Welcome back to The TechCrunch Exchange, a weekly startups-and-markets newsletter. It’s broadly based on the daily column that appears on Extra Crunch, but free, and made for your weekend reading. Want it in your inbox every Saturday? Sign up here.

Ready? Let’s talk money, startups and spicy IPO rumors.

Hey! It’s going to be a long weekend here in the United States, which means that this newsletter is in between myself and being done with work. So, we’re going to hit on even more topics than usual as I am a glutton for both punishment and writing. But I repeat myself.

Up first: Startups and culture.

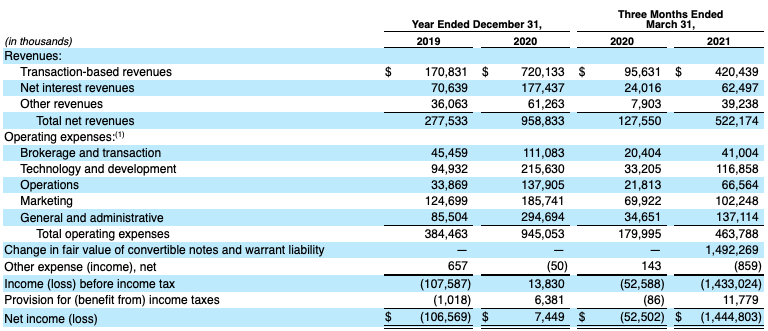

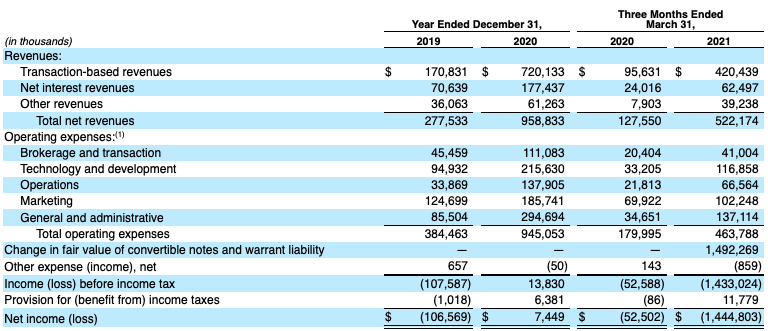

Something that I very much enjoyed this week was the Robinhood IPO filing. You can read our first look here, and a deeper dig into the numbers here. But today we’re going to riff on culture. Observe the following excerpts, the first from the company’s notes on its goals via its S-1 filing:

Over time, we strive to make Robinhood the most trusted, lowest cost, and most culturally relevant money app worldwide.

Surprised that “culturally relevant“ made it into the mix? Then check this out, from the prospectus’s overview section (emphasis added):

Cultural Impact. We pioneered commission-free stock trading with no account minimums, which the rest of the industry emulated, and we have continued to build relationships with our customers by introducing new products that further expand access to the financial system. We believe we have made investing culturally relevant and understandable, and that our platform is enabling our customers to become long-term investors and take greater control of their finances. Over half of 18-44 year olds in the United States know who Robinhood is according to an internal brand study that we conducted in March 2021. As a further sign of our relevance today, Robinhood reached the number-one spot on the Apple App Store multiple times in the first quarter of 2021 and was frequently ranked number one in the Finance category on the Apple App store during 2020 and the first quarter of 2021.

The app store bragging is whatever. The focus on culture caught me up.

I’ve often enjoyed watching culture evolve more and more rapidly over time; TikTok further accelerated the trend. And amongst the youths of the world, I’d hazard, the line between brand and culture is blurring as brands work to move more and more into cultural territory. The Robinhood S-1 is forward-looking in a number of ways, but to see a company going public discuss culture in this manner feels like the future.

Up second: American manufacturing is not dead.

That’s what The Exchange learned this week from a conversation with the CEO of Xometry. The company recently went public. You can read more of our notes on its numbers here, but like Robinhood the former startup raised lots of venture capital and this fits into our broader remit.

What doesn’t, really, is what we learned about manufacturing thanks to the chat. Per CEO Randy Altschuler, his business of connecting companies in need of manufacturing with those able to build stuff is nearly an entirely U.S.-based business. That’s to say that, yes, there is still stuff made here in America.

What Xometry does is actually pretty cool — including offering financial services as part of its role as marketplace middleperson — but what got us the most hype was the idea that a digital service was going to help connect folks in need with folks with tools here in the United States. If Xometry’s vision of the future works out, it could help sustain, and dare we say grow, domestic manufacturing in this nation. Who would have thought that that was possible?

Xometry’s IPO was also a huge success, we should add. It priced above range, and then shot higher. That’s what you want as a company.

And third, some fun odds and ends:

- More tech money in F1: Every race weekend in the Formula 1 calendar helps me notice yet another tech company putting money into racing’s most bonkers series. Zoom has a lot of branding out there, for example. And this week we got news that Crypto.com has closed a five-year, $100-million deal with the racing league. That’s a lot of duckets. Notably Tezos already sponsors some teams, and you can spy both Amazon and Microsoft branding here and there in the series. Oh, and the Splunk-McLaren tie-up was just extended. New life goal: Make lots of money, sponsor F1 team, get paddock access. What could possibly go wrong?

- Unqork has hired a CRO. Not a CFO, so we can’t make too many IPO noises concerning the no-code service that helps big companies build apps. But the news still matters for you no-code fans.

- Finally, Apptopia has download numbers for neobanks. Can you guess which was number one?

— Alex

Source: Tech Crunch