Divergent, the Los Angeles-based startup aiming to revolutionize vehicle manufacturing, has cut about one-third of its staff amid the COVID-19 pandemic that has upended startups and major corporations alike.

The company, which employed about 160 people, laid off 57 workers, according to documents filed with the California Employment Development Department. Founder and CEO Kevin Czinger didn’t provide specific numbers. However, he did confirm to TechCrunch that he had to reduce staff due to the COVID-19 pandemic. A core team remains, he said.

“Whenever you’re doing something that’s affecting people’s jobs — and especially in a company where I basically recruited everyone and knew everyone by face and name — it’s obviously super painful to do that under any circumstance,” Czinger said in an interview this week.

The company’s No. 1 priority was to ensure long-term financial stability and secure the core team, technology development and customer programs no matter what the scenario, Czinger said, adding that there is still enormous uncertainty surrounding the real impact and duration of the COVID-19 pandemic.

“This was about making the company as totally weatherproof as possible,” Czinger said.

Divergent 3D is essentially a Tier 1 supplier for the automotive and aerospace industry. But it can hardly be considered a traditional supplier. After resigning as CEO of the now-defunct EV startup Coda Automotive in 2010, Czinger began to focus on how the vehicle manufacturing process could become more efficient and less wasteful.

Divergent 3D was born out of that initial exploration. The company developed an additive manufacturing platform designed to make it easier and faster to design and build new cars at a fraction of the cost — all while reducing the environmental impact that traditional factories have.

The platform is an end-to-end digital production system that uses high-speed 3D printers to make complex parts out of metal alloys. This system produces the structures of vehicles, such as the full frame, subframes and suspension structures that are part of the crash-performance structure of the vehicle.

In its early years as a company, Divergent 3D was perhaps best known for Blade, the first automobile to use 3D printing to form the body and chassis. Divergent 3D made Blade — which was on the auto show circuit in 2016 — to demonstrate the technology platform.

It was enough to get the attention of investors and at least two global OEMs as customers. Divergent can’t name the customers because of non-disclosure agreements.

The company has raised about $150 million from investors that include venture capital fund Horizons Ventures, automotive and aerospace engineering services company Altran Technologies and Chinese backers O Luxe Holdings, an investment conglomerate backed by the Hong Kong-based real estate investment magnate Li Ka-shing and Shanghai Alliance Investment Limited, an investment arm of the Shanghai Municipal Government.

The latest example of Divergent’s technology is the 21C, a hypercar unveiled in March that was built using the additive manufacturing platform. The high-performance 3D-printed vehicle was produced by Czinger Vehicles. Divergent 3D and Czinger Vehicles are wholly owned subsidiaries under Divergent Technologies.

Czinger said the company is poised to navigate the pandemic and ultimately survive. Divergent 3D has two global OEMs as customers. Structures such as chassis components and subframes, for which Divergent has supply contracts, are going through various testing and validation stages, depending on the program. Those programs, which are for serial production vehicles, are moving forward, Czinger said.

There will be delays as automakers have slowed or stopped operations. Czinger is hopeful that by 2021 the company will be able to announce that its 3D-printed structures will be production vehicles.

Source: Tech Crunch

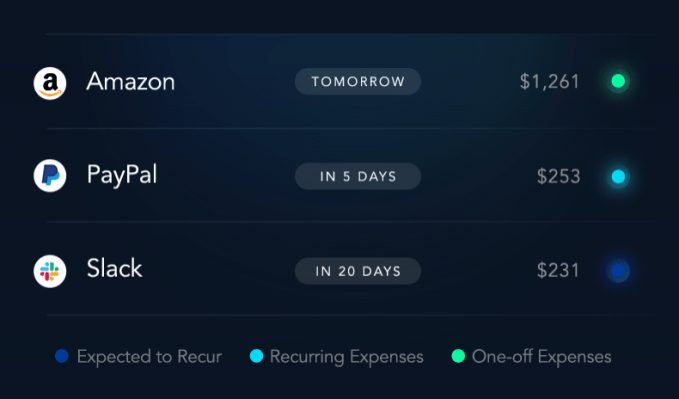

Instead of requiring business owners to make a switch from their existing financial solutions, Digits connects with the accounting software, banks, payroll providers, financial packages, sources of revenue and credit cards the business already uses — like Xero, QuickBooks, NetSuite, Citi, Bank of America or Chase, for example.

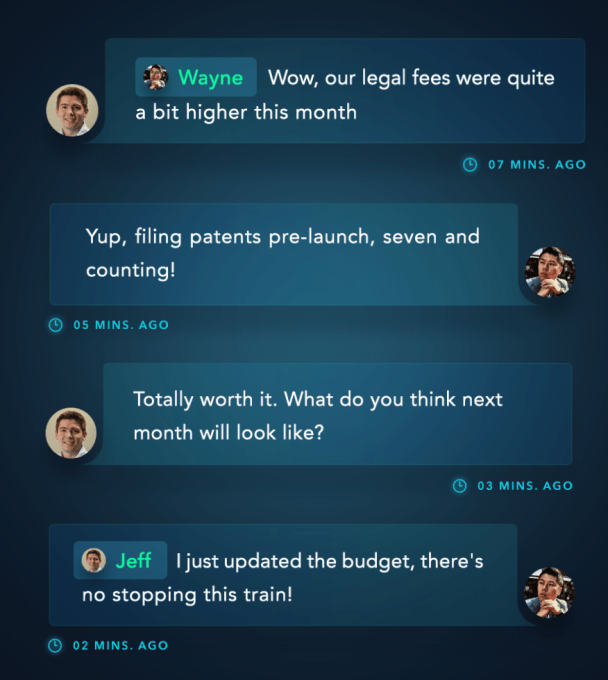

Instead of requiring business owners to make a switch from their existing financial solutions, Digits connects with the accounting software, banks, payroll providers, financial packages, sources of revenue and credit cards the business already uses — like Xero, QuickBooks, NetSuite, Citi, Bank of America or Chase, for example. Digits also uses machine learning technology to predictively categorize transactions as they happen and the software can alert users to anomalies — like suspicious activity or unexpectedly large transactions — in real time. Business owners can use the dashboard to find out things like how quickly expenses are growing, what the cash flow looks like, where costs can be trimmed, what services are being paid for on a recurring basis and more, and can search for transactions.

Digits also uses machine learning technology to predictively categorize transactions as they happen and the software can alert users to anomalies — like suspicious activity or unexpectedly large transactions — in real time. Business owners can use the dashboard to find out things like how quickly expenses are growing, what the cash flow looks like, where costs can be trimmed, what services are being paid for on a recurring basis and more, and can search for transactions.