One lesson from TechCrunch’s Disrupt SF is that founders can’d get enough programming on the really hard questions. How do I get into Y Combinator? How do I hire a technical lead? How do I raise my first round? That’s why we created a special stage at Disrupt SF for the sole purpose of bringing the top Silicon Valley experts on stage to go deep on those questions with TechCrunch editors and also take audience questions. We call this the Extra Crunch stage, in a tip of the hat to TechCrunch’s Extra Crunch subscription service, which has the same, founder-centric mission.

Please check out the agenda for all three days of the Extra Crunch stage below. You can see the full agenda here (including new additions Will Smith and Steph Curry), which includes the main and Q&A stages as well. Get your Disrupt SF pass here – but remember that only Innovator, Founder and Investor passes get access to the programming at Disrupt.

AGENDA for the Extra Crunch Stage

WEDNESDAY, OCTOBER 2

10:05 am – 10:45 am How to Build a Billion-Dollar SaaS Company with Neeraj Agrawal (Battery Ventures), Jyoti Bansal (AppDynamics) and Whitney Bouck (HelloSign)

Growing your SaaS company to a billion dollars in revenue is no easy task. It takes patience, perseverance and a strong team. Often it doesn’t happen until well after a company has gone public. We will talk to three people who have experience working with SaaS startups and understand the unique challenges they face getting to a billion dollars and beyond.

11:05 am – 11:45 am Could the U.S. Government Be Your Next Investor? with Steve Isakowitz (The Aerospace Corporation) and Raj Shah (DIU)

No founder likes dilution, which is why the U.S. government is becoming an increasingly popular source for early-stage, ambitious venture capital. Hear from leaders who have navigated the process to discover your next source of non-dilutive capital.

11:45 am – 12:15 pm How to Evaluate Talent and Make Decisions with Ray Dalio (Bridgewater)

Ray Dalio knows a thing or two about building successful startups. As founder of the firm Bridgewater, he helped build it into one of the most successful investment companies ever, managing a whopping $150 billion in assets. He recently wrote a book called Principles, and he’s here on the TechCrunch Disrupt Extra Crunch stage to discuss the book and companion mobile app on how building a strong culture can lead to a flourishing startup.

1:35 pm – 2:15 pm How to Take a Digital Brand Offline with Rich Fulop (Brooklinen), James Reinhart (thredUP) and Susan Tynan (Framebridge)

E-commerce has fundamentally changed the way we browse and buy physical goods. But even though online sales have taken a huge bite out of brick-and-mortar, it doesn’t mean that digital brands aren’t interested in the prospect of offline channels. Hear from three founders who have taken their own unique approach to launching a store.

2:15 pm – 2:55 pm How to Hire at Breakneck Speed with Scott Cutler (StockX), Harj Taggar (Triplebyte) and Liz Wessel (WayUp)

Nothing is better than striking product-market fit and suddenly finding a path to rapid, venture-scale growth. But as that growth accelerates, how do you create the conditions to rapidly find, attract and hire the talent you need to reach unicorn status? Hear from some of the leading recruiters and services on how they have successfully scaled recruiting and avoided key pitfalls.

3:15 pm – 3:45 pm How to Get into Y Combinator with Ali Rowghani (Y Combinator) and Michael Seibel (Y Combinator)

The seed-stage venture firm has come to form its own startup economy over the years, with its network of companies and founders interconnecting across the tech industry and beyond. Find out how Y Combinator works today, and how you can become a part of it, in this discussion with CEO of YC Continuity Ali Rowghani and CEO and partner Michael Seibel.

3:45 pm – 4:25 pm How to Build a Subscription Product with Alex Friedman (LOLA), Eurie Kim (Forerunner Ventures) and Sandra Oh Lin (KiwiCo)

The direct-to-consumer landscape has exploded in the past year, but the keys to making a subscription product indispensable are still up in the air, as few have discovered a path to success. This chat with LOLA’s Alex Friedman, Forerunner partner Eurie Kim and KiwiCo’s Sandra Oh Lin will address the constant struggles of getting a subscription service off the ground and retaining customers.

4:25 pm – 4:45 pm How to Locate the Value with Dennis Crowley (Foursquare)

Foursquare has pulled off a monumental pivot over the last decade, going from a silly location-based social network to an integral enterprise business with the chops to take on Google and Facebook. Hear founder Dennis Crowley discuss the journey the company has taken over the past ten years and what the next ten years looks like for New York’s tech sweetheart.

THURSDAY, OCTOBER 3

10:00 am – 10:40 am How to Raise My First Dollars with Russ Heddleston (DocSend), Charles Hudson (Precursor) and Annie Kadavy (Redpoint Ventures)

Venture funding may have boomed over the last decade, but the decisions around your initial funding are as tricky as ever. Hear how to take advantage of the current landscape from top Silicon Valley early-stage thinkers, including pre-seed investor Charles Hudson of Precursor Ventures, early-stage investor Annie Kadavy of Redpoint Ventures and Russ Heddleston, CEO of DocSend.

11:00 am – 11:40 am How to Build a Secure Startup without Slowing Growth with Heather Adkins (Google), Jennifer Sunshine Steffens (IOActive) and Dug Song (Duo)

Leading security experts from Google, Duo and IOActive discuss some of the challenges startups and enterprises face in security. How do companies navigate the litany of issues and threats without hampering growth?

12:40 pm – 1:20 pm How to Build a Sex Tech Startup with Cyan Banister (Founders Fund), Cindy Gallop (MakeLoveNotPorn) and Lora Haddock (Lora DiCarlo)

As the old adage goes, sex sells. A panel of investors and founders will discuss the opportunities — and challenges — of building a successful sex tech startup, and how to capitalize on a market that’s projected to be worth more than $123 billion by 2026.

1:40 pm – 2:20 pm How to Build a Space Economy with Tess Hatch (Bessemer Venture Partners), Sara Spangelo (Swarm Technologies) and Adrian Steckel (OneWeb)

From thousand-satellite constellations to space tourism, orbit is a fresh and inspiring source of new startup ideas and evolutions of established ones. Swarm’s Sara Spangelo is taking on low-cost global connectivity and Bessemer Ventures’ Tess Hatch provides the perspective of investors looking to make bets like these happen.

2:20 pm – 3:00 pm How Do I Exit and What Happens Next with Justin Kan (Atrium), Jess Lee (Sequoia Capital) and Mike Marquez (Code Advisors)

Most good startup outcomes are acquisitions, and most good acquisitions happen because a buyer needs your company for a specific reason. Hear from Justin Kan (sold Twitch), Jess Lee (sold Polyvore) and top Silicon Valley banker Mike Marquez of Code Advisors about how to make them happen the right way.

3:20 pm – 4:00 pm How to be a Positive Force in the Gig Economy with Sarah Cannon (Index Ventures), Derecka Mehrens (Working Partnerships USA) and Amanda de Cadanet (GirlGaze Network)

As gig workers continue to struggle with financial instability, inadequate labor protections and few alternatives, hear from leaders and companies that are now trying to figure out how to create an equitable, just and sustainable economic system for gig workers.

4:00 pm – 4:40 pm How Do You Decide Between Bootstrapping and Raising Venture Capital? with Ben Chestnut (Mailchimp) and Kathryn Petralia (Kabbage)

In this panel, we host two founders who have each grown their respective startups to stratospheric levels, but with very different funding approaches. Kathryn Petralia, co-founder and president of SMB lender Kabbage, has raised prodigious venture capital, including $500 million in equity from the likes of the SoftBank Vision Fund and an additional $2 billion in debt financing to underwrite Kabbage’s loan products. Meanwhile, Ben Chestnut, co-founder and CEO of MailChimp, has built a massive and well-known marketing automation business entirely by bootstrapping. Why did they choose their different financing strategies? Come hear from two leading founders about how they thought through their fundraises and the lessons we can all learn from their experiences.

FRIDAY, OCTOBER 4

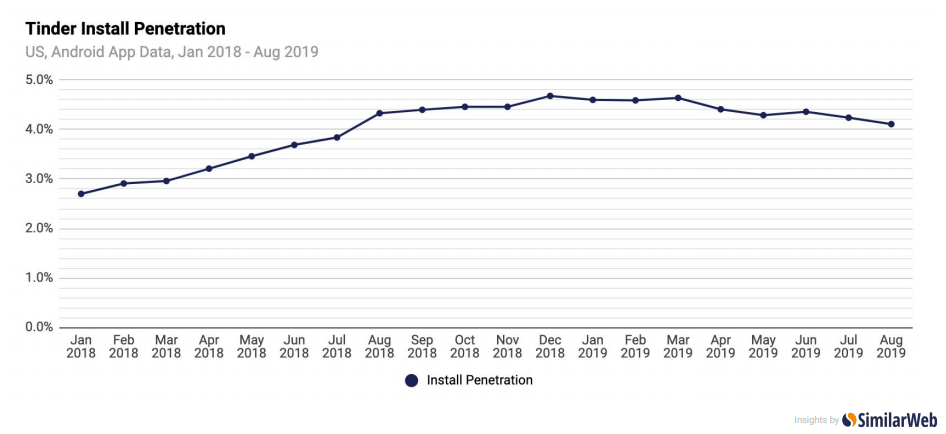

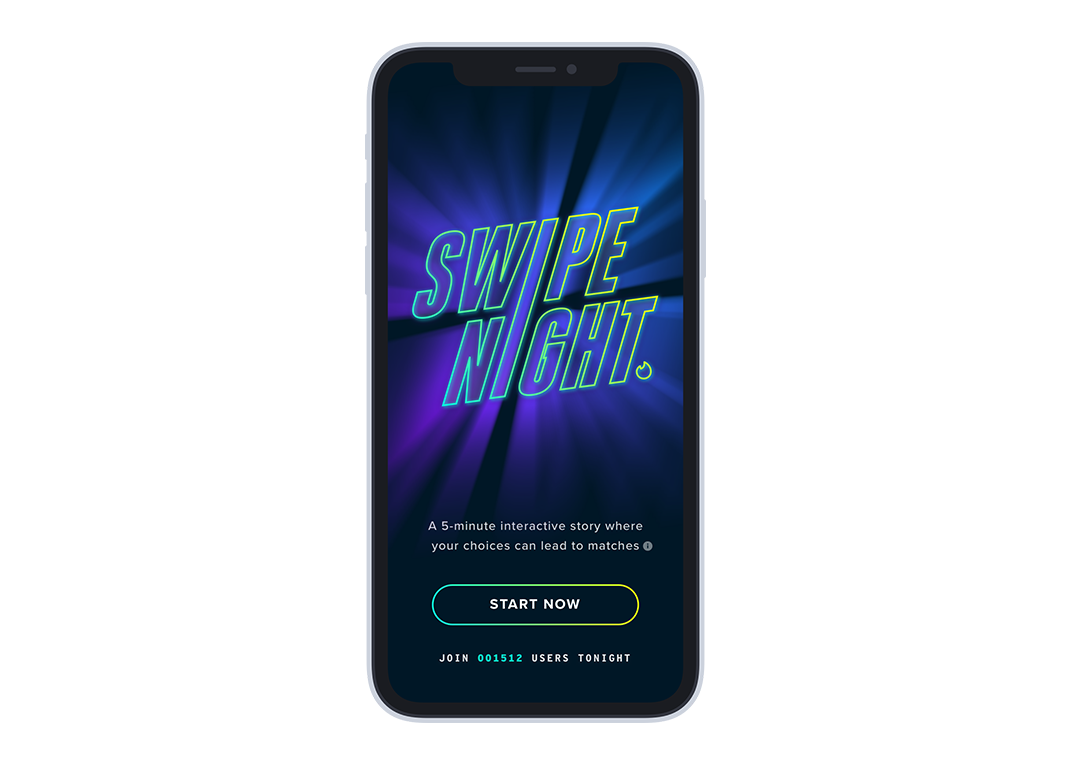

10:05 am – 10:55 am How to Iterate Your Product with Manik Gupta (Uber), Diya Jolly (Okta), Ravi Mehta (Tinder) and Robby Stein (Instagram)

Launching an MVP and finding early product-market fit are just the first steps in the journey to build a great startup. Learn from leading product thinkers from Instagram, Okta, Tinder and Uber on how they expand, grow and refine their products to increase their value without alienating existing users.

10:55 am – 11:15 am How to Take a Hardware Company Public with James Park (Fitbit) and Eric Friedman (Fitbit)

Ten years after launching their product at TechCrunch 50, Fitbit co-founders James Park and Eric Friedman join us to discuss the company’s ups and downs.

11:35 am – 12:15 pm How to Build a Brand that Gets Attention with Brooke Hammerling (Brew Media Relations), Chelsea Cain Maclin (Bumble) and Ben Pham (Character)

Brooke Hammerling is the founder of one of the most iconic tech startup PR firms of the past decade, Brew Media Relations, which was sold for $15 million in 2016. Chelsea Cain Maclin is VP of Marketing at Bumble, one of the most recognizable brands in the app world today. And Ben Pham is the founder of Character, a brand design firm that’s worked with the likes of Oculus, Nike, DoorDash and Peet’s Coffee. The three will discuss how to think about brand design and what gets and keeps the attention of users.

1:25 pm – 1:50 pm How to be a Serial Founder with David Cancel (Drift)

So your first company worked out well. Let’s say you have a burning desire to do another one — what’s the right way to do it the next time around? Hear from frequent founder David Cancel (formerly of Performable/HubSpot, Lookery, Ghostery, Compete) on what he’s done.

1:50 pm – 2:30 pm How to Build a Better Banking Startup with Chris Britt (Chime), Adam Dell (Clarity Money; Goldman Sachs) and Angela Strange (Andreessen Horowitz)

Chris Britt, the chief executive of Chime, Goldman Sachs’ Adam Dell and Andreessen Horowitz’s Angela Strange know that money is what everyone wants. The problem is how to make it more accessible to everyone in the world. Hear them discuss how to build a better bank for everyone.

2:50 pm – 3:10 pm What’s Growing on the Consumer Internet with Andrew Chen (Andreessen Horowitz)

You may know Andrew Chen as a widely read startup growth strategist, but today he’s investing in his expertise. As a partner at top venture firm Andreessen Horowitz, he is focused on consumer internet companies, seeking out the new growth in this maturing tech sector. Come hear the latest on what he’s seeing in the industry both from the growth and investing perspective.

3:10 pm – 4:10 pm Disrupt Hackathon Finals

The top contenders of the Disrupt Hackathon demo their projects that they spent the last two days creating to compete for sponsor prizes and the $10K TechCrunch best of show award.

Source: Tech Crunch