Editor’s Note: Technology, startups, entrepreneurship, unicorns, S-1s. Silicon Valley has created an economic engine unlike any other in the world over the past few decades. That success has come with incredible influence over our society, politics, and economy, an influence that is increasingly under the microscope. Our industry has gained outsized power, and now it needs to meet that power with outsized responsibility.

In a new series for TechCrunch Extra Crunch, Greg Epstein, the humanist chaplain at Harvard and MIT, will interrogate issues of ethics and how they apply to technology and startups today. As Epstein writes:

In 2018 I joined MIT in addition to my role at Harvard, and the experience of becoming a chaplain at what is officially a technology institute inspired me to reorient much of my work toward helping people think about and create ethical lives in a technological world.

I’ve essentially moved from studying religion to studying tech, and it’s a surprisingly natural transition. After all, the late great tech critic and ethicist Neil Postman first wrote about the idea of a religion of technology back in 1992, expressing concern about the role of the fax machine in modern society.

And regardless of what you believe, the ‘religion of tech,’ if such a thing exists, would likely have more followers than any other religion in the world. The question I’m most interested in asking, then, is: how do our values shape the technology we create? Well, that and its inverse: how is our technology shaping our values?

Today, Epstein interviews Anand Giridharadas, who has become one of the world’s most prominent critics of inequality and inequity in contemporary capitalism. His book Winners Take All: The Elite Charade of Changing the World has triggered a conversation around the implications of our economic structure and what should be done about it.

In Cambridge today, Epstein and his office will be awarding the Rushdie Award to Giridharadas for his humanist achievements, and Giridharadas will keynote the “Social Enterprise Conference” at Harvard.

This interview is approximately 5,300 words / 22 minutes read time. The first third has been ungated given the importance of this subject. To read the whole interview, be sure to join the Extra Crunch membership. ~ Danny Crichton

Introduction and the meaning of progress

Photo by Michael S. Schwartz/Getty Images

Greg Epstein: How would you summarize your argument in Winners Take All?

Anand Giridharadas: The heart of the argument is that we live in an age of staggering inequality, that is fundamentally about a monopolizing of the future itself. The winners of our age, the people who manage to be on the right side of an era of precipitous change and churn, have managed to build, operate, and maintain systems that siphon off most of the fruits of progress to them.

I don’t think there’s a person alive today who would deny that this has been a very fertile age for innovation. That there’s been no shortage of new stuff invented, new promise, new companies, new capital expenditure.

Take any measure of … I often joke, innovation is the Latin word for new shit. I don’t think anybody would say, “I feel shortchanged in the absolute level of new shit in this age.” I’m not sure what age you would preferred to have lived in.

I have never ever in my life had a meeting, or an interview with someone in finance who is like,”Well, our business is really about inspiring connection through money in our communities.”

But if you go to many, many societies, including the one you and I live in, but many others, and you ask people, “What about progress?”, which is most people’s lives getting better, in my definition, I think it would also be hard to deny that many, if not most people, in certainly the advanced countries, will tell you, “No. I haven’t experienced much progress, and I do feel shortchanged on that score.”

And so, if you start with the premise of how is it that we live in an age of tremendous innovation, and for so many people, so little progress, the answer is the winners of our age have cornered the fruits of innovation, so that they fail to translate into progress.

And, at the heart of what I’m trying to establish with the book, is how they have then turned around, and in response to this exclusion, and the anger it generates, sought to pass themselves off as change agents who can fix the problem that they are complicit in causing, and who can fight the fire that they helped set.

This is not the first generation of ultra rich people in history to seek to justify their own rule, but they’ve found a particularly ingenious way to do it, which is to seek to be the solution to the problem that they are still actively working to cause.

Greg: What do you say to the folks who would say it’s not just new shit, as you put it so well, but that all the new shit, even if there is more inequality, adds up to a better quality of life for everybody? That yeah, there is rising inequality, but everybody’s driving around in a car, everybody’s on the phone. People are by and large living longer. They’re living more healthily. They’re living with less violence.

Greg Epstein. Photo via Humanist Hub

Anand: No. That’s false. Life expectancy has gone down, for the last three years, in America. Do people know that? Do the readers of TechCrunch know that life expectancy has gone down in America? Do the readers of TechCrunch know how rare that is in history, for life expectancy to go down?

Think about the last time you went to the doctor. Think about all the tests they do these days. We have two children. We have a one-year-old and a four-year-old. Between the birth, between the pregnancy with the four-year-old, and the pregnancy with the one-year-old, there were several new tests, and new technologies invented, that we had access to with the one-year-old, that weren’t ready yet when we had the four-year-old. That’s how much new shit there is. So, how is life expectancy going down?

I start the book with all these stats, and try to separate out the innovation from the progress. Literacy has not improved in America, even though all these books have been scanned. Another area that the TechCrunch reader would surely point to, as well, it’s become easier than ever to start your own business and be an entrepreneur. One third as many young people today own their own business, as they did in the 80s. One third as many. The average twelfth grader tests more poorly in reading today, than in 1992.

If you think about all the new tests, going back to that medical example, all the new diagnostics, all the new genetic work that has been done, it really actually requires a tremendous amount of rigging to have all of that go into one end of the machine, and have a decline in life expectancy come out of the other.

That’s not a natural occurrence. The natural occurrence would be for people to live longer, because of all the stuff that’s happened. You have to really jury rig the society, to ensure that somehow a very large number of people are unaffected by that positive stuff, and in fact are subjected to a bunch of negative stuff that the positive stuff can’t touch.

Tech and religion

Greg: I think what we’re told is that the positive stuff would not be possible, if it wasn’t for that jury rigging. And I think what you’re doing, and a number of people are doing, is pushing back against that narrative.

Anand: That’s at the heart of this whole thing. That is the religion that my book seeks to slay, is the religion of win-win-ism, which is a false religion. And it is a religion that says that it’s true in both its win-win form, and its inverse lose-lose form.

What win-win-ism says is, the best way to help the least among us is to do what’s good for the richest and most powerful. The best guide to what’s going to be good for America is going to be what’s good for Jeff Bezos, and Amazon, and Facebook, and Google, and Goldman Sachs. But, the inverse is also true. The win-win religion holds that if you do anything that has any cost, significant cost, for the winners of our age, you will only be hurting the most powerless among us.

Greg: I’m fascinated by the way you speak of win-win-ism as a religion — in the book you also talk about how high-powered consultants at places like McKinsey subscribe to a ‘religion of facts.’ And in a profile piece on Justin Rosenstein of Asana, you portray him sitting around a table in Silicon Valley, talking about community and saying a secular grace. It seemed like you were trying to show that what you call this “religion” even has its own rituals, its own congregations.

And it’s not just you: I’ve been studying the intersection of secularism and religion for almost 20 years, and now that I’ve started to work on the ethics of technology, I’ve noticed almost everyone I’m reading seems to refer to technology as a kind of secular religion. I’m wondering what’s going on there.

What’s the importance of using those terms, for you? How does that help your argument?

Anand: I think it’s actually helpful to understand as a religion to understand how removed it is from reality. Because, otherwise, you’re left with the puzzle of how can people at Silicon Valley continue to spread the narrative that as long as you sprinkle their algorithms on things, they will tend toward equality, justice, and emancipation.

They’re still spreading that narrative now. I mean, it’s blockchain today, and tomorrow it will be something else. But, we now have 25, 30 years of evidence that in fact these technologies played into existing power divides, and in many cases accentuated them.

I mean, with all the whole supposedly leveling tech revolution, fewer companies now run America than did before the tech revolution. And they all know this at some level. They understand the facts. They understand that we do live in this winners-take-all world that has been rich-splained to us as being some kind of new age of emancipation.

To my mind, the only way they can keep believing is as an act of faith. I don’t think it’s possible to look at the world right now, and objectively say what they continue to say, which is that them being in charge, these technologies being in charge, rich people doing more of what they have been doing, it’s gonna save us. You can only maintain this view if it’s a faith, constantly re-evangelized. And that’s why I think they spend so much time in conferences. I think if they were at home more, or in the office more, I think they would really fall prey to doubts.

Greg: The conference is sort of the revival meeting of the tech religion.

Anand: It is 100% a revival meeting, yes. And I think they need it.

Silicon Valley and Winners Take All

Photo by Patrick Nouhailler via Flickr used under Creative Commons

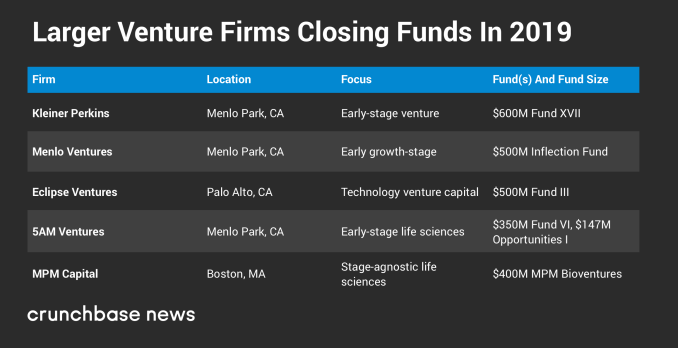

Greg: Venture capitalists are another parallel I see to religion. You mention how they are seen today as thinkers, philosophers. I tend to think of VC’s as priests in the tech religion. What reaction have you been getting from that community in particular? From tech VC’s, or from Silicon Valley as a whole?

Anand: I hear anecdotally, first of all, that Winners Take All has caused a lot of discussion in the Valley. People text me from dinner parties saying, “Oh my god, a fight just broke out at my dinner party about your book.” And I would say the Valley has probably been the most resistant to my critique. But a lot of people, even in the stratospheres I write about, understand that there is something badly wrong, the system needs to seriously change.

Even in the best possible case where you are a good person who made decent money, you have benefited from a system of taxation, for starters, that decided it was a greater priority to make sure you held on to as much of that money as possible than it was to make sure that people had decent schools in this country.

A lot of people reach out to me [privately] and say, “look, I don’t know quite how to get there, but I kind of agree with you that I’m living on top of an indefensible mountain here. And I’m not sure how to get down. I’m not necessarily even sure how I got up here, but I’m aware that this is an indefensible mountain, and I’m aware that I should not be on it. Let’s talk.” But, in Silicon Valley in general, I think there has been the most resistance. Because [many] are truly possessed of the feeling that leaving them alone, and letting them do whatever they want to do, and grow however they want to grow, is what is best for the world.

My best read on someone like Mark Zuckerberg is that he sincerely feels that he was a rare, lucky person in history who has the privilege of having certain knowledge, and insight, and an idea that if he is left alone to pursue to its fullest will emancipate the world more than maybe any government, more than maybe any social movement, etc. I think Zuckerberg genuinely feels, and I have sort of come to understand this from people who know him, and understand how he thinks, that journalists asking him questions, or regulators pushing back, are essentially deferring his emancipation of the world. I don’t think that makes him … I don’t think he is a cynic. And that’s why he is so difficult to deal with. I think he is a true believer. But that makes him in some ways even more difficult for us to deal with.

Greg: I mean, in the religion metaphor that would make him more like a Messianic figure.

Anand: Which he absolutely is.

Greg: Right. In religious history, some Messianic figures actually believe their Messianism.

Anand: Right. And I think in some ways our society is better protected against a Goldman Sachs fighting for bad policy in Washington, making a bunch of money on it, and then throwing five million dollars at a women’s shelter. We’re not great at it, but if you think of the financial industry, we regulate the hell out of them. It’s not perfect, but we are all up in their grill.

There are people at the SEC watching every trail. And I think that’s because everybody understands the game, like, they’re trying to make money. I love people in finance, because no one in finance has ever tried to convince me that they’re not in finance, or they’re not motivated by finance.

I have never ever in my life had a meeting, or an interview with someone in finance who is like, “Well, our business is really about inspiring connection through money in our communities.”

Greg: I have actually had that exact meeting, by the way.

Anand: That’s kind of amazing. But, in general, people in finance own the idea that they work in finance. Whereas, with tech, I think a lot of our culture has bought into the idea that there are these figures of emancipation, and liberation, and social leveling. And it has bought them a tremendous [amount] of space and freedom that they have exploited and abused.

A newer generation is thinking differently?

Source: Tech Crunch