Gone are the days when cities and tech startups are constantly at odds with each other. Passport, a mobility management startup, has partnered with Charlotte, N.C., Detroit, MIch., and Omaha, Neb. to create a framework to apply parking principles, data analysis and more to the plethora of shared micromobility services.

“For many cities, the only option has been to impose bans, fees or permit systems intended to cap the number of scooters allowed on their streets,” Passport CEO Bob Youakim told TechCrunch via email. “While this allows cities to temporarily control scooter deployment, there are greater benefits to achieve by aligning with new mobility providers.”

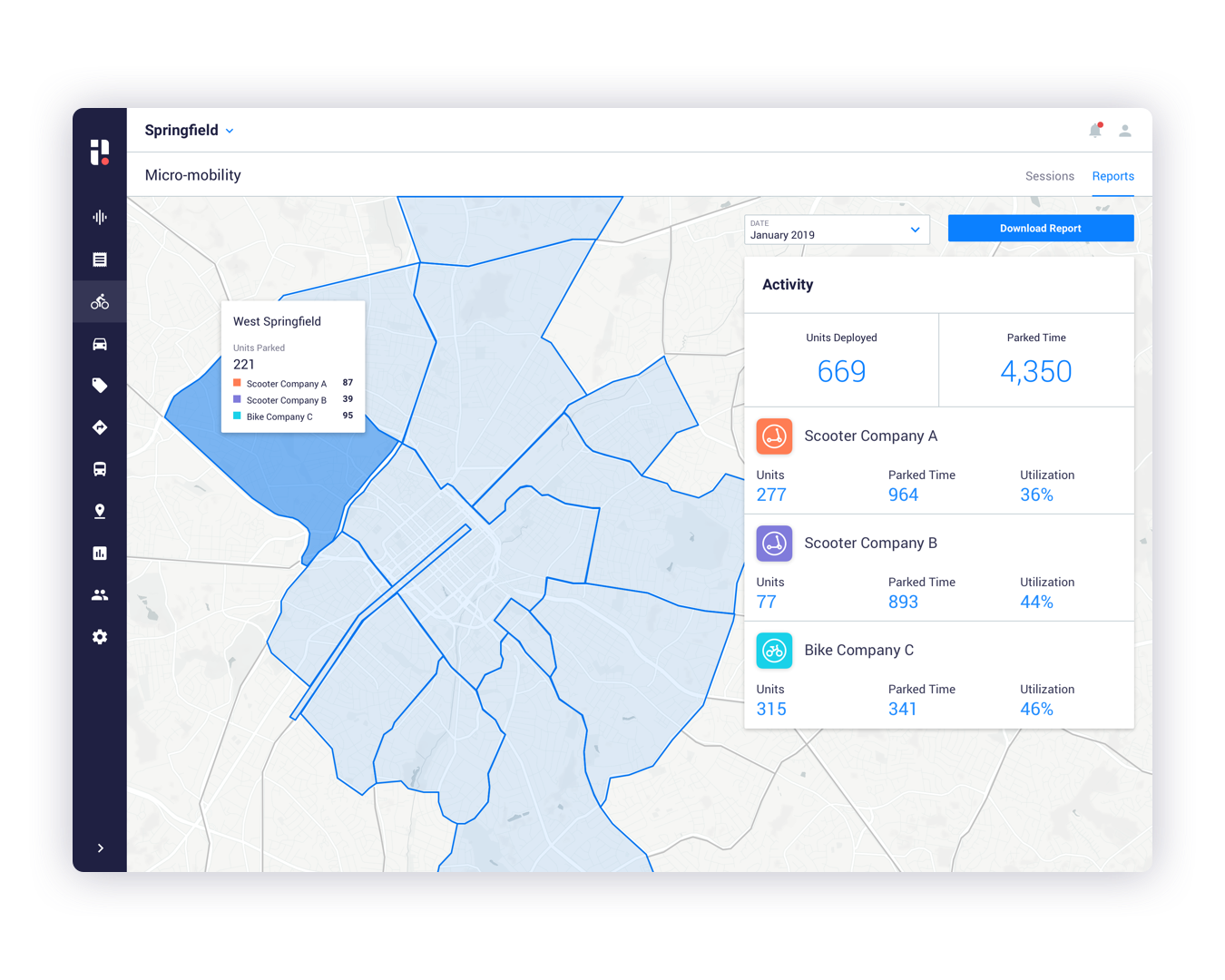

With Passport, those cities will be able to easily analyze scooter usage, parking patterns and curb utilization. Passport also enables cities to implement real-time curbside pricing and payments and better manage scooter placement. The idea is that cities and mobility providers will work better together if there are economic incentives in place.

“Cities already have a well-established system for charging cars to park on the curb and this same solution should be applied to other modes of transportation,” Youakim said. “By charging scooters to park with usage-based pricing, cities can more effectively manage scooters in their communities and naturally balance supply and demand.”

Passport has also partnered with scooter operator Lime to research ways in which a system of flexible parking charges could replace scooter caps.

“This is a prime example of cities and Lime collaborating to both determine the right fleet size through data and jointly achieve mode shift, sustainability and accessibility objectives,” Lime Director of Transportation Partnerships said in a statement.

In Detroit, the city outlined its official pilot program last October, capping the number of scooters each company could deploy at 400. When the scooters first landed in Detroit, they were very concentrated in the greater downtown area, Detroit Chief of Mobility Innovation Mark de la Vergne told TechCrunch via email.

As part of this program, the hope is to continue to increase the availability of scooters in underserved areas, as well as better manage the supply and demand economics.

“I’m very interested to see how these cities can work together to develop a new business/regulatory model that can be scaled nationally,” he said.

Over in Charlotte, the hope is to learn more about how to implement dynamic pricing and encourage people to wear helmets.

“We will be evaluating how this partnership shapes transportation mobility in Charlotte as it relates to e-scooters,” Charlotte Department of Transportation Deputy Director Dan Gallagher said. “As a city we want to be able to provide our community with the best transportation network that provides access to jobs, education, transit and housing.”

Source: Tech Crunch