Are January layoffs just a few post-WeWork jitters?

TechCrunch has found itself writing about layoffs at a few notable tech companies this week — and not just Softbank-backed ones. The focus is very much profits, as Alex Wilhelm summed up on Thursday, especially after the failed WeWork IPO and subsequent valuation and headcount decimation. We’ll be digging into the topic more soon but there does seem to be a certain consumery thread here. And perhaps some fears of negative macro trends bubbling up?

23andMe cut 16% or 100 people, citing slowing sales for DNA tests. Quora reduced an undisclosed number to focus on revenue.

Plenty of tech investors have criticized Softbank’s approach to writing large check for large valuations, but they can’t avoid the same fears these days. So does Mozilla, which had to cut 70 people this month after struggling to build revenue products.

It still all seems sort of normal given the very high valuations and recent reconsiderations, at least so far. Layoffs may very well continue this year in a way that is necessary and even healthy in the long run.

More on TechCrunch, from Alex:

23andMe and Mozilla are not alone, however. Playful Studios cut staff just this week, 2019 itself saw more than 300% more tech layoffs than in the preceding year and TechCrunch has covered a litany of layoffs at Vision Fund-backed companies over the past few months, including:

- Staff cuts at Zume, the startup famous for considering making mobile pizza robots

- Personnel reductions at Rappi, an e-commerce company

- Cuts at Getaround, a car rental service

- Layoffs at Oyo, a budget hotel unicorn

Scooter unicorns Lime and Bird have also reduced staff this year. The for-profit drive is firing on all cylinders in the wake of the failed WeWork IPO attempt. WeWork was an outlier in terms of how bad its financial results were, but the fear it introduced to the market appears pretty damn mainstream by this point. (Forsake hope, alle ye whoe require a Series H.)

Image: Bryce Durbin/TechCrunch

2019 venture data had soft spots, maybe

Fresh data sets are in on last year from Crunchbase, as well as PitchBook and the NVCA. Alex identified a few key takeaways: slightly lower early-stage fundings, a big global year overall, and some of the above WeWork-attributed drops already surfacing in the Q4 data over on TechCrunch.

I have to wonder what we really know right now, though. These are the best publicly-accessible funding databases out there, but many companies have stopped filing Form Ds with the U.S. Securities and Exchange Commission in recent years, as Danny Crichton has been covering in this ongoing series. That was a main data source, especially about early-stage stealth companies.

The Crunchbase report goes over the global trend for the year, and that’s another confounding factor, actually — how trackable are startup funding dollars across borders these days? And how do you account for remote teams in that mix? And how do you account for crypto…?

If you are building a company now at any stage, the financial signs out now are not in my humble opinion ones to have any fear over. Especially relative to the other problems that are almost certainly in front of you.

There is a lot of money in VC now regardless of anything else, as the Pitchbook-NVCA report notes, and there will be for a long time.

How to handle a recession

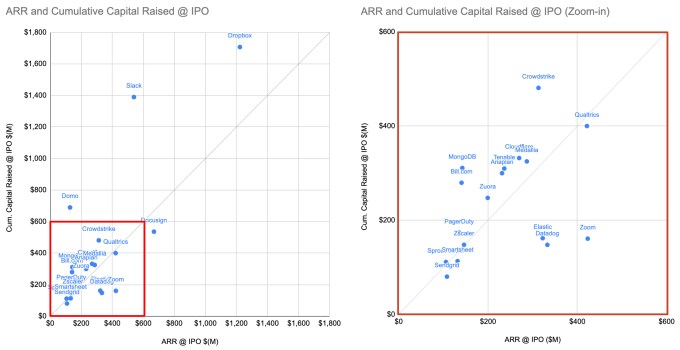

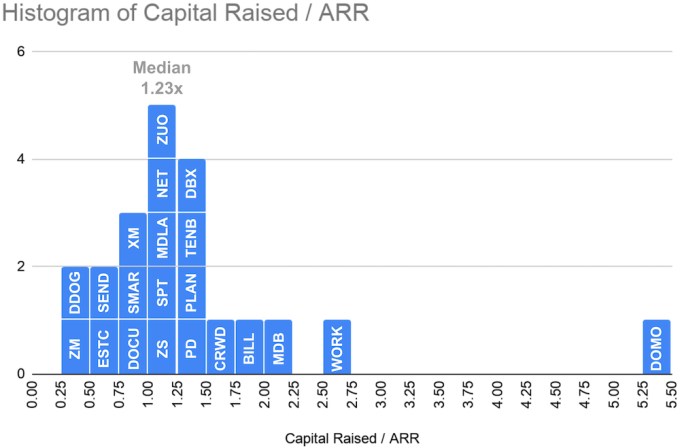

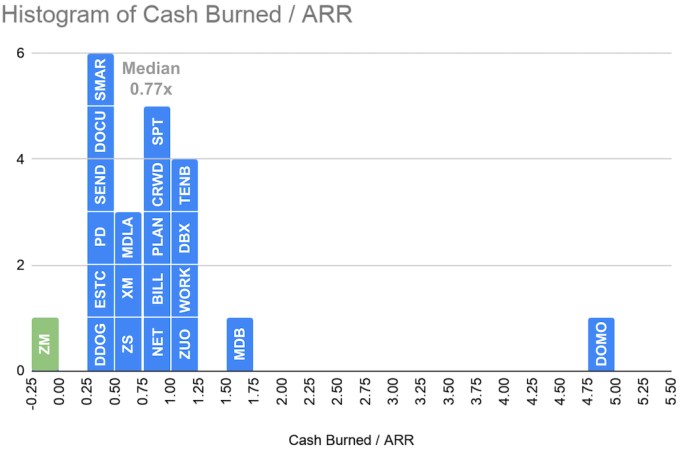

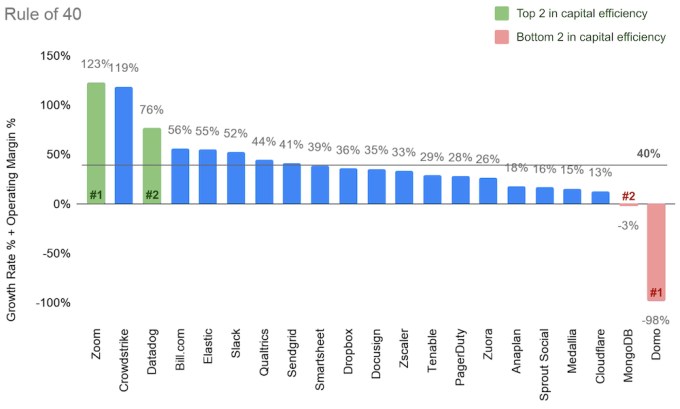

As if on cue, we had a couple guest columnists provide articles about capital efficiency and recession-proofing your company. Shin Kim has a two-parter on TechCrunch and Extra Crunch, where he breaks down why most tech IPOs are not WeWork (in a good way) and how to pace your own fundraising regardless of anything else going on.

Schwark Satyavolu, meanwhile, digs into the best practices for startups in the next recession for Extra Crunch, starting with this brutal real-life intro:

I founded my first startup, Yodlee, in a strong economy with almost 20 competitors. Ten years and a painful recession later, we were the only game in town. Critical to our success was acquiring our largest competitor, something we never could have done in a strong economy because they never would have been willing to sell. The recession made it untenable for them to fundraise, enabling us not only to buy them, but to do so without cash in an all-equity deal.

A proclamation about board diversity

Board representation is a hot topic for companies of all sizes and none other than Goldman Sachs said this week that it would only take companies public that had at least one underrepresented board member.

CEO David Solomon said that companies that had gone public in the last four years with at least one female board member did significantly better than those without, but Megan Dickey notes for Extra Crunch that’s not quite all the way towards the goal:

But the lack of people of color on boards is perhaps a more urgent issue. Late last year, a Crunchbase study found that 60% of the most funded VC-backed startups don’t have a single woman on their board of directors. But there are even fewer black people, let alone black women, on boards. A 2018 Deloitte study found that of the Fortune 100 companies, white men held 61.4% of board seats, white women held 19.1%, men of color had 13.7% of board seats and women of color had just 5.8% of board seats.

Connie Loizos, meanwhile, writes for TechCrunch that boards themselves are not all of the way towards the goal:

Let’s be real here. Directors of public companies typically meet just four times a year to review quarterly results. It’s important and necessary, sure. But beyond ensuring that strategic objectives are being met and hopefully making useful introductions to the company, these roles are assigned more importance by industry watchers than they should. (They often pay ludicrous amounts given the work involved, too.)

Even pledging that Goldman is only going to take public companies that give back — say 1% of future profits to the NAACP, as one idea — would instantly put the bank in pole position for those founders and investors who truly want to be progressive. Goldman might miss out on a lot of business in the immediate term, we realize, but we’re guessing it’s a gamble that would pay off over time.

Around the horn

Lame LPs, founder referenceability and the future of VC signaling (TC)

Why is everyone making OKR software? (EC)

Should tech giants slam the encryption door on the government? (TC)

Where top VCs are investing in adtech and martech (EC)

US mobile app subscription revenue jumped 21% in 2019 to $4.6B across the top 100 apps (TC)

Relativity Space could change the economics of private space launches (EC)

Can a time machine offer us the meaning of life? (TC)

#EquityPod

Alex and Danny are back on Equity this week, here’s a menu before you listen to the episode here (and if you haven’t subscribed yet, you can do that here).

-

Why Front’s latest investment (a $59 million Series C) is a pretty big deal. Not because of how much money it has raised — the firm has raised more in a single, preceding round — but because of who put the capital to work.

-

On the venture capital front, Danny and Alex also chewed over signaling risk in venture, and why bigger funds are writing earlier and earlier checks.

-

Also on the docket was the latest from Lambda School, which our former co-host and friend Kate Clark wrote. The gist is that regardless of how you feel about the company, your views are probably a bit too negative, or a bit too positive. (More on the company’s ilk from Extra Crunch here, and here.)

-

And three media deals, including The Athletic’s latest investment ($50 million), who might buy the company behind the hit podcast “Serial” and why Spotify might buy The Ringer. Which is about sports, it turns out.

Want Startups Weekly in your inbox each week? You can sign up for this and TechCrunch’s other newsletters here.

Source: Tech Crunch