Editor’s note: Get this free weekly recap of TechCrunch news that any startup can use by email every Saturday morning (7am PT). Subscribe here.

They say business needs certainty to succeed, but new tech startups are still getting funded aggressively despite the pandemic, recession, trade wars and various large disasters created by nature or humans. But before we get to the positive data, let’s spend some time reviewing the hard news — there is a lot of it to process.

TikTok is on track to get banned if it doesn’t get sold first, and leading internet company Tencent’s WeChat is on the list as well, plus Trump administration has a bigger “Clean Network” plan in the works. The TikTok headlines are the least significant part, even if they are dominating the media cycle. The video-sharing social network is just now emerging as an intriguing marketing channel, for example. And if it goes, few see any real opening in the short-form video space that market leaders aren’t already deep into. Indeed, TikTok wasn’t a startup story since the Musical.ly acquisition. It was actually part of an emerging global market battle between giant internet companies, that is being prematurely ended by political forces. We’ll never know if TikTok could have continued leveraging ByteDance’s vast resources and protected market in China to take on Facebook directly on its home turf.

Instead of quasi-monopolies trying to finish taking over the world, those with a monopoly on violence have scrambled the map. WeChat is mainly used by the Chinese diaspora in the US, including many US startups with friends, family and colleagues in China. And the Clean Network plan would potentially split the Chinese mobile ecosystem from iOS and Android globally.

Let’s not forget that Europe has also been busy regulating foreign tech companies, including from both the US and China. Now every founder has to wonder how big their TAM is going to be in a world cleaved back the leading nation-states and their various allies.

“It’s not about the chilling effect [in Hong Kong],” an American executive in China told Rita Liao this week about the view in China’s startup world. “The problem is there won’t be opportunities in the U.S., Canada, Australia or India any more. The chance of succeeding in Europe is also becoming smaller, and the risks are increasing a lot. From now on, Chinese companies going global can only look to Southeast Asia, Africa and South America.”

The silver lining, I hope, is that tech companies from everywhere are still going to be competing in regions of the world that will appreciate the interest.

Startup fundraising activity is booming and set to boom more

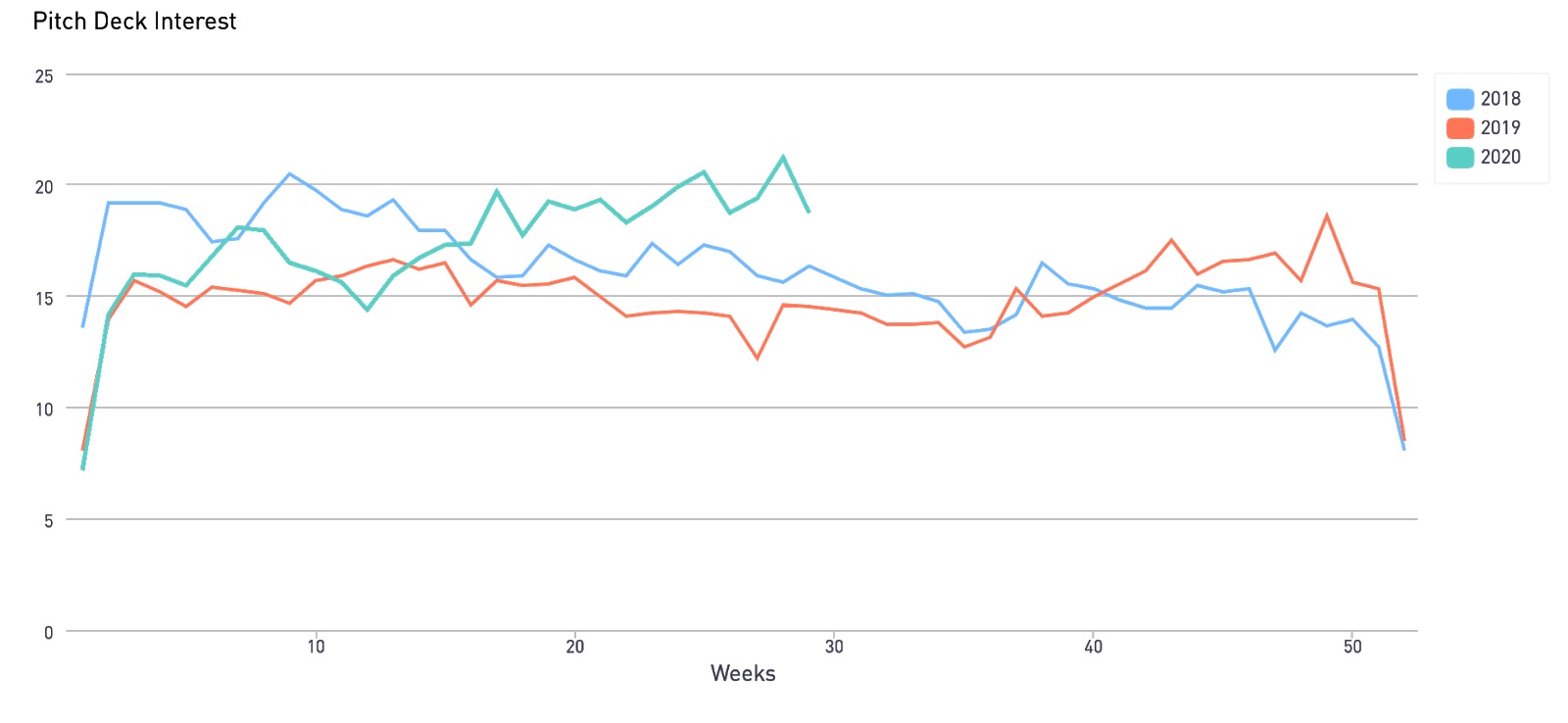

A fresh analysis from our friends over at Docsend reveals that startup investment activity has actually sped up this year, at least by the measure of pitchdeck activity on its document management platform used by thousands of companies in Silicon Valley and globally (which makes it a key indicator of this hard-to-see action).

Founders are sending out more links than before and VCs are racing through more decks faster, despite the gyrations of the pandemic and other shocks. Meanwhile, many startups shared that they had cut back hard in March and now have more room to wait or raise on good terms. Docsend CEO Russ Heddleston concludes that the rest of the year could actually see activity increase further as companies finish adjusting to the latest challenges and are ready to go back out to market.

All this should shape how you approach your pitchdeck, he writes separately for Extra Crunch. Additional data shows that decks should be on the short side, must include a “why now” slide that addresses the COVID-19 era, and show big growth opportunities in the financials.

SaaS founders could transcend VC fundraising via securitized debt

“In one decade, we went from buying licenses for software to paying monthly for services and in the process, revolutionized the hundreds of billions spent on enterprise IT,” Danny Crichton observes. “There is no reason why in another decade, SaaS founders with the metrics to prove it shouldn’t have access to less dilutive capital through significantly more sophisticated debt underwriting. That’s going to be a boon for their own returns, but a huge challenge for VC firms that have been doubling down on SaaS.”

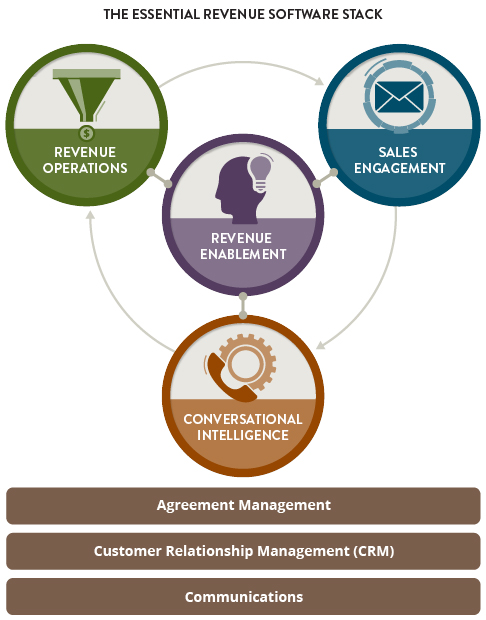

Sure, the market is sort of providing this with various existing venture debt vehicles, and by other routes like private equity (which has acquired a taste for SaaS metrics this past decade). Danny sees a more sophisticated world evolving, as he details on Extra Crunch this week. First, he sees underwriters tying loans to recurring revenues, even to the point that your customers could be your assets that the bank takes if you go bust. The trend could then build from there:

Part two is to take all those individual loans and package them together into a security… Imagine being an investor who believes that the world is going to digitize payroll. Maybe you don’t know which of the 30 SaaS providers on the market are going to win. Rather than trying your luck at the VC lottery, you could instead buy “2018 SaaS payroll debt” securities, which would give you exposure to this market that’s safer, if without the sort of exponential upside typical of VC investments. You could imagine grouping debt by market sector, or by customer type, or by geography, or by some other characteristic.

Image Credits: Hussein Malla / AP

Help the startup scene in Beirut

Beirut is home to a vibrant startup scene but like the rest of Lebanon it is reeling from a massive explosion at its main port this week. Mike Butcher, who has helped connect TechCrunch with the city over the years, has put together a guide to local people and organizations that you can help out, along with stories from local founders about what they are overcoming. Here’s Cherif Massoud, a dental surgeon turned founder of invisible-braces startup Basma:

We are a team of 25 people and were all in our office in Beirut when it happened. Thankfully we all survived. No words can describe my anger. Five of us were badly injured with glass shattered on their bodies. The fear we lived was traumatizing. The next morning day, we went back to the office to clean all the mess, took measurements of all the broken windows and started rebuilding it. It’s a miracle we are alive. Our markets are mainly KSA and UAE, so customers were still buying our treatments online, but the team needed to recover so we decided to take a break, stop the operations for a few days and rest until next Monday.

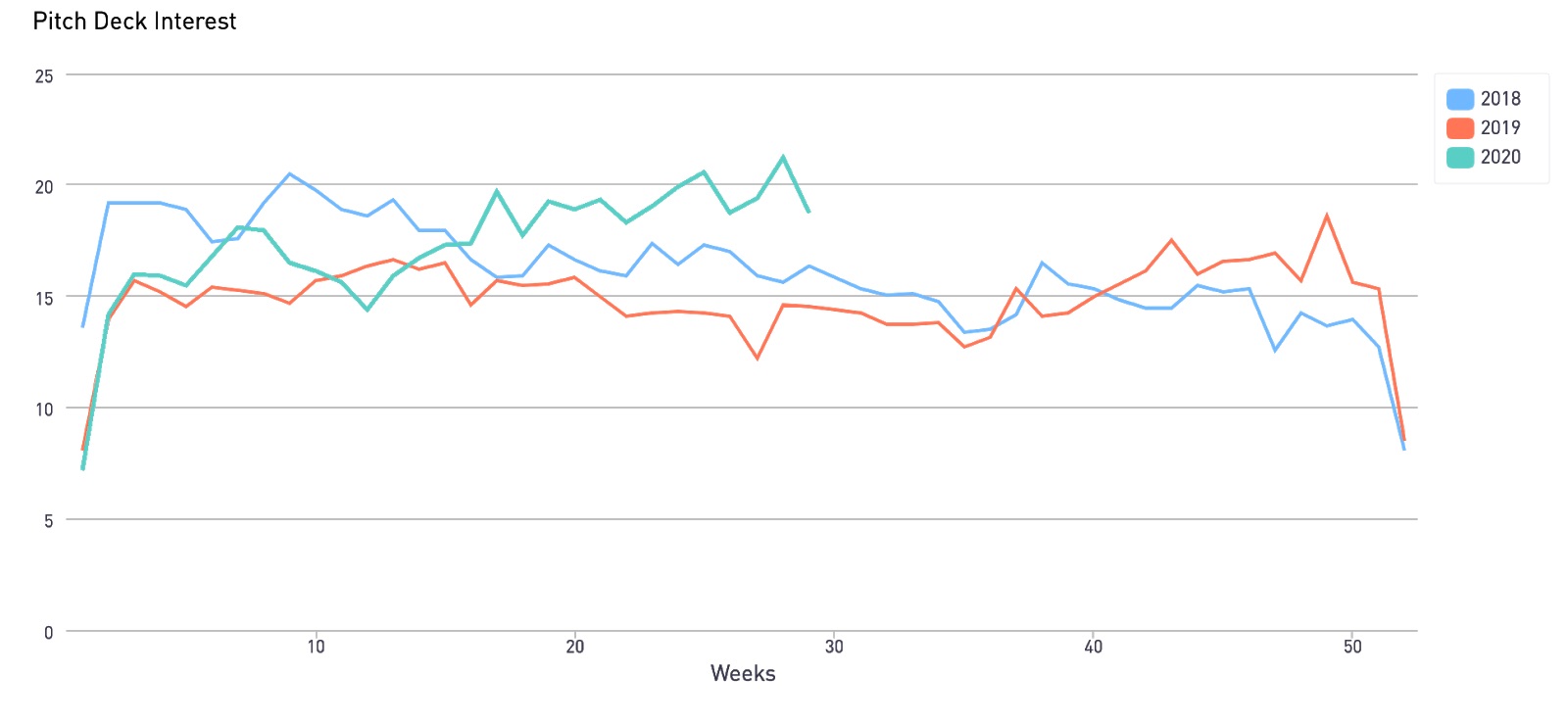

How to build a great “revenue stack”

Every business has been scrambling to figure out online sales and marketing during the pandemic. Fortunately the Cambrian explosion of SaaS products began years ago and now there are many powerful options for revenue teams of all shapes and sizes. The problem is how to put everything together right for your company’s needs. Tim Porter and Erica La Cava of Madrona Venture Group have created a framework for how to build what they call the “revenue stack.” While most companies are already using some form of CRM, communications and agreement management software generally, each one needs to figure out four new “capabilities.” What they define as revenue enablement, sales engagement, conversational intelligence and revenue operations.

Here’s a sample from Extra Crunch, about sales engagement:

Some think of sales engagement as an intelligent e-mail cannon and analysis engine on steroids. While in reality, it is much more. Consider these examples: How can I communicate with prospects in a way that is both personalized and efficient? How do I make my outbound sales reps more productive and enable them to respond more quickly to leads? What tools can help me with account-based marketing? What happened to that email you sent out to one of your sales prospects?

Now, take these questions and multiply them by a hundred, or even a thousand: How do you personalize a multitouch nurture campaign at scale while managing and automating outreach to many different business personas across various industry segments? Uh-oh. Suddenly, it gets very complicated. What sales engagement comes down to is the critical understanding of sending the right information to the right customer, and then (and only then) being able to track which elements of that information worked (e.g., led to clicks, conversations and conversions) … and, finally, helping your reps do more of that. We see Outreach as the clear leader here, based in Seattle, with SalesLoft as the number two. Outreach in particular is investing considerably in adding additional intelligence and ML to their offering to increase automation and improve outcomes.

Around TechCrunch

Hear how working from home is changing startups and investing at Disrupt 2020

Extra Crunch Live: Join Wealthfront CEO Andy Rachleff August 11 at 1pm EDT/10am PDT about the future of investing and fintech

Register for Disrupt to take part in our content series for Digital Startup Alley exhibitors

Boston Dynamics CEO Rob Playter is coming to Disrupt 2020 to talk robotics and automation

Across the week

TechCrunch

The tale of 2 challenger bank models

Majority of tech workers expect company solidarity with Black Lives Matter

‘Made in America’ is on (government) life support, and the prognosis isn’t good

What Microsoft should demand in exchange for its ‘payment’ to the US government for TikTok

Equity Monday: Could Satya and TikTok make ByteDance investors happy enough to dance?

Extra Crunch

5 VCs on the future of Michigan’s startup ecosystem

Eight trends accelerating the age of commercial-ready quantum computing

A look inside Gmail’s product development process

The story behind Rent the Runway’s first check

After Shopify’s huge quarter, BigCommerce raises its IPO price range

From Alex Wilhelm:

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast (now on Twitter!), where we unpack the numbers behind the headlines.

As ever, I was joined by TechCrunch managing editor Danny Crichton and our early-stage venture capital reporter Natasha Mascarenhas. We had Chris on the dials and a pile of news to get through, so we were pretty hyped heading into the show.

But before we could truly get started we had to discuss Cincinnati, and TikTok. Pleasantries and extortion out of the way, we got busy:

- E-commerce and fintech stay hot as Square reported big earnings, Shopify and Etsy do well, and more. We tied this to recent VC results in the fintech space, which saw a record number of $100 million rounds in Q2. There were some signs of weakness elsewhere, but the general state of things in tech is surprisingly hot, given the pandemic and recession.

- Gumroad founder Sahil Lavingia has a new seed fund that he built in collaboration with AngelList.

- D2C women’s-health startup Stix raised a $1.3 million seed round.

- Quantum-computing startup Rigetti raised a $79 million Series C.

- Rippling raised $145 million at an eye-popping $1.35 billion valuation; the company’s last value, set a year ago, was $270 million.

- AgentSync put together a $4.4 million seed round to help bring APIs to insurtech.

- Turning away from funding to some neat product news, India-based Statiq is building a bootstrapped EV-charging network.

- And as we wrapped, the Byju’s-WhiteHat Jr. deal was neat, JIO is soaking up a huge amount of Indian VC, and Natasha’s latest piece on learning pods had us arguing about what things are worth.

It was another fun week! As always we appreciate you sticking with and supporting the show!

Equity drops every Monday at 7:00 a.m. PT and Friday at 6:00 a.m. PT, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts.

Source: Tech Crunch