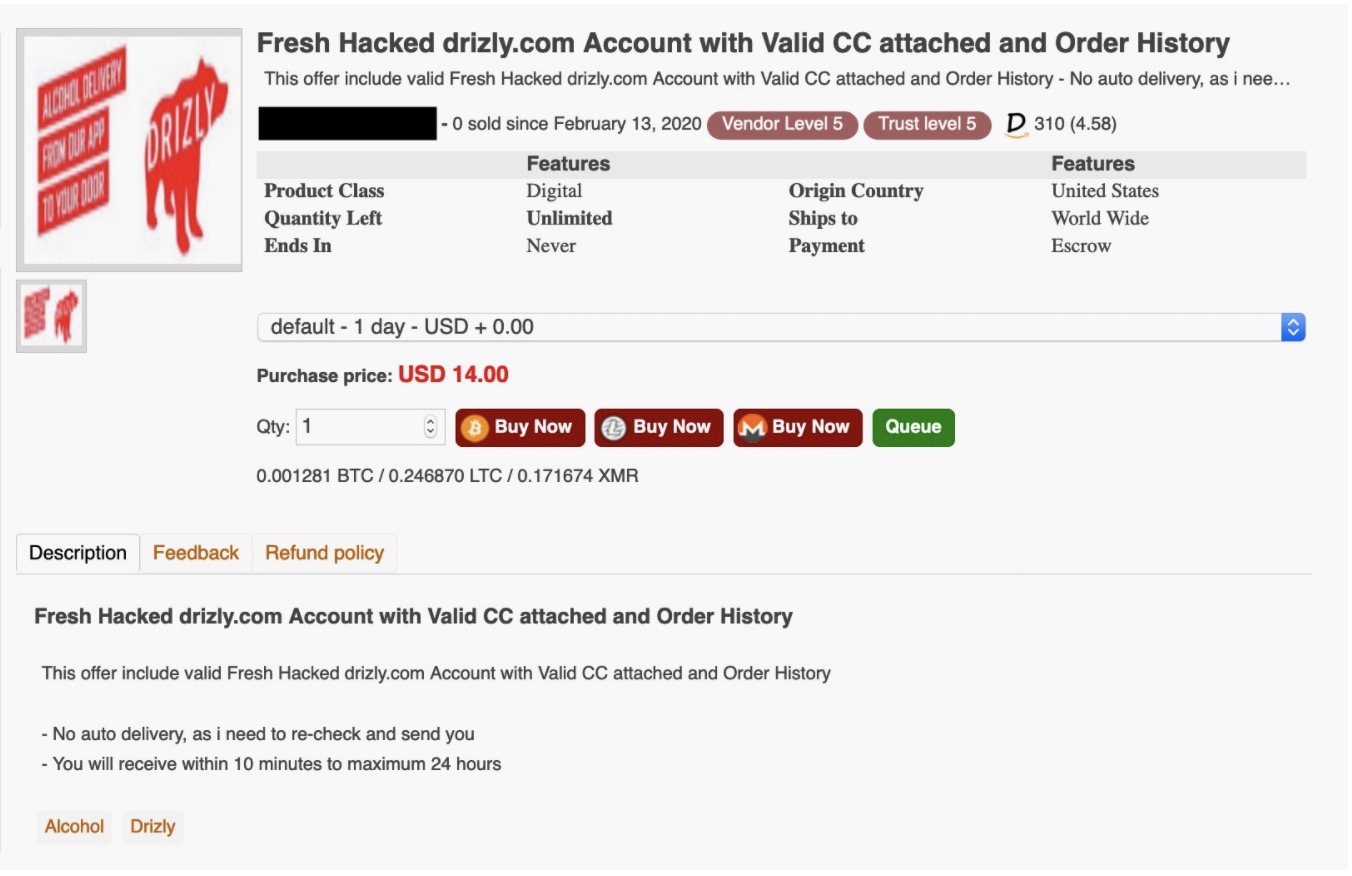

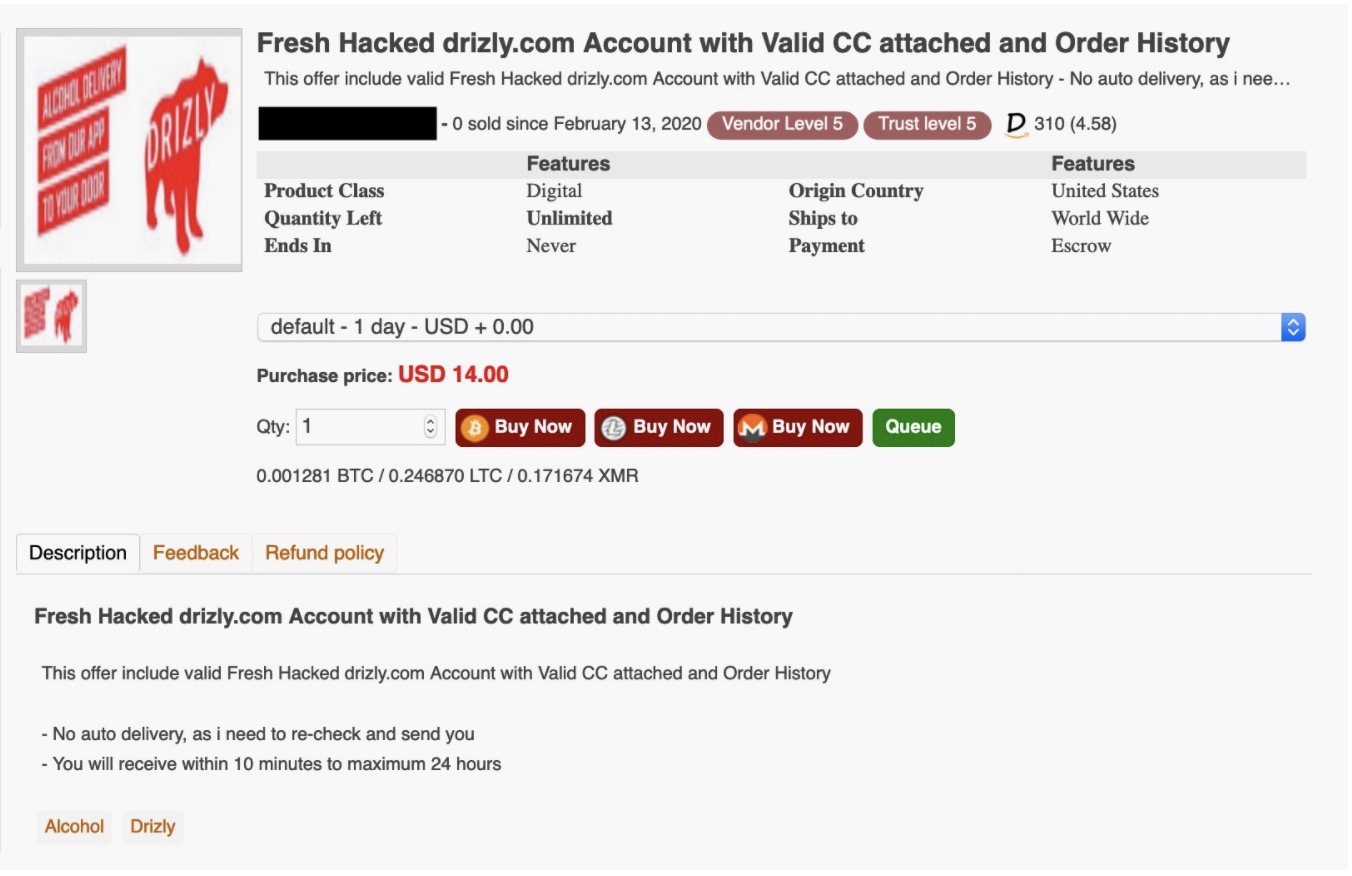

This week, our cybersecurity editor Zack Whittaker reported on two data breaches involving delivery companies. The first was Drizly, one of the biggest online alcohol delivery services in the U.S. and Canada, raising over $68 million to date. Drizly told customers a hacker “obtained” some customer data. The hacker took customer email addresses, date-of-birth, passwords hashed using the stronger bcrypt algorithm and, in some cases, delivery addresses.

As many as 2.5 million Drizly accounts are believed to have been stolen. Here’s something to take note of, Drizy told TechCrunch that no financial information was compromised. However, a listing on a dark web marketplace from a well-known seller of stolen data claims otherwise. TechCrunch, of course, didn’t link to it. But Whittaker did take and share a screenshot.

Meanwhile, online shopping and delivery service Instacart is blaming customers who reused passwords for a recent spate of account breaches. The data breach compromised 270,000 Instacart customers. The company published a statement late on Thursday saying its investigation showed that Instacart “was not compromised or breached,” but pointed to credential stuffing, where hackers take lists of usernames and passwords stolen from other breached sites and brute-force their way into other accounts.

Customers can’t shoulder all of the responsibility. Instacart, as Whittaker notes, still does not support two-factor authentication, which — if customers had enabled — would have prevented the account hacks to begin with.

Other delivery news …

Flipkart, which is owned by Walmart, launched a hyperlocal service in suburbs of Bangalore, four years after the e-commerce group abruptly concluded its previous foray into this category.

The new service called Flipkart Quick uses the company’s supply chain infrastructure and a new location mapping technology framework to deliver within 90 minutes to customers more than 2,000 products across grocery, perishables, smartphones, electronics accessories and stationary items.

It’s electric

Remember the days when electric vehicle news was relegated to Tesla, the Nissan Leaf and Chevy Bolt? Times have changed and, well, stayed the same. Tesla still dominates the headlines and this week wasn’t any different. (more on them later). But now, there are dozens of other electric vehicle models coming to market. The upshot: charging infrastructure is becoming more important. (Hey, not everyone has a garage).

This week, GM and EVgo announced plans to add more than 2,700 new fast chargers. The rollout, which will take five years, will triple the size of the EVgo network. The first of these new EVgo fast charging stations will be available to customers starting early 2021.

The companies are targeting high-traffic areas like grocery stores, retail outlets, entertainment centers, areas where people typically spend 15 to 30 minutes. The stations, which will be powered by renewable energy, will feature new charging technology with 100 to 350-kilowatt capabilities, the companies said.

The charging partnership follows a numerous announcements from GM around its electric vehicle strategy. Earlier this week, GM said steel construction has started on the nearly 3-million-square-foot factory that will mass produce Ultium battery cells and packs. The Ultium battery, along with a modular propulsion system and electric vehicle platform, is the cornerstone of GM’ strategy to bring 20 electric vehicles to market by 2023.

GM recently released a video of its upcoming GMC Hummer EV and next week plans to reveal the Cadillac LYRIQ.

Image Credits: GM/EVgo

Other electric news this week …

BMW said it will offer the all-electric versions of X1 compact SUV and the 5 Series as part of the German automaker’s plans to have 25 electrified models in its portfolio by 2023.

Electric Brands is working on a VW Bus-inspired EV called the eBussy, via The Drive.

Fisker Inc. revealed in a presentation that was filed with the SEC that a “cornerstone agreement” with Volkswagen has been delayed, the Verge reported. Fisker wants to use Volkswagen’s modular EV platform for its upcoming electric vehicles.

Kandi Technologies Group, the Chinese electric vehicle and parts manufacturer, bringing two EVs to the United States through its subsidiary Kandi America. The two models, which are priced under $30,000 before federal incentives, will be the cheapest EVs in the United States.

Lucid Motors provided new details about its upcoming electric vehicle, the Air. In short, this luxury EV sedan is loaded up with hardware — dozens of sensors, a driver monitoring system and an Ethernet-based architecture — for an advanced driver assistance system that aims to match and even surpass its rivals.

There will be 32 sensors in all, according to Lucid, which has branded its advanced driver assistance system DreamDrive. Lidar, a sensor that gets a lot of attention, will be on the vehicle. But I was struck by the number of radar sensors on the Air. There will be five radars in all, giving the vehicle 360 degrees of radar coverage.

Panasonic revealed to TechCrunch this week that it developed new battery technology for the “2170” lithium-ion cells it produces and supplies to Tesla, a change that improves energy density by 5% and reduces costly cobalt content. The new, higher energy dense 2170 cells will be produced by Panasonic at Tesla’s factory in Sparks, Nevada. Improvements on the battery tech will continue with a 20% improvement in energy density over the next five years and a goal to be cobalt free.

Rivian’s retail strategy is starting to emerge. The company has said it will try and repurpose existing buildings for its stores, when possible. This week, the company said it is pursuing the purchase of the historic Laguna Beach South Coast Cinema. The theater’s present structure, was opened in 1935 and stood as the city’s only cinema until it closed its doors in August 2015.

Tesla’s sales in China are becoming increasingly important to its bottom line. An SEC filing this week shows that revenue in China climbed 102.9% year-over-year to $1.4 billion. That means China now makes up 23.3% of Tesla’s total revenues of $6 billion in the quarter, compared to just about 11% in the same period a year before.

Tesla also revealed in the same SEC filing that it received payroll-related benefits from the government, funds that helped reduce the impact of the coronavirus pandemic on its business, Reuters reported.

Speaking of Tesla … CEO Elon Musk took to Twitter on Tuesday night to say that the automaker would be “open to licensing software and supplying powertrains & batteries” to other automakers. Musk added that that would even include Autopilot, the advanced driver assistance software that Tesla offers to provide intelligent cruise control in a number of different driving scenarios. No word on whether any companies are biting.

ADA and mobility

Image Credits: iStock / Getty Images

The Americans with Disabilities Act of 1990 paved the way for decades of incremental changes to the way buildings, businesses and laws accommodate people with a wide variety of disabilities. As reporter Devin Coldewey notes, the law’s effect on tech has been profound.

There is still a lot of work to do. I’m looking at all of you autonomous vehicle engineers, designers and founders.

Here are a few stories that highlight the impact of ADA.

Start with Coldewey’s overview on ADA and tech. Then move over to Streetsblog, which digs into the role bicycles have played as mobility assistive devices. Finally, check out this story on Fable, a startup that aims to make disability-inclusive design easier by providing testing and development assistance from disabled folks on-demand.

See ya’ll next week.

Source: Tech Crunch