For the last decade, the largest technology companies have increasingly looked outside of tech to grow their operations. From automotive to retail to groceries, these companies use massive competitive advantages in the form of data, consumer relationships and software engineers to fundamentally change markets.

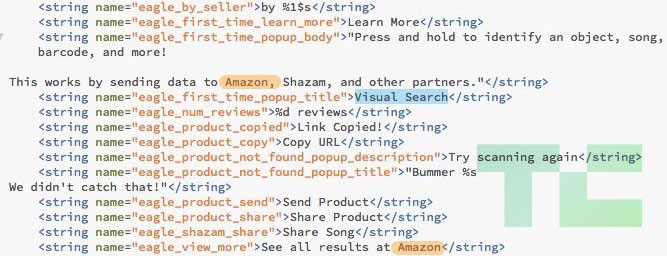

Now, companies like Apple and Google and Amazon are eyeing innovation across the insurance landscape. For example, Amazon is teaming with JPMorgan and Berkshire Hathaway to create a new way to approach health insurance, focusing first on the group’s own employees. On the retail side, Amazon is selling product insurance and extended warranties at the point of sale and investing in insurtech startups. Meanwhile, Tesla is developing an insurance product specific to the Model S. Waymo, Uber and Lyft are certainly having similar conversations internally.

Obviously, these are all preliminary steps. Insurance is a complex, multifaceted and, yes, risky business. In the end, whether or not companies like Amazon become insurers themselves depends on their appetite for risk, their ability to innovate and the potential pay off.

To start, let’s look at the reasons why tech giants are well-suited to upend the space.

They have direct consumer relationships

Like many businesses, a large aspect of a successful insurance business is distribution. Just look at brokers, which are a major means of distribution for insurers today — their cut can be up to 30 percent of the cost of an insurance policy. Brokers also see better margins than insurers themselves, usually around 10 percent net margins. Facebook, Amazon, Apple, Microsoft and Google (FAAMG) possess direct relationship with billions of consumers and could, over time, disrupt the broker business.

They have deep data and analytics

The big secret in insurance is that insurers are actually terrible at using their data. Different departments (marketing, underwriting, claims) rarely work together, and their data tends to be siloed. FAAMG, on the other hand, has put data at the core of their offering; they know how to leverage analytics and AI to create better products.

Tech giants may be tempted to use their troves of data to compete with insurers directly.

They also have access to data that insurers can only dream of having: global geospatial imagery of homes, infrastructure and buildings; location, browsing and advertising data; even real-world behavioral data from smartphones and IoT devices. Combining all these signals can create a very complete picture of human behavior, interests and risk profile.

They have an army of software engineers and a monopoly of AI talent

Tech innovation has long been a challenge for insurance incumbents. Old systems are difficult to displace in any industry, but the complexity of insurance, tradition of relying on the past to predict the future and silos of data can make it a Herculean effort. Tech giants, on the other hand, regularly cannibalize their own revenue with new products and can enlist tens of thousands of engineers to develop fantastic digital customer experiences and bring large-scale efficiencies to back-end insurance systems through better software and AI.

So, yes, FAAMG has a number of major advantages over insurance incumbents. But for tech giants, new verticals and initiatives are also longer-term decisions around margins and market scope. It’s an obvious point, but if FAAMG wants to jump into insurance, they’ll want a decent return. Can they find that in insurance?

There are a number of reasons why it might be a tough sell.

Ultra-low margins

Average insurance net margins are 3-8 percent, and 25-30 percent gross margins, which are meager for tech standards. Software companies average around 80 percent gross margins and around 15 percent net margins. Even consumer hardware like the iPhone — a costly endeavor by software standards — sees 55-60 percent gross margins.

Within insurance, health tends to have the highest margins, followed by property and casualty (i.e. home and auto insurance), followed by life insurance. So if anything, healthcare is probably the closest thing to “low-hanging fruit” — but it’s not exactly attractive to most companies outside insurance.

High risk

Such low margin also means that one major event can destroy a company’s balance sheet for an entire fiscal year (think disasters like hurricanes, fire, flood, etc.). In addition, tech companies don’t have the historical data and actuarial scientists that insurers have spent decades building up, so they might be more prone to misjudging their overall risk exposure.

Complex administration

For insurers, evaluating and underwriting policies is an expensive endeavor. Claims, customer support and back-end are costly and complex. That said, most insurance companies are already outsourcing the development of core administration software to companies like GuideWire and Duck Creek, and then customizing the software to meet their specific needs at the last mile. So it’s not as huge of a leap as it once was to think that the likes of Amazon or Google could develop similar infrastructure in-house to rival incumbent systems. Or, they could easily buy one of the development companies outright and subsume that expertise.

Amazon makes a big move

Still, the creation and underwriting of policies is something tech giants have avoided to date. Amazon has been working on warranties for certain products as an add-on to their margins — but these were backed and administered by The Warranty Group rather than Amazon itself. Before that, Amazon acted as a sales channel for SquareTrade and built up an understanding of the warranty business before diving in deeper. Tesla, as another example, announced it was selling Tesla-branded tailor-made policies for its vehicle owners, but those policies were backed by Liberty Mutual.

What role will tech giants in the U.S. play in the insurance landscape?

Then, in January, Amazon made a well-publicized announcement, in tandem with Berkshire Hathaway and JPMorgan, around its intention to create a private healthcare option for their workers. We don’t know much about the initiative, but Amazon has been working on a healthcare technology project codenamed 1492 for some time. Rumors point to a “platform for electronic medical record data, telemedicine, and health apps.” Amazon’s technology paired with Berkshire Hathaway’s insurance knowledge and JPMorgan’s financial expertise makes the creation of a new health insurance entity more likely. If so, this would be a significant shot across the bow of U.S. healthcare insurers.

Of all the tech giants, it would not be a surprise if Amazon were the first to jump into insurance. Amazon has mastered the art of building massive businesses off of razor-thin margins. They’re also targeting health insurance, which presents the best margin opportunity. They can test their offering within the company first and then scale across their massive consumer base. Finally, they have a history of building out complex back-end services for their own purposes before offering it to their customers — just look at AWS.

Will other tech companies follow Amazon’s lead?

Signs point to yes. Recently, Google’s sister company, Verily, “has been in talks with insurers about jointly bidding for contracts that would involve taking on risk for hundreds of thousands of patients.” In addition, Apple will be opening a network of medical clinics for its employees.

It may not stop at health insurance. There’s no question technology is changing human behavior and society, and as the developers of much of this new tech, FAAMG will inevitably be pushed closer to other sectors of insurance, as well, including home and auto.

Autonomous vehicle fleets will make companies like Tesla, Google and Uber the owners of tens of thousands of cars, subjecting them to the risk that comes with that. Meanwhile, IoT hardware and accompanying services are bringing tech giants into the living room. That’s a literal statement when it comes to Amazon Key. Nest, Google Home and Amazon Echo are more innocuous, but provide all sorts of data about what’s going on inside the home and could, someday, help inform the creation of real-time home insurance policies.

East Asia as a leading indicator?

It also can be instructive to look at markets outside the U.S. In East Asia, businesses are taking a more aggressive posture vis-à-vis insurance. Baidu, Alibaba, Rakuten, Tencent and LINE have all shown some level of appetite for offering their own insurance products. These companies can verify identities, enforce trust and access the behavioral and financial data necessary to provide better policies than many insurance incumbents in those countries.

They also are exploring new ways of looking at risk and changing user behavior: Tencent’s WeSure is paying users to stay healthy by walking more, while Yongqianbao, a lending company, tracks unconventional digital data to determine credit risk, such as phone brand (iPhone users are less likely to default) and whether they let their phone batteries run down.

Still, the question remains: What role will tech giants in the U.S. play in the insurance landscape? Will they act as a channel for existing insurers, as a provider of data and analytics to those insurers or even as a provider of direct insurance themselves?

Insurance may not be lucrative-enough for tech giants in the short-term, but as real-time data and analytics are used to create insurance policies, tech giants may be tempted to use their troves of data to compete with insurers directly. Until then, we can expect insurers and tech giants to form alliances, as they have in East Asia, with tech companies using insurance and warranties as a value-add for their customers, and insurers using tech companies as a sales channel. Regardless, the story of FAAMG (and others) in insurance is undoubtedly just getting started, and we’ll have to check back in as the landscape develops.

Source: Tech Crunch