Welcome back to Transportation Weekly; I’m your host Kirsten Korosec, senior transportation reporter at TechCrunch . This is the fifth edition of our newsletter and we love the reader feedback. Keep it coming.

Never heard of TechCrunch’s Transportation Weekly? Catch up here, here and here. As I’ve written before, consider this a soft launch. Follow me on Twitter @kirstenkorosec to ensure you see it each week. (An email subscription is coming).

This week, we explore the world of light detection and ranging sensors known as LiDAR, young drivers, trouble in Barcelona, autonomous trucks in California, and China among other things.

ONM …

There are OEMs in the automotive world. And here, (wait for it) there are ONMs — original news manufacturers. (Cymbal clash!) This is where investigative reporting, enterprise pieces and analysis on transportation lives.

This week, we’re going to put our analysis hats as we explore the world of LiDAR, a sensor that measures distance using laser light to generate highly accurate 3D maps of the world around the car. LiDAR is considered by most in the self-driving car industry (Tesla CEO Elon Musk being one exception) a key piece of technology required to safely deploy robotaxis and other autonomous vehicles.

There are A LOT of companies working on LiDAR. Some counts track upwards of 70. For years now, Velodyne has been the primary supplier of LiDAR sensors to companies developing autonomous vehicles. Waymo, back when it was just the Google self-driving project, even used Velodyne LiDAR sensors until 2012.

Dozens of startups have sprung up with Velodyne in its sights. But now Waymo has changed the storyline.

To catch you up: Waymo announced this week that it will start selling its custom LiDAR sensors — the technology that was at the heart of a trade secrets lawsuit last year against Uber.

Waymo’s entry into the market doesn’t necessarily upend other companies’ plans. Waymo is going to sell its short range LiDAR, called Laser Bear Honeycomb, to companies outside of self-driving cars. It will initially target robotics, security and agricultural technology.

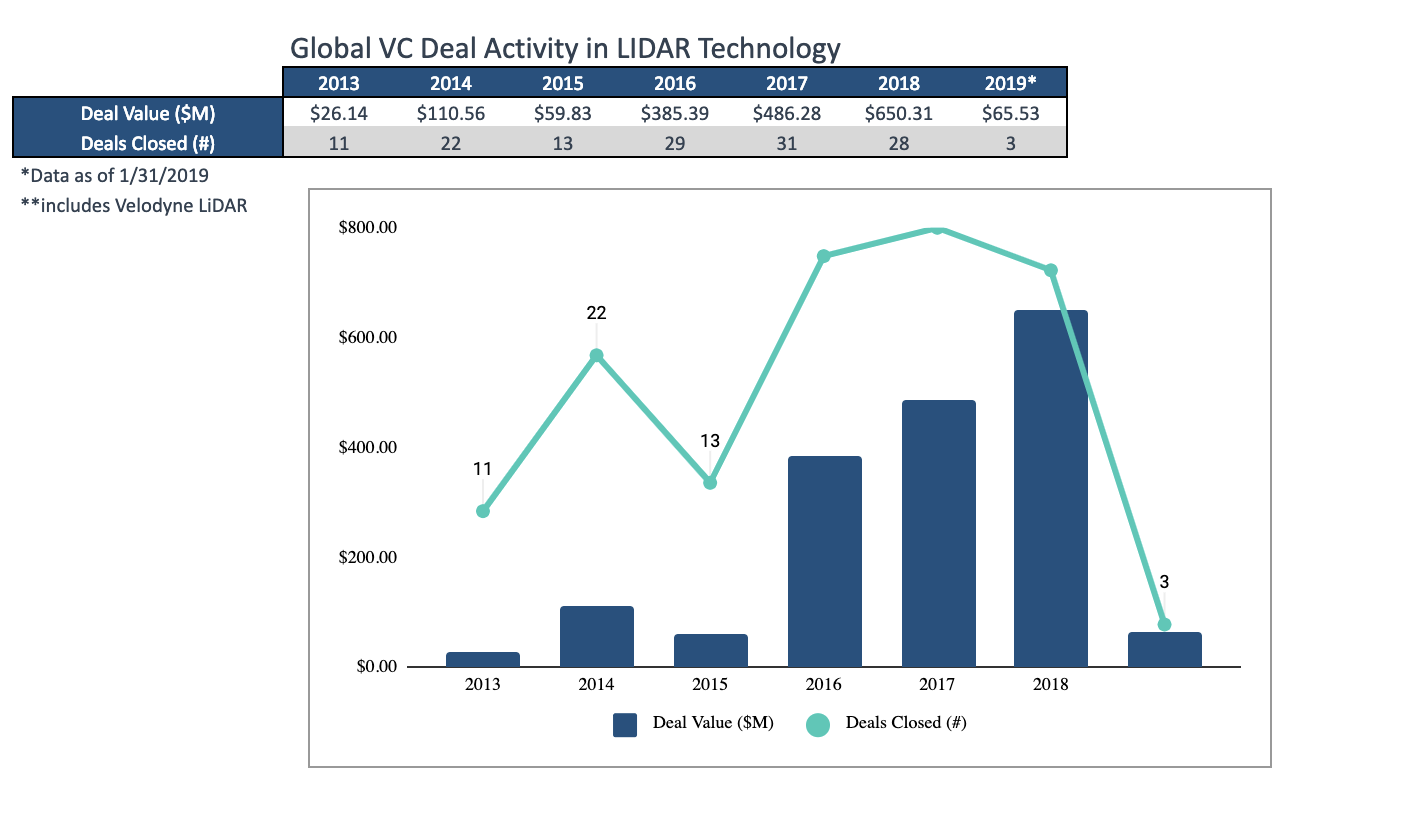

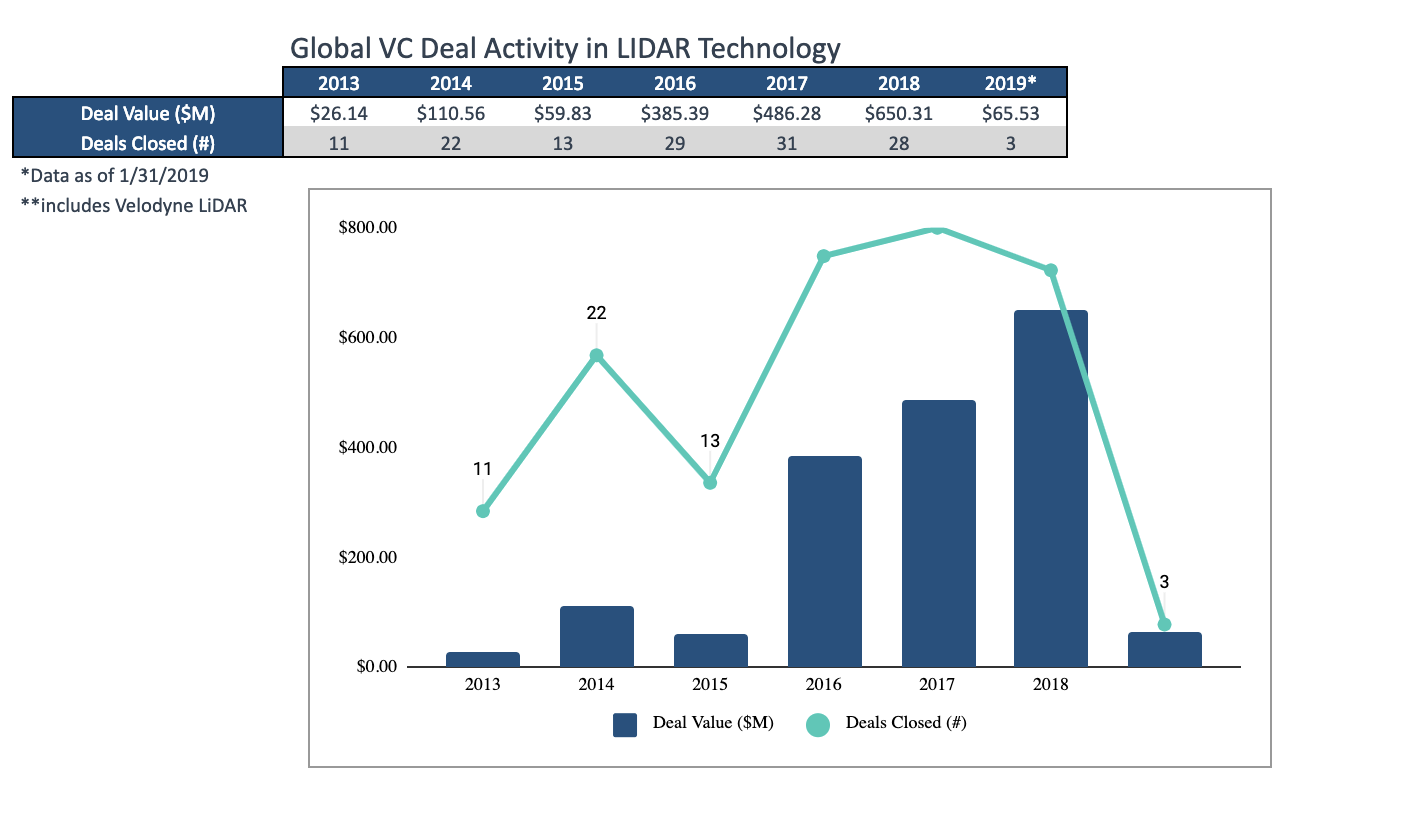

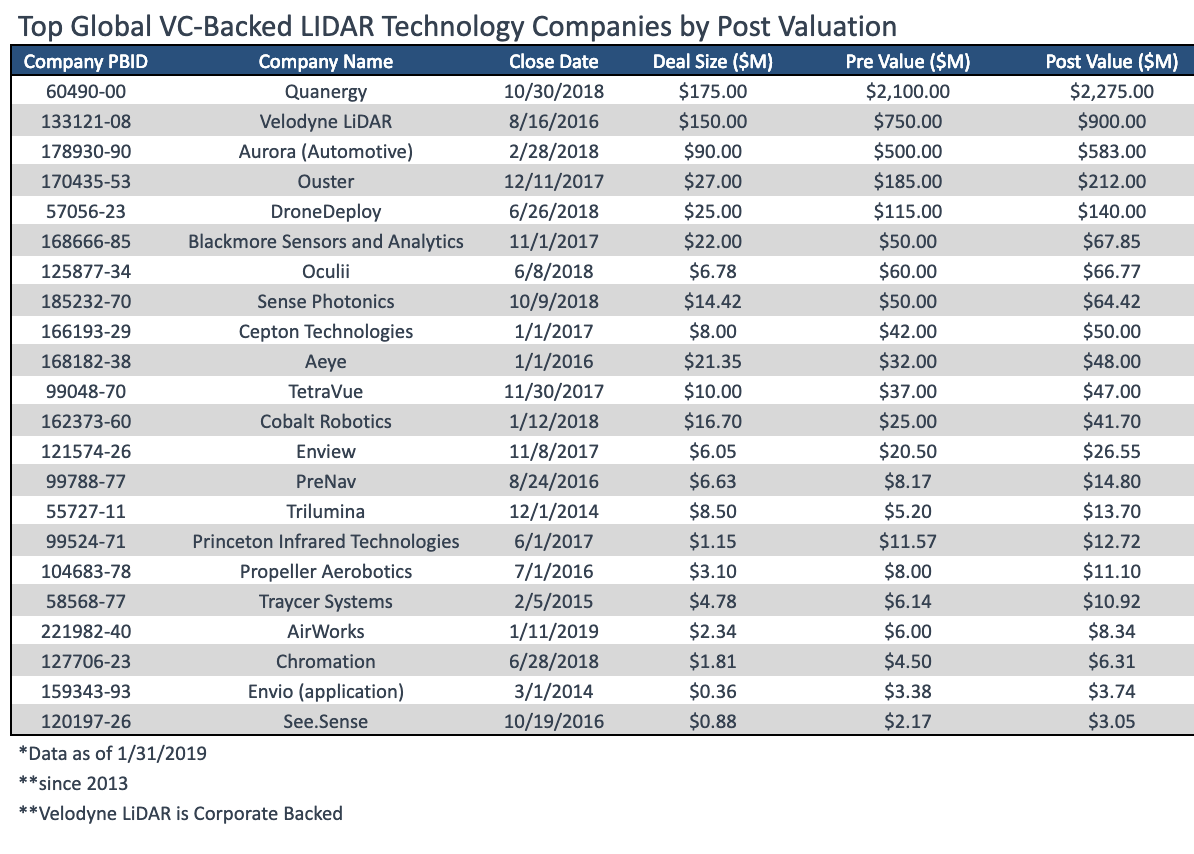

It does put pressure on startups, particularly those with less capital or those targeting the same customer base. Pitchbook ran the numbers for us to determine where the LiDAR industry sits at the moment. There are two stories here: there are a handful of well capitalized startups and we may have reached “peak” LiDAR. Last year, there were 28 VC deals in LiDAR technology valued at $650 million. The number of deals was slightly lower than in 2017, but the values jumped by nearly 34 percent.

The top global VC-backed LiDAR technology companies (by post valuation) are Quanergy, Velodyne (although mostly corporate backed), Aurora (not self-driving company Aurora Innovation),

Ouster, and DroneDeploy. The graphic below, also courtesy of Pitchbook, shows the latest figures as of January 31, 2019.

Dig In

Researchers discovered that two popular car alarm systems were vulnerable to a manipulated server-side API that could be abused to take control of an alarm system’s user account and their vehicle.

The companies — Russian alarm maker Pandora and California-based Viper (or Clifford in the U.K.) — have fixed the security vulnerabilities that allowed researchers to remotely track, hijack and take control of vehicles with the alarms installed. What does this all mean?

Our in-house security expert and reporter Zack Whittaker digs in and gives us a reality check. Follow him @zackwhittaker.

Since the first widely publicized car hack in 2015 proved hijacking and controlling a car was possible, it’s opened the door to understanding the wider threat to modern vehicles.

Most modern cars have internet connectivity, making their baseline surface area of attack far greater than a car that doesn’t. But the effort that goes into remotely controlling a vehicle is difficult and convoluted, and the attack — often done by chaining together a set of different vulnerabilities — can take weeks or even longer to develop.

Keyfob or replay attacks are far more likely than say remote attacks over the internet or cell network. A keyfob sends an “unlock” signal, a device captures that signal and replays it. By replaying it you can unlock the car.

This latest car hack, featuring flawed third-party car alarms, was far easier to exploit, because the alarm systems added a weakness to the vehicles that weren’t there to begin with. Car makers, with vast financial and research resources, do a far greater job at securing their vehicle than the small companies that focus on functionality over security. For now, the bigger risk comes from third parties in the automobile space, but the car makers can’t afford to drop their game either.

A little bird …

We hear a lot. But we’re not selfish. Let’s share.

The California Department Motor Vehicles is the government body that regulates autonomous vehicle testing on public roads. The job of enforcement falls to the California Highway Patrol.

In an effort to gauge the need for more robust testing guidelines, the California Highway Patrol decided to hold an event at its headquarters in Sacramento. Eight companies working on autonomous trucking technology were invited. It was supposed to be a large event with local and state politicians in attendance. And it was supposed to validate autonomous trucking as an emerging industry.

There’s just one problem: only one AV trucking company is willing and able to complete this course. We hear that this AV startup actually already went ahead and completed the test course.

The California Highway Patrol has postponed event, for now, presumably until more companies can join.

Got a tip or overheard something in the world of transportation? Email me or send a direct message to @kirstenkorosec.

Deal of the week

Instead of highlighting one giant deal, let’s step back and take a broader view of mobility this week. The upshot: 2018 saw a decline in total investments in the sector and money moved away from ride-hailing and towards two-wheeled transportation.

According to new research from EY, mobility investments in 2018 reached $39.1 billion, down from $55.2 billion in the previous year. (The figures EY provided was through November 2018).

Ride-hailing companies raised $7.1 billion in 2018, a 73 percent decline from the previous year when $26.7 billion poured into this sector.

Investors, it seems, are shifting their focus to other business models, notably first and last-mile connectivity. EY estimates $7 billion was invested in two-wheeler mobility companies such as bike-sharing and electric scooters in 2018. The U.S. and China together have contributed to more than 80 percent of overall two-wheeler mobility investments this year alone, according to EY research shared with TechCrunch.

Other deals:

Snapshot

Let’s talk about Generation Z, that group of young people born 1996 to the present, and one startup that is focused on turning that demographic into car owners.

There’s lots of talk and hand wringing about young people choosing not to get a driver’s license, or not buying a vehicle. In the UK, for instance, about 42 percent of young drivers aged 17 to 24, hold a driver’s license. That’s about 2.7 million people, according to the National Travel Survey 2018 (NTS) of the UK government’s department of transport. An additional 2.2 million have a provisional or learner license. Combined, that amounts to about 13 percent of the car driving population of the UK.

In the UK, evidence suggests that a rise in motoring costs have discouraged young people from learning. And there lies one opportunity that a new startup called Driver1 is targeting.

Driver 1 is a car subscription service designed exclusively for first car drivers aged 17 to 24. The company has been in stealth mode for about a year and is just now launching.

“The young driver market is being underserved by the car industry, Driver1 founder Tim Hammond told TechCrunch. “And primarily it’s the financing that’s not available for that age group. It’s also something that’s not really affordable for any of the car subscription models like Fair.com and it’s not suitable for the OEM subscription services either financially or from an age perspective for young drivers.”

The company’s own research has found this group wants a newer car for 12 to 15 months.

“The car is the extension of their device,” Hammond said, noting these drivers don’t want the old junkers. “They want their iPhones and they want the car that goes with it.”

The company is working directly with leasing companies — not dealerships — to provide young drivers with 3 to 5-year-old cars that have lost 60 percent or so of their value. Driver1 is targeting under $120 a month for the customer and has a partnership with remarketing company Manheim, which is owned by Cox Automotive.

The startup is focused on the UK for now and has about 600 members who have reserved their cars for purchase. Driver1 is aiming to capture about 10 percent of the 1 million or so young people in the UK who pass their learners permit each year. The company plans it expand to France and other European countries in the fall.

Tiny but mighty micromobility

Ca-caw, ca-caw! That’s the sound of Bird gearing up to launch Bird Platform in New Zealand, Canada and Latin America in the coming weeks. The platform is part of Bird’s mission to bring its scooters across the world “and empower local entrepreneurs in regions where we weren’t planning to launch to run their own electric-scooter sharing program with Bird’s tech and vehicles,” Bird CEO Travis VanderZanden told TechCrunch.

MRD’s two cents: Bird Platform seems like a way for Bird to make extra cash without having to do any of the work i.e. charging the vehicles, maintaining them and working with city officials to get permits. Smart!

Meanwhile, the dolla dolla bills keep pouring into micromobility. European electric scooter startup Voi Technology raised an additional $30 million in capital. That was on top of a $50 million Series A round just three months ago.

Oh, and because micromobility isn’t just for startups, Volkswagen decided to launch a kind of weird-looking electric scooter in Geneva. Because, why not?

— Megan Rose Dickey

One more thing …

Lyft is trimming staff to prepare for its IPO. TechCrunch’s Ingrid Lunden learned that the company has laid off about 50 staff in its bike and scooter division. It appears most of these folks are people who joined the Lyft through its acquisition of electric bike sharing startup Motivate a deal that closed about three months ago.

Notable reads

It’s probably not smart to suggest another newsletter, but if you haven’t checked out Michael Dunne’s The Chinese Are Coming newsletter, you should. Dunne has a unique perspective on what’s happening in China, particularly as it related to automotive and newer forms of mobility such as ride-hailing. One interesting nugget from his latest edition: there are more than 20 other new electric vehicle makers in China.

“Most will fall away within the next 3 to 4 years as cash runs out,” Dunne predicts.

Other quotable notables:

Here’s a fun read for the week. TechCrunch’s Lucas Matney wrote about a YC Combinator startup Jetpack Aviation.The startup has launched pre-orders this week for the moonshot of moonshots, the Speeder, a personal vertical take-off and landing vehicle with a svelte concept design that looks straight out of Star Wars or Halo.

Testing and deployments

Spanish ride-hailing firm Cabify is back operating in Barcelona, Spain despite issuing dire warnings that new regulations issued by local government would crush its business and force it to fire thousands of drivers and leave forever. Turns out forever is one month.

Spanish ride-hailing firm Cabify is back operating in Barcelona, Spain despite issuing dire warnings that new regulations issued by local government would crush its business and force it to fire thousands of drivers and leave forever. Turns out forever is one month.

The Catalan Generalitat issued a decree last month imposing a wait time of at least 15 minutes between a booking being made and a passenger being picked up. The policy was made to ensure taxis and ride-hailing firms are not competing for the same passengers, following a series of taxi strikes, which included scenes of violence. Our boots on the ground reporter Natasha Lomas has the whole story.

Sure, Barcelona is just one city. But what happened in Barcelona isn’t an isolated incident. The early struggles between conventional taxis and ride-hailing operations might be over, but that doesn’t mean the matter has been settled altogether.

And it’s not likely to go away. Once, robotaxis actually hit the road en masse — and yes, that’ll be awhile — these same struggles will pop up again.

Other deployments, or, er, retreats ….

Bike share pioneer Mobike retreats to China

On the autonomous vehicle front:

China Post, the official postal service of China, and delivery and logistics companies Deppon Express, will begin autonomous package delivery services in April. The delivery trucks will operate on autonomous driving technologies developed by FABU Technology, an AI company focused on intelligent driving systems.

On our radar

There is a lot of transportation-related activity this month. Come find me.

SXSW in Austin: TechCrunch will be at SXSW. And there is a lot of mobility action here. Aurora CEO and co-founder Chris Urmson was on stage Saturday morning with Malcolm Gladwell. Mayors from a number of U.S. cities as well as companies like Ford and Mercedes are on the scene. Here’s where I’ll be.

- 2 p.m. to 6:30 p.m. (local time) March 9 at the Empire Garage for the Smart Mobility Summit, an annual event put on by Wards Intelligence and C3 Group. The Autonocast, the podcast I co-host with Alex Roy and Ed Niedermeyer, will also be on hand.

- 9:30 a.m. to 10:30 a.m. (local time) March 12 at the JW Marriott. The Autonocast and founding general partner of Trucks VC, Reilly Brennan will hold a SXSW podcast panel on automated vehicle terminology and other stuff.

- 3:30 p.m (local time) over at the Hilton Austin Downtown, I’ll be moderating a panel Re-inventing the Wheel: Own, Rent, Share, Subscribe. Sherrill Kaplan with Zipcar, Amber Quist, with Silvercar and Russell Lemmer with Dealerware will join me on stage.

- TechCrunch is also hosting a SXSW party from 1 pm to 4 pm Sunday, March 10, 615 Red River St., that will feature musical guest Elderbrook. RSVP here.

Nvidia GTC

TechCrunch (including yours truly) will also be at Nvidia’s annual GPU Technology Conference from March 18 to 21 in San Jose.

Self Racing Cars

The annual Self Racing Car event will be held March 23 and March 24 at Thunderhill Raceway near Willows, California.

There is still room for participants to test or demo their autonomous vehicles, drive train innovation, simulation, software, teleoperation, and sensors. Hobbyists are welcome. Sign up to participate or drop them a line at contact@selfracingcars.com.

Thanks for reading. There might be content you like or something you hate. Feel free to reach out to me at kirsten.korosec@techcrunch.com to share those thoughts, opinions or tips.

Nos vemos la próxima vez.

Source: Tech Crunch

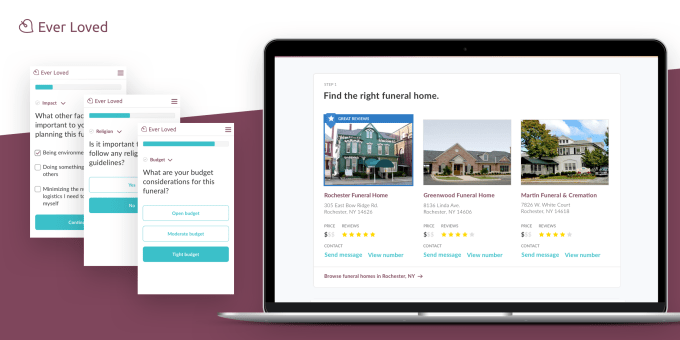

Amazon has made us expect to see prices and reviews up front, so Ever Loved has gathered rate estimates for about two-thirds of US funeral homes and is pulling in testimonials. You can search for 4-star+ funeral homes nearby and instantly get high-quality results. Meanwhile, funeral homes can sign up to claim their page and add information.

Amazon has made us expect to see prices and reviews up front, so Ever Loved has gathered rate estimates for about two-thirds of US funeral homes and is pulling in testimonials. You can search for 4-star+ funeral homes nearby and instantly get high-quality results. Meanwhile, funeral homes can sign up to claim their page and add information.