Earlier this year, the business community received a wake-up call issued with all of the might that $6 trillion can muster.

The call came from Laurence Fink, the founder and chief executive of the global investment firm, BlackRock, and was delivered as a letter to the CEOs of the world’s largest companies.

Aptly titled, “A Sense of Purpose,” the letter informed business leaders that driving record profits is no longer enough to garner BlackRock’s support. Companies must also positively contribute to society, or in Mr. Fink’s words, “Companies must benefit all of their stakeholders, including shareholders, employees, customers, and the communities in which they operate.”

I was elated when I read the letter. I’ve spent my entire career as a social entrepreneur advocating for businesses—specifically technology businesses in Silicon Valley—to use their technology, wealth, and influence for social good. After reading the letter in the New York Times and seeing the extensive coverage in major business publications, I turned to the leading Silicon Valley tech blogs to get their take on this blockbuster announcement. After all, the Bay Area is home to many of BlackRock’s largest clients.

Crickets. Fink’s letter wasn’t covered by the technology press. Well, to be accurate, I checked the first ten pages of Google results as well as all of the tech pubs in Techmeme’s top ten list. Nothing.

Guys (I hate to say it, but it’s mostly guys here in the Valley), Fink’s point is that ignoring society’s voice will lead to the loss of our “license to operate.” Putting the Valley’s collective hands over our ears and saying “we can’t hear you” only works for so long.

Instead, what if Silicon Valley embraced the letter to commit good for the better of society as a whole, not just the interests of the software and data industrial complex? What if Fink’s letter served as a constant reminder to build products that make the world a 10x more equitable place to live and prosper and not just to build products that deliver 10x profit?

With those questions in mind, here are two interrelated and crucial ways to commit good on purpose while making sure Silicon Valley technology companies embrace “A Sense of Purpose.”

Put People Before Algorithms. The goal of algorithms must not be to replace, manipulate, or deceive in the name of profit. This is all too often the case as black-box algorithms use massive amounts of data to attract eyeballs, encourage clicks, and, in more dire circumstances, even determine if someone goes to prison.

We must always ask up front how unaccountable algorithms impact individuals and society as a whole. Instead of eyeballs, clicks, and even prison time served, algorithms should be optimized to make people better—more efficient in their jobs, more informed in their daily lives, and more connected to their communities. We must make a cognizant effort to analyze and identify the risks of algorithms-gone-rogue before they result in disasters. Let’s not only ask, “How can we make more money?” but also, “What could go wrong?”

Risk-benefit analysis already takes place around boardroom tables by those with monetary interests, but those conversations fail to include the diverse voices of the communities that will feel the decision’s impact. There will never be perfect clarity around what will unfold after a decision is made. That’s exactly why decisions that impact thousands, millions, and even billions of people must include all company stakeholders—shareholders, employees, customers, and the communities in which they operate—if we are ever to prevent a world where algorithms reign supreme in the name of profit.

Treat Diversity as Our Greatest Asset. It’s very easy to discount points of view, values, and even someone’s humanity when the voice of diversity is not present. Establishing diversity as a core company principle is a good start, but it’s not enough. Diversity must be omnipresent and it must be truly embraced across an organization as an asset, not a statistic.

Many in Silicon Valley will tell you that diversity has been a top priority for years, only to follow with reports that cite a 2% increase in women employees, 0% increase in black employees, and no data at all on the number of employees with disabilities. Let’s not conflate transparency with priority. We must increase diversity now while investing in STEM education and training to create a more diverse pipeline of workers for tomorrow’s technology jobs. By making the workforce of today and tomorrow more diverse, we make our communities more diverse. We are then one step closer to never discounting a point of view, value, or someone’s entire humanity due to a lack of voice.

It’s not too late to use Mr. Fink’s letter as a wake-up call for Silicon Valley to commit good on purpose. While the two proposals detailed in this article are aspirational, they have at their core something much more valuable than $6 trillion. These ideas are about regaining Silicon Valley’s conscience. They are about investing in a collective future that prizes diversity and equality, not a future that allows technology, data, and algorithms to further entrench the inequality that we face today in Silicon Valley and everywhere that feels our impact.

Source: Tech Crunch

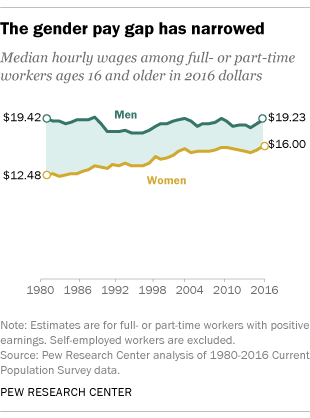

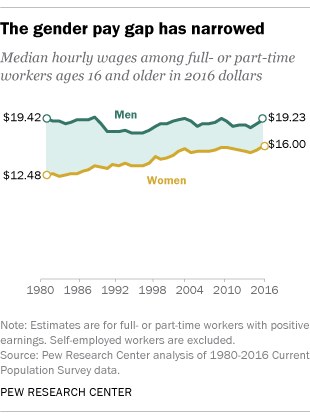

The racial pay gap also continues to exist. Similar to the gender pay gap, the racial pay gap has narrowed in recent years, but white men continue to out-earn black and Hispanic men, and all groups of women.

The racial pay gap also continues to exist. Similar to the gender pay gap, the racial pay gap has narrowed in recent years, but white men continue to out-earn black and Hispanic men, and all groups of women.

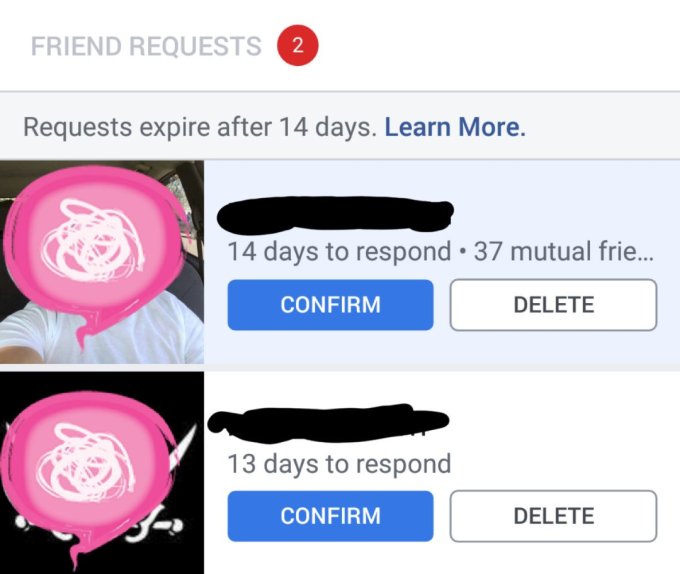

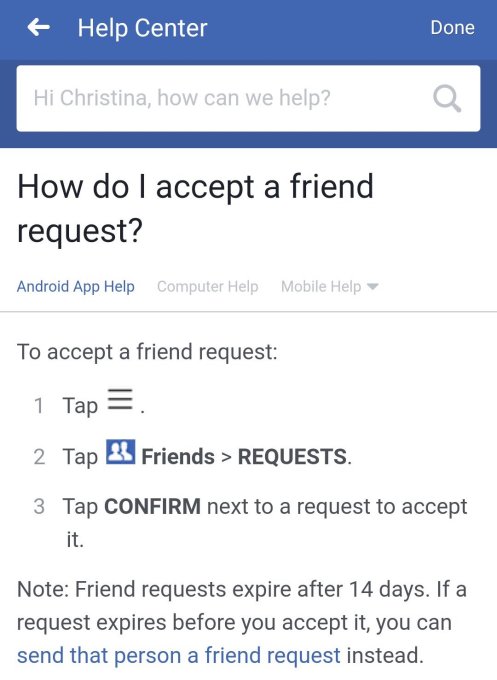

Those in the test group will see a “14 days to respond” countdown on their friend requests. A ‘Learn More’ link leads to this

Those in the test group will see a “14 days to respond” countdown on their friend requests. A ‘Learn More’ link leads to this