Mike Volpi is a general partner at

Index Ventures. Before co-founding the firm’s San Francisco office with Danny Rimer, Volpi served as the chief strategy officer at Cisco Systems.

It was just 5 years ago that there was an ample dose of skepticism from investors about the viability of open source as a business model. The common thesis was that Redhat was a snowflake and that no other open source company would be significant in the software universe.

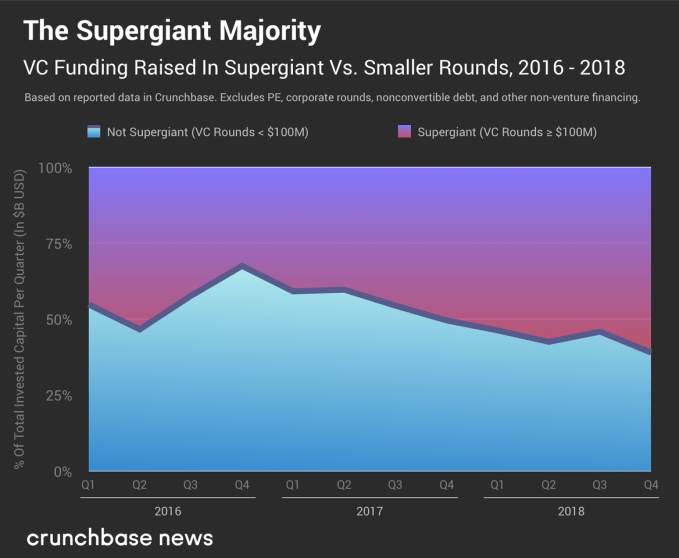

Fast forward to today and we’ve witnessed the growing excitement in the space: Redhat is being acquired by IBM for $32 billion (3x times its market cap from 2014); Mulesoft was acquired after going public for $6.5 billion; MongoDB is now worth north of $4 billion; Elastic’s IPO now values the company at $6 billion; and, through the merger of Cloudera and Hortonworks, a new company with a market cap north of $4 billion will emerge. In addition, there’s a growing cohort of impressive OSS companies working their way through the growth stages of their evolution: Confluent, HashiCorp, DataBricks, Kong, Cockroach Labs and many others. Given the relative multiples that Wall Street and private investors are assigning to these open source companies, it seems pretty clear that something special is happening.

So, why did this movement that once represented the bleeding edge of software become the hot place to be? There are a number of fundamental changes that have advanced open source businesses and their prospects in the market.

David Paul Morris/Bloomberg via Getty Images

From Open Source to Open Core to SaaS

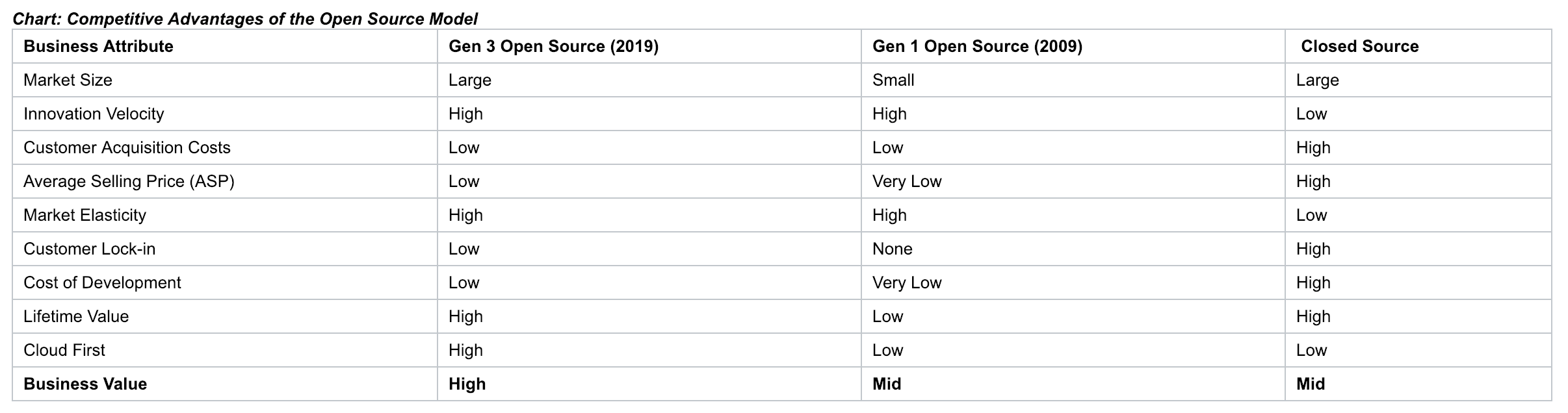

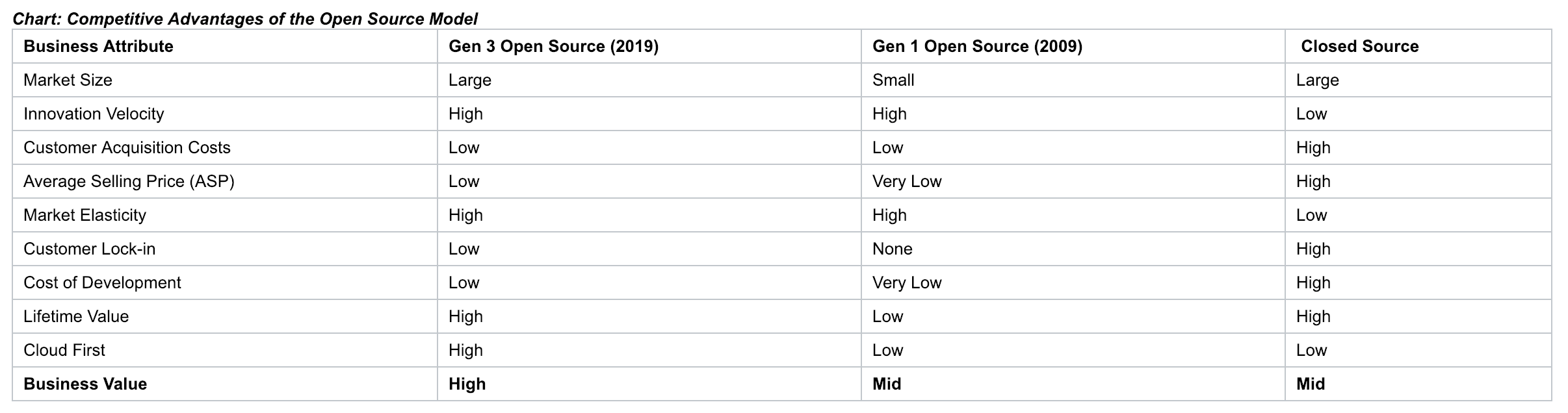

The original open source projects were not really businesses, they were revolutions against the unfair profits that closed-source software companies were reaping. Microsoft, Oracle, SAP and others were extracting monopoly-like “rents” for software, which the top developers of the time didn’t believe was world class. So, beginning with the most broadly used components of software – operating systems and databases – progressive developers collaborated, often asynchronously, to author great pieces of software. Everyone could not only see the software in the open, but through a loosely-knit governance model, they added, improved and enhanced it.

The software was originally created by and for developers, which meant that at first it wasn’t the most user-friendly. But it was performant, robust and flexible. These merits gradually percolated across the software world and, over a decade, Linux became the second most popular OS for servers (next to Windows); MySQL mirrored that feat by eating away at Oracle’s dominance.

The first entrepreneurial ventures attempted to capitalize on this adoption by offering “enterprise-grade” support subscriptions for these software distributions. Redhat emerged the winner in the Linux race and MySQL (thecompany) for databases. These businesses had some obvious limitations – it was harder to monetize software with just support services, but the market size for OS’s and databases was so large that, in spite of more challenged business models, sizeable companies could be built.

The successful adoption of Linux and MySQL laid the foundation for the second generation of Open Source companies – the poster children of this generation were Cloudera and Hortonworks. These open source projects and businesses were fundamentally different from the first generation on two dimensions. First, the software was principally developed within an existing company and not by a broad, unaffiliated community (in the case of Hadoop, the software took shape within Yahoo!) . Second, these businesses were based on the model that only parts of software in the project were licensed for free, so they could charge customers for use of some of the software under a commercial license. The commercial aspects were specifically built for enterprise production use and thus easier to monetize. These companies, therefore, had the ability to capture more revenue even if the market for their product didn’t have quite as much appeal as operating systems and databases.

However, there were downsides to this second generation model of open source business. The first was that no company singularly held ‘moral authority’ over the software – and therefore the contenders competed for profits by offering increasing parts of their software for free. Second, these companies often balkanized the evolution of the software in an attempt to differentiate themselves. To make matters more difficult, these businesses were not built with a cloud service in mind. Therefore, cloud providers were able to use the open source software to create SaaS businesses of the same software base. Amazon’s EMR is a great example of this.

The latest evolution came when entrepreneurial developers grasped the business model challenges existent in the first two generations – Gen 1 and Gen 2 – of open source companies, and evolved the projects with two important elements. The first is that the open source software is now developed largely within the confines of businesses. Often, more than 90% of the lines of code in these projects are written by the employees of the company that commercialized the software. Second, these businesses offer their own software as a cloud service from very early on. In a sense, these are Open Core / Cloud service hybrid businesses with multiple pathways to monetize their product. By offering the products as SaaS, these businesses can interweave open source software with commercial software so customers no longer have to worry about which license they should be taking. Companies like Elastic, Mongo, and Confluent with services like Elastic Cloud, Confluent Cloud, and MongoDB Atlas are examples of this Gen 3. The implications of this evolution are that open source software companies now have the opportunity to become the dominant business model for software infrastructure.

The Role of the Community

While the products of these Gen 3 companies are definitely more tightly controlled by the host companies, the open source community still plays a pivotal role in the creation and development of the open source projects. For one, the community still discovers the most innovative and relevant projects. They star the projects on Github, download the software in order to try it, and evangelize what they perceive to be the better project so that others can benefit from great software. Much like how a good blog post or a tweet spreads virally, great open source software leverages network effects. It is the community that is the source of promotion for that virality.

The community also ends up effectively being the “product manager” for these projects. It asks for enhancements and improvements; it points out the shortcomings of the software. The feature requests are not in a product requirements document, but on Github, comments threads and Hacker News. And, if an open source project diligently responds to the community, it will shape itself to the features and capabilities that developers want.

The community also acts as the QA department for open source software. It will identify bugs and shortcomings in the software; test 0.x versions diligently; and give the companies feedback on what is working or what is not. The community will also reward great software with positive feedback, which will encourage broader use.

What has changed though, is that the community is not as involved as it used to be in the actual coding of the software projects. While that is a drawback relative to Gen 1 and Gen 2 companies, it is also one of the inevitable realities of the evolving business model.

Linus Torvalds was the designer of the open-source operating system Linux.

Rise of the Developer

It is also important to realize the increasing importance of the developer for these open source projects. The traditional go-to-market model of closed source software targeted IT as the purchasing center of software. While IT still plays a role, the real customers of open source are the developers who often discover the software, and then download and integrate it into the prototype versions of the projects that they are working on. Once “infected”by open source software, these projects work their way through the development cycles of organizations from design, to prototyping, to development, to integration and testing, to staging, and finally to production. By the time the open source software gets to production it is rarely, if ever, displaced. Fundamentally, the software is never “sold”; it is adopted by the developers who appreciate the software more because they can see it and use it themselves rather than being subject to it based on executive decisions.

In other words, open source software permeates itself through the true experts, and makes the selection process much more grassroots than it has ever been historically. The developers basically vote with their feet. This is in stark contrast to how software has traditionally been sold.

Virtues of the Open Source Business Model

The resulting business model of an open source company looks quite different than a traditional software business. First of all, the revenue line is different. Side-by-side, a closed source software company will generally be able to charge more per unit than an open source company. Even today, customers do have some level of resistance to paying a high price per unit for software that is theoretically “free.” But, even though open source software is lower cost per unit, it makes up the total market size by leveraging the elasticity in the market. When something is cheaper, more people buy it. That’s why open source companies have such massive and rapid adoption when they achieve product-market fit.

Another great advantage of open source companies is their far more efficient and viral go-to-market motion. The first and most obvious benefit is that a user is already a “customer” before she even pays for it. Because so much of the initial adoption of open source software comes from developers organically downloading and using the software, the companies themselves can often bypass both the marketing pitch and the proof-of-concept stage of the sales cycle. The sales pitch is more along the lines of, “you already use 500 instances of our software in your environment, wouldn’t you like to upgrade to the enterprise edition and get these additional features?” This translates to much shorter sales cycles, the need for far fewer sales engineers per account executive, and much quicker payback periods of the cost of selling. In fact, in an ideal situation, open source companies can operate with favorable Account Executives to Systems Engineer ratios and can go from sales qualified lead (SQL) to closed sales within one quarter.

This virality allows for open source software businesses to be far more efficient than traditional software businesses from a cash consumption basis. Some of the best open source companies have been able to grow their business at triple-digit growth rates well into their life while maintaining moderate of burn rates of cash. This is hard to imagine in a traditional software company. Needless to say, less cash consumption equals less dilution for the founders.

Photo courtesy of Getty Images

Open Source to Freemium

One last aspect of the changing open source business that is worth elaborating on is the gradual movement from true open source to community-assisted freemium. As mentioned above, the early open source projects leveraged the community as key contributors to the software base. In addition, even for slight elements of commercially-licensed software, there was significant pushback from the community. These days the community and the customer base are much more knowledgeable about the open source business model, and there is an appreciation for the fact that open source companies deserve to have a “paywall” so that they can continue to build and innovate.

In fact, from a customer perspective the two value propositions of open source software are that you a) read the code; b) treat it as freemium. The notion of freemium is that you can basically use it for free until it’s deployed in production or in some degree of scale. Companies like Elastic and Cockroach Labs have gone as far as actually open sourcing all their software but applying a commercial license to parts of the software base. The rationale being that real enterprise customers would pay whether the software is open or closed, and they are more incentivized to use commercial software if they can actually read the code. Indeed, there is a risk that someone could read the code, modify it slightly, and fork the distribution. But in developed economies – where much of the rents exist anyway, it’s unlikely that enterprise companies will elect the copycat as a supplier.

A key enabler to this movement has been the more modern software licenses that companies have either originally embraced or migrated to over time. Mongo’s new license, as well as those of Elastic and Cockroach are good examples of these. Unlike the Apache incubated license – which was often the starting point for open source projects a decade ago, these licenses are far more business-friendly and most model open source businesses are adopting them.

The Future

When we originally penned this article on open source four years ago, we aspirationally hoped that we would see the birth of iconic open source companies. At a time where there was only one model – Redhat – we believed that there would be many more. Today, we see a healthy cohort of open source businesses, which is quite exciting. I believe we are just scratching the surface of the kind of iconic companies that we will see emerge from the open source gene pool. From one perspective, these companies valued in the billions are a testament to the power of the model. What is clear is that open source is no longer a fringe approach to software. When top companies around the world are polled, few of them intend to have their core software systems be anything but open source. And if the Fortune 5000 migrate their spend on closed source software to open source, we will see the emergence of a whole new landscape of software companies, with the leaders of this new cohort valued in the tens of billions of dollars.

Clearly, that day is not tomorrow. These open source companies will need to grow and mature and develop their products and organization in the coming decade. But the trend is undeniable and here at Index we’re honored to have been here for the early days of this journey.

Source: Tech Crunch

“Our product portfolio continues to evolve, and now we have a variety of products for users to enjoy audio,” Google told us in a statement. “We have therefore stopped manufacturing our Chromecast Audio products. We will continue to offer assistance for Chromecast Audio devices, so users can continue to enjoy their music, podcasts and more.”

“Our product portfolio continues to evolve, and now we have a variety of products for users to enjoy audio,” Google told us in a statement. “We have therefore stopped manufacturing our Chromecast Audio products. We will continue to offer assistance for Chromecast Audio devices, so users can continue to enjoy their music, podcasts and more.”