Earlier today, news broke that Bozoma Saint John is leaving her position as chief brand officer at Uber to head over to Endeavor. At Endeavor, an entertainment industry behemoth, Saint John will serve as chief marketing officer, working across all of Endeavor’s portfolio companies, which includes William Morris Endeavor and IMG.

I had the chance to catch up with Saint John for a little bit over the phone to learn more about why she left. For starters, “nothing horrible or terrible happened,” she told me in response to a question about if something bad caused her to leave. “I am very thankful for that because we’ve had enough of those stories. We don’t want any more of that.”

Now that we’ve gotten that out of the way, Saint John told me she wasn’t looking to leave Uber. Instead, Endeavor reached out to her and she didn’t want to pass up this opportunity to change the narrative around diversity and inclusion.

“Sometimes people think [pop culture] is superficial,” she told me. “These are where the stories that are being told are created. If we can help influence that, then that’s so much better for the entire narrative of what we need to get across.”

What we need to get across, she said, is “all the deep stuff,” like diversity, inclusion and sexual harassment.

“These are all pop culture issues,” she said. “It’s like, how can all of those things work in concert to make sure the narrative is told in a way that is powerful.”

While Saint John felt the work she was doing at Uber was important, there were other things Uber needed to take care of before she could be most impactful, she said. For example, Uber still has work to do around corporate culture, she said. As you all may remember, Uber had a horrific 2017, with reports of sexual harassment, mismanagement and an overall toxic culture. While Uber has taken some steps in the right direction, there is still work to be done, Saint John said.

“I’m not saying the corporate culture has righted itself 100 percent,” she said. “Or it’s where it needs to be today. It isn’t. There’s still a lot to be done in that regard.”

She went on to say that she never wanted to use Uber’s small wins around human resources and culture as marketing. Instead, it needed to be done because it was the right thing to do — not just to make Uber look good. Unfortunately, that left Saint John with “a huge gaping hole,” she said.

At Uber, Saint John said she had some personal work wins — like the partnership with LeBron James and Kevin Durant. She pointed to how powerful it was when James spoke about being a black man in America.

“I do feel very good about the stuff I was able to do there, but I know I’ll be able to do much more impactful work right now at Endeavor,” Saint John said.

As CMO at Endeavor, Saint John said she envisions being able to impact storytelling in a new type of way. And as industries, including Hollywood, battle with issues around sexual harassment and toxic work environments, Saint John said she wants to be part of crafting the solution — whether or not it’s part of her job.

“Unfair or not — as a black woman, as you know — when you’re in the job, it doesn’t matter what job you’re doing,” she said. “You are sometimes forcibly in the center of the conversation and sometimes, unfairly, given the reigns to fix it, quote un quote. So while I don’t feel the responsibility of actually doing that job — because there are people whose job that is — I do still feel the responsibility of contributing and creating solutions for the company I’m in and the industry for which I work, which is Hollywood.”

Source: Tech Crunch

Well Snap is stepping up. Snapchat will let you retract your risque, embarassing, or incriminating messages thanks to a new feature called Clear Chats that’s rolling out globally over the next few weeks.

Well Snap is stepping up. Snapchat will let you retract your risque, embarassing, or incriminating messages thanks to a new feature called Clear Chats that’s rolling out globally over the next few weeks.

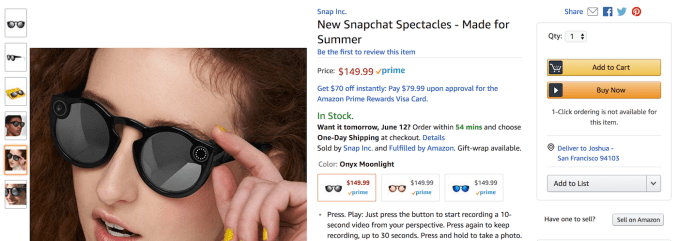

Finally, Snapchat is launching a new ecommerce ad unit that shows a carousel of purchaseable items at the bottom of the screen that users can tap to buy without leaving the Snapchat app. This follows our

Finally, Snapchat is launching a new ecommerce ad unit that shows a carousel of purchaseable items at the bottom of the screen that users can tap to buy without leaving the Snapchat app. This follows our