Along with a cadre of other TechCrunch folks, I spent this week extremely focused on one event: Y Combinator. The elite accelerator announced a staggering 377 startups as its Summer 2021 cohort. We covered every single on-the-record startup that presented and plucked out some favorites:

- Here are all the companies from Y Combinator’s Summer 2021 Demo Day, Part 1

- Here are all the companies from Day 2 of Y Combinator’s Summer 2021 Demo Day

- Our favorite startups from YC’s Summer 21 Demo Day, Part 1

- Our favorite startups from YC’s Summer 21 Demo Day, Part 2

There’s something quite earnest and magical about spending literally hours hearing founder after founder pitch their ideas, with one minute, a single slide and a whole lot of optimism. It’s why I like covering demo days: I get tunnel vision into where innovation is going next, what behemoths are ripe for disruption and what founders think is a witty competitive edge versus a simple baseline.

That said, I will share one caveat. While YC is an ambitious snapshot, it’s not entirely illustrative of the next wave of decision-makers and leaders within startups — from a diversity perspective. The accelerator posted small gains in the number of women and LatinX founders in its batch, but dropped in the number of Black founders participating. The need for more diverse accelerators has never been more obvious, and as some in the tech community argue, is Y Combinator’s biggest blind spot.

This in mind, I want to leave you with a few takeaways I had after listening to hundreds of pitches. Here’s what 377 Y Combinator pitches taught me about startups:

- Instacart walked so YC startups could stroll. Instacart, last valued at $39 billion, is one of Y Combinator’s most successful graduates — which makes it even more spicier that a number of startups within this summer’s batch want to take on the behemoth. Instead of going after the obvious — speed — startups are looking to enhance the grocery delivery experience through premium produce, local recipes and even ugly vegetables. It suggests that there may be a new chapter in grocery delivery, one in which ease isn’t the only competitive advantage.

- Crypto’s pre-seed world is quieter than fintech. YC feels more like a fintech accelerator than ever before, but when it comes to crypto, there weren’t as many moonshots as I’d expect. We discussed this a bit in the Equity podcast, but if anyone has theories as to why, I’m game to hear ‘em.

- Edtech wants to disrupt artsy subjects. It’s common to see edtech founders flock to subjects like science and mathematics when it comes to disruption. Why? Well, from a pure pedagogical perspective, it’s easier to scale a service that answers questions that only have one right answer. While math may fit into a box that works for a tech-powered AI tutoring bot, arts, on the other hand, may require a little bit more human touch. This is why I was excited to see a number of edtech startups, from Spark Studio to Litnerd, focusing on humanities in their pitches. As shocking as it sounds, to rethink how a bookclub is read is definitely a refreshing milestone for edtech.

- Sometimes, the best pitch is no pitch at all. One pitch stood out simply because it addressed the elephant in the room: We’re all stressed. Jupe sells glamping-in-a-box and the profitable business likely benefited from COVID-19. I remember that because the founder used a portion of his pitch to tell investors to breathe, because it’s been a long two days. Being human, and more importantly, speaking like one, is what it takes to stand out these days.

On that note, exhale. Let’s move on to the rest of this newsletter, which includes nostalgic nods to Wall Street, public filings and my favorite new podcast. As always, you can find and support me on Twitter @nmasc_ or send me tips at natasha.m@techcrunch.com.

A return to old school Wall Street

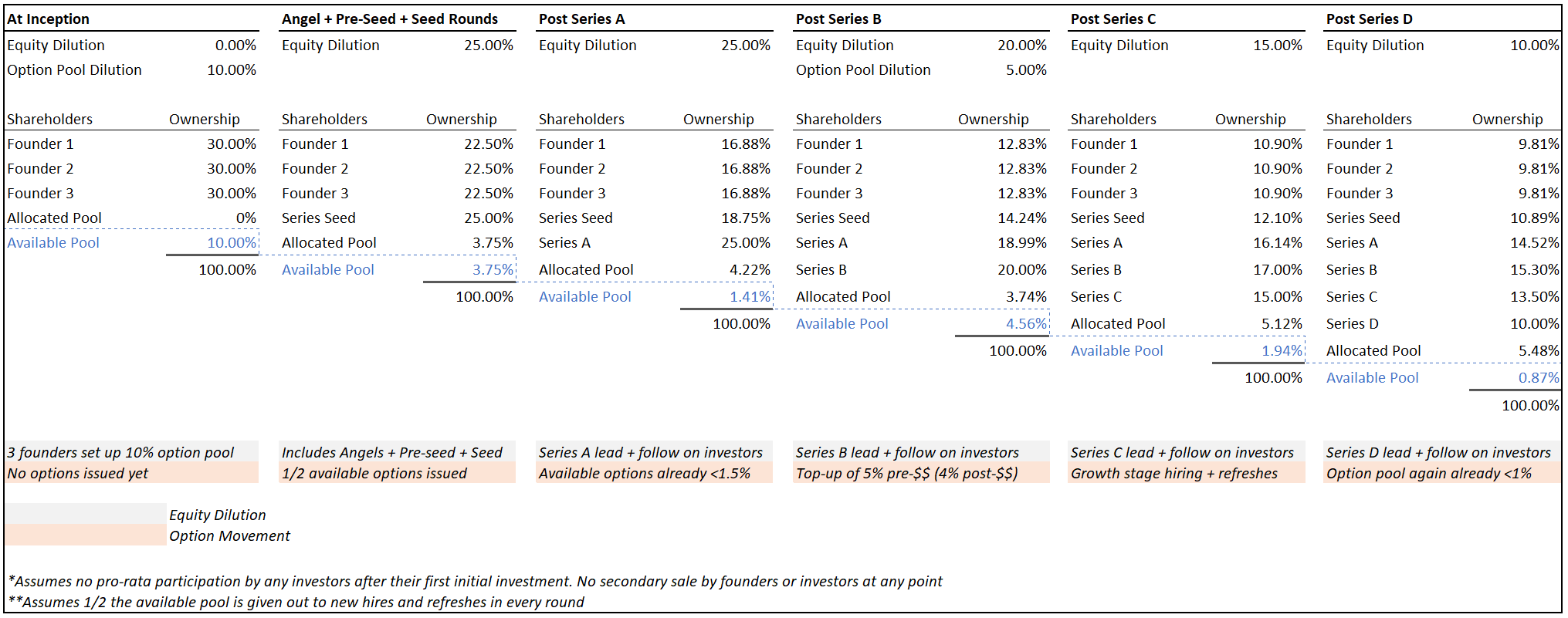

With so many new funds, solo-GPs and alternative capital sources on the market these days, founders are confused. Funding may have moved away from three dudes on Sand Hill Road, but it’s also become more fragmented, which means entrepreneurs need to be even more sophisticated in how they fill up their cap tables. This week, I interviewed one recently venture-backed startup that proposed a solution: a return to old school Wall Street.

Here’s what to know: Hum Capital wants to help investors allocate their resources to ambitious businesses, perfectly. The startup seeks to emulate the world of old school Wall Street, which helped ambitious business owners find the best financing option for their goal, instead of today’s dance of startups trying to prove worthiness for one type of capital. In my story, I explained more about the business.

At this stage, Hum Capital’s product is easy to explain:

It uses artificial intelligence and data to connect businesses to the available funders on the platform. The startup connects with a capital-hungry startup, ingests financial data from over 100 SaaS systems, including QuickBooks, NetSuite and Google Analytics, and then translates them to the some 250 institutional investors on its platform.

From Hum to mmhmm:

- LoftyInc Capital launches third fund at $10M for a more diverse portfolio of African startups

- Coral Capital closes third fund with $128M for startups in Japan

- How capital as a service can help you get your first check in 2021

- Investors discuss alt-financing and the role of venture capital

- Fundraising for your startup? We’ve got you covered at TechCrunch Disrupt 2021

- When the economic tide goes out, we’ll see which VCs are naked

IPO filings & other hubbub

Image Credits: ansonmiao / Getty Images

When the pandemic began to impact startups, Toast was top of the list. The restaurant tech startup had a series of deep layoffs as many of its clients in the hospitality industry had to shut down. Months later, Toast reentered headlines with a dramatically different message: It’s going public, and here’s all of our financial data.

Here’s what you need to know: This week, Toast published its S-1, offering a portrait into how the startup was impacted by the COVID-19 pandemic and answering questions on why it’s going public now. After ripping apart the Warby Parker S-1, Alex had five takeaways from the Toast S-1. My favorite excerpt? Toast was smart to diversify beyond its hardware, hand-held payment processors:

Toast’s two largest revenue sources — software and fintech incomes — have posted constant growth on a quarter-over-quarter basis. Hardware revenues have proved slightly less consistent, although they are also moving in a positive direction this year and set what appears to be an all-time record result in Q2 2021.

Toast would have had a much worse second quarter last year if it didn’t have software revenues. And since then, its growth would not have been as impressive without payments revenues (its fintech line item, speaking loosely). The broad revenue mix that Toast built has proved to limit downside while opening lots of room for growth.

Butter or jam:

- Inside Freshworks’ IPO filing

- What Amplitude’s choice to direct list says about its products, growth and value

- Forbes jumps into hot media liquidity summer with a SPAC combo

Around TC

You already bought your tickets to Disrupt right? If not, here’s the link, with a fancy discount from yours truly.

Now that that’s out of the way, I want you to listen to Found, TechCrunch’s newest podcast that focuses on talking to early-stage founders about building and launching their companies. Recent episodes include:

- How one founder turned painful personal experience into the solution for a huge gap in healthcare

- How one founder aims to bring researchers and food producers together around cultured meat

- How one founder identified a gap in education working as a teacher and built a startup to fix it

- How one founder turned her extensive retail experience into an entirely new kind of shopping

Across the week

Seen on TechCrunch

- Air conditioning is one of the greatest inventions of the 20th Century. It’s also killing the 21st

- Apollo completes its $5B acquisition of Verizon Media, now known as Yahoo

- Vista Equity to acquire majority stake in SaaS startup Drift, taking it to unicorn status

- Zoom announces first startups receiving funding from $100M investment fund

- Bill Gates offers direction, not solutions

Seen on Extra Crunch

- Virtual events startups have high hopes for after the pandemic

- Use cohort analysis to drive smarter startup growth

- The pre-pitch: 7 ways to build relationships with VCs

- All the reasons why you should launch a credit or debit card

- Using AI to reboot brand-client relationships

Talk next week,

Source: Tech Crunch